Nokia 2014 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

133

Financial statements

NOKIA IN 2014

Foreign currency translation

Functional and presentation currency

The nancial statements of all Group entities are measured using

functional currency, the currency of the primary economic

environment in which the entity operates. The consolidated nancial

statements are presented in euro, the functional and presentation

currency of the parent.

Transactions in foreign currencies

Transactions in foreign currencies are recorded at exchange rates

prevailing at the dates of the individual transactions. For practical

reasons, a rate that approximates the actual rate at the date of the

transaction is often used. At the end of the accounting period, the

unsettled balances on foreign currency monetary assets and liabilities

are valued at the exchange rates prevailing at the end of the

accounting period. Foreign exchange gains and losses arising from

statement of nancial position items and fair value changes of related

hedging instruments are recognized in nancial income and expenses.

Unrealized foreign exchange gains and losses related to non-current

available-for-sale investments, such as equity investments, are

recognized in other comprehensive income.

Foreign Group companies

All income and expenses of foreign Group companies where the

functional currency is not euro are translated into euro at the average

foreign exchange rates for the accounting period. All assets and

liabilities of foreign Group companies are translated into euro at

foreign exchange rates prevailing at the end of the accounting period.

Dierences resulting from the translation of income and expenses at

the average rate and assets and liabilities at the closing rate are

recognized as translation dierences in other comprehensive income.

On the disposal of all or part of a foreign Group company through

sale, liquidation, repayment of share capital or abandonment, the

cumulative amount or proportionate share of translation dierences

is recognized as income or expense when the gain or loss on disposal

is recognized.

Foreign Group companies in hyperinationary economies

The nancial statements of foreign Group companies where the

functional currency is the currency of a hyperinationary economy

areadjusted to reect changes in general purchasing power.

Non-monetary items in the statement of nancial position and all

items in the income statement are restated to the current purchasing

power by applying the general price index and translated into euro

using the measuring unit current at the end of the accounting period.

Inationary gains and losses on the net monetary position are

recognized as gains and losses in the consolidated income statement.

Comparatives presented as current year amounts in the prior year

nancial statements in a stable currency are not restated.

Assessment of the recoverability of long-lived assets, intangible

assets and goodwill

The Group assesses the carrying value of goodwill annually or more

frequently if events or changes in circumstances indicate that such

carrying value may not be recoverable. The carrying value of

identiable intangible assets and long-lived assets is assessed if

events or changes in circumstances indicate that such carrying value

may not be recoverable. Factors that trigger an impairment review

include, but are not limited to, underperformance relative to historical

or projected future results, signicant changes in the manner of the

use of the acquired assets or the strategy for the overall business,

and signicant negative industry or economic trends.

For purposes of impairment testing, goodwill has been allocated

to the cash-generating units or groups of cash-generating units

(“CGUs”) expected to benet from the synergies of the combination.

A cash-generating unit, as determined for the purposes of the Group’s

goodwill impairment testing, is the smallest group of assets, including

goodwill, generating cash inows that are largely independent of the

cash inows from other assets or groups of assets.

The Group conducts its impairment testing by determining the

recoverable amount for the asset or cash-generating unit. The

recoverable amount of an asset or a cash-generating unit is the

higher of its fair value less costs of disposal and its value-in-use.

The recoverable amount is compared with the asset or

cash-generating unit’s carrying value. The carrying value of a

cash-generating unit’s net assets is determined by allocating relevant

net assets to cash-generating units on a reasonable and consistent

basis. An impairment loss is recognized immediately in the

consolidated income statement if the recoverable amount for an

asset or a cash-generating unit is less than its carrying value.

Other intangible assets

Acquired patents, trademarks, licenses, software licenses for internal

use, customer relationships and developed technology are capitalized

and amortized using the straight-line method over their useful lives,

generally three to seven years. When an indication of impairment

exists, the carrying amount of the related intangible asset is assessed

for recoverability. Any resulting impairment losses are recognized

immediately in the consolidated income statement.

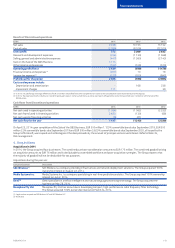

Property, plant and equipment

Property, plant and equipment are stated at cost less accumulated

depreciation. Depreciation is recorded on a straight-line basis over the

expected useful lives of the assets as follows:

Buildings and constructions

Buildings and constructions 20—33 years

Light buildings and constructions 3—20 years

Machinery and equipment

Production machinery, measuring

and test equipment 1—5 years

Other machinery and equipment 3—10 years

Land and water areas are not depreciated. Assets held for sale are not

depreciated as they are carried at the lower of carrying value and fair

value less costs to sell.

Maintenance, repairs and renewals are generally expensed in the

period in which they are incurred. However, major renovations are

capitalized and included in the carrying amount of the asset when it

is probable that future economic benets in excess of the originally

assessed standard of performance of the existing asset will ow to the

Group. Major renovations are depreciated over the remaining useful

life of the related asset. Leasehold improvements are depreciated

over the shorter of the lease term and the useful life. Gains and losses

on the disposal of property, plant and equipment are included in

operating prot or loss.

Leases

The Group has entered into various operating lease contracts. The

related payments are treated as rental expenses and recognized in the

consolidated income statement on a straight-line basis over the lease

terms unless another systematic approach is more representative of

the pattern of the Group’s benet.