Nokia 2014 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

144 NOKIA IN 2014

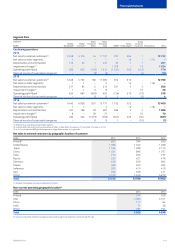

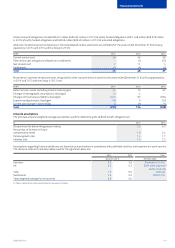

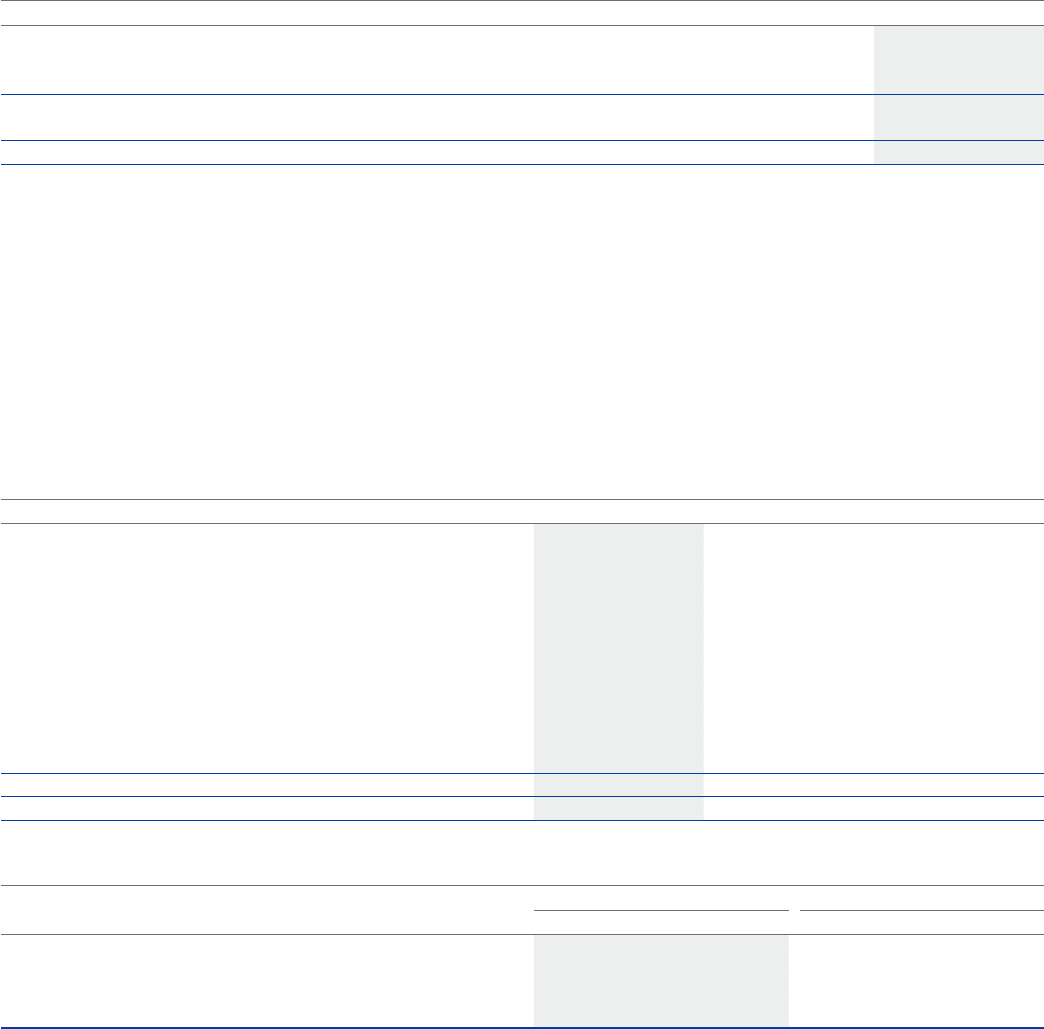

Total consideration paid, aggregate fair values of intangible assets, other net assets acquired and resulting goodwill at each acquisition date are

as follows:

EURm Aggregate fair values

Total cash consideration 175

Identied intangible assets 77

Other net assets 22

Total identiable net assets 99

Goodwill 76

Total 175

The intangible assets are customer- and marketing-related, and technology-based intangible assets. Goodwill has been allocated to

cash-generating units or groups of cash-generating units expected to benet from the synergies of the combination. Refer to Note 10,

Impairment. Acquisition-related costs of EUR 3 million have been charged to selling, general and administrative expenses in the consolidated

income statement.

Acquisitions in 2013

Acquisition of Siemens’ non-controlling interest in Nokia Networks

On August 7, 2013 the Group completed the acquisition of Siemens’ 50% interest in the joint venture, Nokia Networks (formerly Nokia Siemens

Networks, Nokia Solutions and Networks), for a consideration of EUR 1 700 million. Transaction-related costs amounted to EUR 7 million.

Following the acquisition, Nokia Siemens Networks B.V., the parent entity of Nokia Networks, became a wholly owned subsidiary of the Group.

The acquisition did not result in a change in control. The acquisition of non-controlling interest was accounted for as an equity transaction.

Thetransaction reduced the Group’s equity by EUR million, representing the dierence between the carrying amount of Siemens’

non-controlling interest on the date of acquisition of EUR million and the total consideration paid. Refer to Note 2, Segment information.

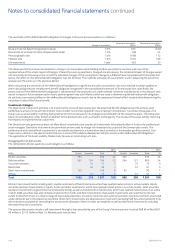

5. Revenue recognition

EURm 2014 2013 2012

Continuing operations

Revenue from sale of products and licensing(1) 7 427 6 399 6 509

Nokia Networks 5 884 4 960 4 874

HERE 965 910 1 101

Nokia Technologies 578 529 534

Revenue from services 4 966 5 314 5 476

Nokia Networks 4 961 5 310 5 474

HERE 54 2

Contract revenue recognized under percentage

of completion accounting 353 1 012 3 431

Nokia Networks 353 1 012 3 431

Eliminations and Group Common Functions (14) (16) (16)

Total 12 732 12 709 15 400

(1) Includes HERE sales to Discontinued operations of EUR 31 million (EUR 154 million in 2013 and EUR 374 million in 2012).

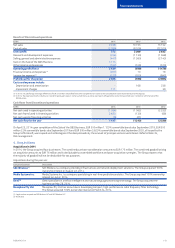

Revenue recognition-related items for construction contracts in progress at December 31 are:

EURm

2014 2013

Assets Liabilities Assets Liabilities

Contract revenues recorded prior to billings 82 162

Billings in excess of costs incurred 40 99

Advances received 1 14

Retentions 12 23

Assets are included in accounts receivable and liabilities are included in accrued expenses in the consolidated statement of nancial position.

The aggregate amount of costs incurred and prots recognized, net of recognized losses, for construction contracts in progress since inception

is EUR 4 219 million at December 31, 2014 (EUR 13 049 million in 2013), the majority of which relates to projects near completion. The decrease

in the aggregate amount of costs incurred and prots recognized is in line with the decrease in revenue recognized under contract accounting.

Notes to consolidated nancial statements continued