Nokia 2014 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

160 NOKIA IN 2014

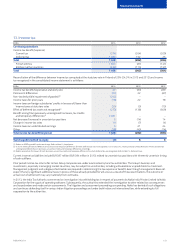

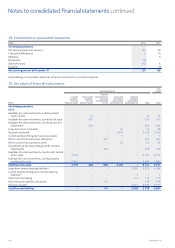

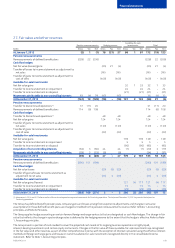

Fair value hierarchy

Financial assets and liabilities recorded at fair value are categorized based on the amount of unobservable inputs used to measure their fair

value. Three hierarchical levels are based on an increasing amount of judgment associated with the inputs used to derive fair value for these

assets and liabilities, level 1 being market values and level 3 requiring most management judgment. At the end of each reporting period, the

Group categorizes its nancial assets and liabilities to appropriate level of fair value hierarchy. Items measured at fair value on a recurring basis

at December 31 are:

EURm

Instruments with

quoted prices in

active markets

(level 1)

Valuation

technique using

observable data

(level 2)

Valuation

technique using

non-observable

data (level 3) Total

Continuing operations

2014

Available-for-sale investments, publicly quoted equity shares 14 – – 14

Available-for-sale investments, carried at fair value 113 556 570

Other current nancial assets, derivatives(1) –241 –241

Investments at fair value through prot and loss, liquid assets 418 – – 418

Available-for-sale investments, liquid assets carried at fair value 2 116 11 –2 127

Available-for-sale investments, cash equivalents carried at fair value 2 643 – – 2 643

Total assets 5 192 265 556 6 013

Other nancial liabilities, derivatives(1) –174 –174

Total liabilities –174 –174

2013

Available-for-sale investments, publicly quoted equity shares 11 – – 11

Available-for-sale investments, carried at fair value 56 18 429 503

Other current nancial assets, derivatives(1) –191 –191

Investments at fair value through prot and loss, liquid assets 382 – – 382

Available-for-sale investments, liquid assets carried at fair value 945 11 –956

Available-for-sale investments, cash equivalents carried at fair value 3 957 – – 3 957

Total assets 5 351 220 429 6 000

Other nancial liabilities, derivatives(1) –35 –35

Total liabilities –35 –35

(1) Refer to Note 20, Derivative nancial instruments for the allocation between hedge accounted and non-hedge accounted derivatives.

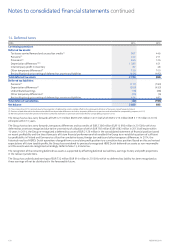

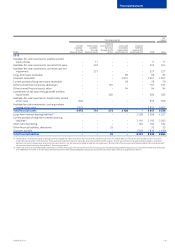

The level 1 category includes nancial assets and liabilities that are measured in whole or in signicant part by reference to published quotes

in an active market. A nancial instrument is regarded as quoted in an active market if quoted prices are readily and regularly available from an

exchange, dealer, broker, industry group, pricing service or regulatory agency and those prices represent actual and regularly occurring market

transactions on an arm’s length basis. This category includes listed bonds and other securities, listed shares and exchange traded derivatives.

The level 2 category includes nancial assets and liabilities measured using a valuation technique based on assumptions that are supported by

prices from observable current market transactions. These include assets and liabilities for which pricing is obtained via pricing services, but

where prices have not been determined in an active market, nancial assets with fair values based on broker quotes and assets that are valued

using the Group’s own valuation models whereby the material assumptions are market observable. The majority of the Group’s

over-the-counter derivatives and certain other instruments not traded in active markets are included in this category.

The level 3 category includes nancial assets and liabilities measured using valuation techniques based on non-observable inputs. This means

that fair values are determined in whole or in part using a valuation model based on assumptions that are neither supported by prices from

observable current market transactions in the same instrument nor based on available market data. The fair value measurement objective

remains the same, that is, to estimate an exit price from the perspective of the Group.

The level 3 investments mainly include unlisted equities and unlisted venture funds where the fair value is determined based on relevant

information such as operating performance, recent transactions and available market data on peer companies. No individual input has

asignicant impact on the total fair value.

Notes to consolidated nancial statements continued