Nokia 2014 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120 NOKIA IN 2014

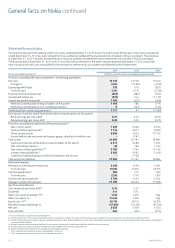

Authorizations proposed to the Annual General Meeting 2015

On January 29, 2015 Nokia announced that the Board will propose

that the AGM convening on May 5, 2015 authorize the Board to resolve

to repurchase a maximum of 365 million Nokia shares. The proposed

maximum number of shares that may be repurchased corresponds

to less than 10% of all the shares of the Company. The shares may

be repurchased in order to optimize the capital structure of the

Company and are expected to be cancelled. In addition, shares may

be repurchased in order to nance or carry out acquisitions or other

arrangements, to settle the Company’s equity-based incentive plans,

or to be transferred for other purposes. The shares may be

repurchased either through a tender oer made to all shareholders

on equal terms, or in another proportion than that of the current

shareholders. The authorization would be eective until November 5,

2016 and terminate the current authorization for repurchasing of

the Company’s shares resolved at the Annual General Meeting on

June 17, 2014.

Nokia also announced on January 29, 2015 that the Board will propose

to the Annual General Meeting to be held on May 5, 2015 that the

Annual General Meeting authorize the Board to resolve to issue a

maximum of 730 million shares through issuance of shares or special

rights entitling to shares in one or more issues. The Board may issue

either new shares or treasury shares held by the Company. The Board

proposes that the authorization may be used to develop the

Company’s capital structure, diversify the shareholder base, nance

or carry out acquisitions or other arrangements, settle the Company’s

equity-based incentive plans, or for other purposes resolved by the

Board. The proposed authorization includes the right for the Board

to resolve on all the terms and conditions of the issuance of shares

and special rights entitling to shares, including issuance in deviation

from the shareholders’ pre-emptive rights. The authorization

would be eective until November 5, 2016 and terminate the

current authorization granted by the Annual General Meeting

on June 17, 2014.

Oer and listing details

Our capital consists of shares traded on Nasdaq Helsinki under the

symbol “NOK1V”. Our ADSs, each representing one of our shares, are

traded on the New York Stock Exchange under the symbol “NOK”. The

ADSs are evidenced by American Depositary Receipts (“ADRs”) issued

by Citibank, N.A., as the Depositary under the Amended and Restated

Deposit Agreement dated as of March 28, 2000 (as amended), among

Nokia, Citibank, N.A. and registered holders from time to time of ADRs,

as amended on February 6, 2008.

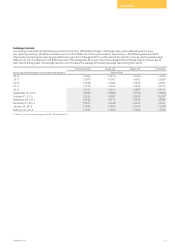

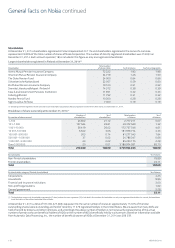

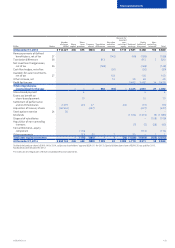

The table below sets forth, for the periods indicated, the reported high

and low quoted prices for our shares on Nasdaq Helsinki, and the high

and low quoted prices for the ADSs, as reported on the New York Stock

Exchange composite tape.

Nasdaq OMX Helsinki

price per share

New York Stock Exchange

price per ADS

High Low High Low

EUR USD

2010 11.82 6.58 15.89 8.00

2011 8.48 3.33 11.75 4.46

2012 4.46 1.33 5.87 1.63

2013

First Quarter 3.64 2.45 4.90 3.19

Second Quarter 3.01 2.30 4.12 3.02

Third Quarter 5.10 2.88 6.78 3.81

Fourth Quarter 6.03 4.64 8.18 6.22

Full year 6.03 2.30 8.18 3.02

2014

First Quarter 6.11 4.89 8.20 6.64

Second Quarter 6.01 5.13 8.35 7.00

Third Quarter 6.89 5.38 8.73 7.30

Fourth Quarter 6.97 5.95 8.58 7.58

Full year 6.97 4.89 8.73 6.64

Most recent six months

September 2014 6.89 6.26 8.73 8.24

October 2014 6.97 5.95 8.58 7.58

November 2014 6.79 6.14 8.44 7.63

December 2014 6.84 6.05 8.37 7.61

January 2015 7.23 6.33 8.13 7.40

February 2015 7.20 6.63 8.09 7.49

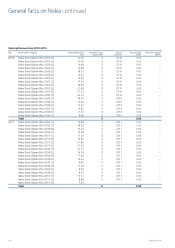

General facts on Nokia continued