Nokia 2014 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

145

Financial statements

NOKIA IN 2014

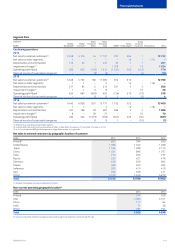

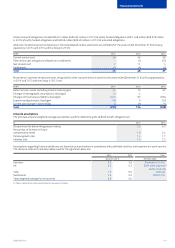

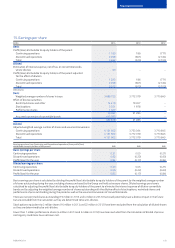

6. Expenses by nature

EURm 2014 2013 2012

Continuing operations

Personnel expenses 3 812 3 857 4 108

Cost of material 3 046 2 835 3 820

Subcontracting costs(1) 2 374 2 799 3 372

Depreciation and amortization 297 560 1 088

Real estate costs 274 351 446

Other(1) 1 418 1 252 2 150

Total 11 221 11 654 14 984

(1) In 2013 and 2012, certain items have been reclassied from other to subcontracting costs to conform with current year presentation.

Rental expenses included in the above line items amount to EUR 193 million (EUR 256 million in 2013 and EUR 361 million in 2012).

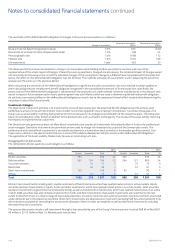

7. Personnel expenses

EURm 2014 2013 2012

Continuing operations

Salaries and wages 3 215 3 432 4 295

Share-based payment expense (Note 25) 65 42 11

Pension expense, net 207 206 232

Other social expenses 366 403 507

Total 3 853 4 083 5 045

Personnel expenses include termination benets. Pension expense, comprising multi-employer, insured and dened contribution plans is EUR

162 million (EUR 160 million in 2013 and EUR 193 million in 2012). Expenses related to dened benet plans comprise the remainder.

Average number of employees 2014 2013 2012

Continuing operations

Nokia Networks 50 680 52 564 64 052

HERE 6 067 5 897 6 441

Nokia Technologies and Group Common Functions 819 872 1 315

Total 57 566 59 333 71 808

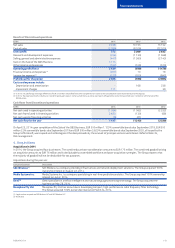

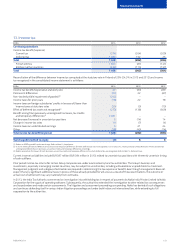

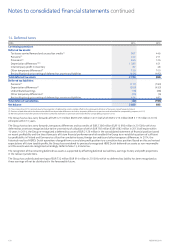

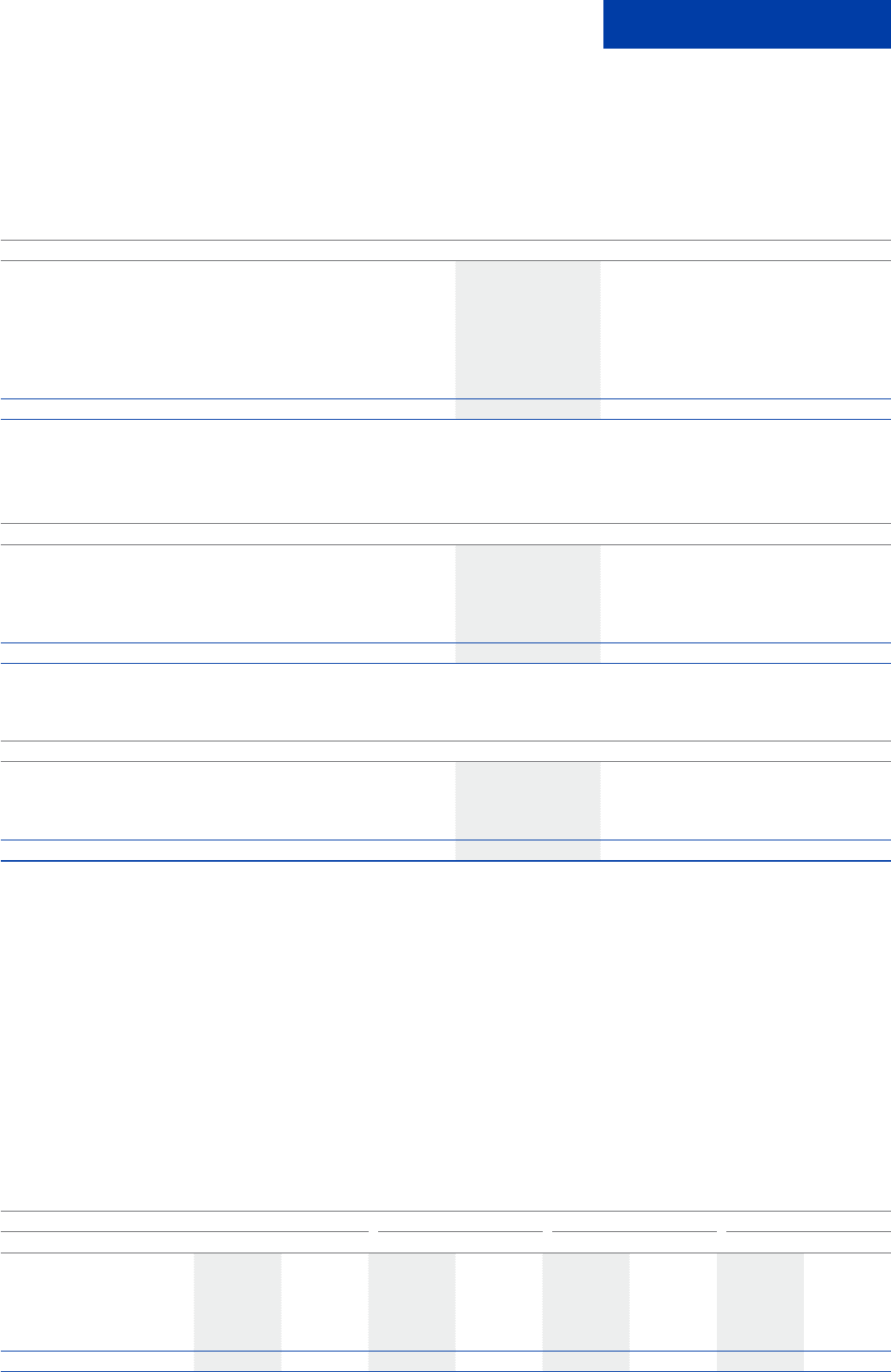

8. Pensions

The Group operates a number of post-employment plans in various countries including both dened contribution and dened benet plans.

These plans expose the Group to actuarial risks such as investment risk, interest rate risk, and life expectancy risk. The characteristics and

associated risks of the dened benet plans vary depending on legal, scal, and economic requirements in each country. These characteristics

and risks are further described below and relate to the plans included in the Continuing operations of the Group.

The disclosures for 2014 and 2013 are attributable to the Continuing operations of the Group. Disclosures relating to the 2012 comparative

annual period represent the results of the consolidated Group prior to the Sale of the D&S Business. Accordingly, 2014 and 2013 results are not

directly comparable with 2012.

The total net accrued pension cost of EUR 500 million (EUR 199 million in 2013) consists of an accrual of EUR 530 million included in other

long-term liabilities (EUR 237 million in 2013) and a prepayment of EUR 30 million included in other non-current assets (EUR 38 million in 2013).

Dened benet plans

The Group’s most signicant dened benet pension plans are in Germany, UK, India and Switzerland. Together they account for 91% (91% in

2013) of the Group’s total dened benet obligation and 92% (92% in 2013) of the Group’s total plan assets.

The dened benet obligations, the fair value of plan assets, the eects of the asset ceiling and the net dened benet balance at December 31

for Continuing operations are:

2014 2013 2014 2013 2014 2013 2014 2013

EURm Defined benefit obligation Fair value of plan assets Effects of asset ceiling Net defined benefit balance

Germany (1 381) (1 062) 965 904 (416) (158)

UK (122) (98) 130 108 810

India (117) (85) 112 82 (1) (1) (6) (4)

Switzerland (102) (78) 70 63 (32) (15)

Other (162) (130) 110 104 (2) (6) (54) (32)

Total (1 884) (1 453) 1 387 1 261 (3) (7) (500) (199)