Nokia 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

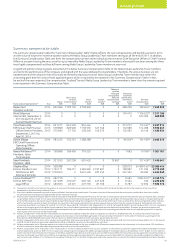

103

Corporate governance

NOKIA IN 2014

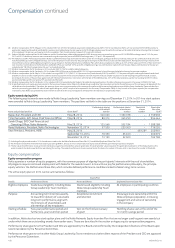

In the event that a sale or an IPO has not occurred, the maximum

totalpayment to Mr. Suri pursuant to the plan would be limited to

EUR10.8 million. In the unlikely event of an IPO or exit event the value

of the options could exceed this maximum.

30% of the options become exercisable on the third anniversary

of the grant date with the remainder vesting on the fourth anniversary

or, if earlier, all the options will vest on the occurrence of certain

corporate transactions such as an initial public oering

(“CorporateTransaction above”).

If a Corporate Transaction has not taken place by the sixth anniversary

of the grant date, the options will be cashed out. If an IPO has taken

place, equity-settled options remain exercisable until the tenth

anniversary of the grant date.

Share ownership of the Board of Directors and

the Nokia Group Leadership Team members

General

The following section describes the ownership or potential ownership

interest in Nokia of the members of our Board and the Nokia Group

Leadership Team at December 31, 2014, either through share

ownership or, with respect to the Nokia Group Leadership Team,

through holding of equity-based incentives, which may lead to share

ownership in the future.

With respect to the Board, approximately 40% of director

compensation is paid in the form of Nokia shares that are purchased

from the market. It is also Nokia’s policy that the Board members

retain all Nokia shares received as director compensation until the end

of their board membership (except for those shares needed to oset

any costs relating to the acquisition of the shares, including taxes). In

addition, it is Nokia’s policy that non-executive members of the Board

do not participate in any of Nokia’s equity programs and do not receive

stock options, performance shares, restricted shares or any other

equity-based or otherwise variable compensation for their duties

as Board members.

For a description of the remuneration of our Board members,

refer to “—Board of Directors” above.

The Nokia Group Leadership Team members receive equity-based

compensation primarily in the form of performance shares. Stock

options are no longer granted and restricted shares are only granted

in exceptional circumstances. For a description of our equity-based

compensation programs for employees and executives, refer to “—

Equity compensation” above.

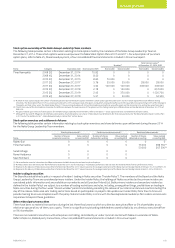

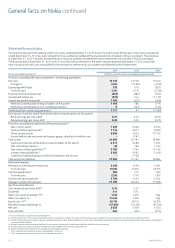

Share ownership of the Board of Directors

At December 31, 2014, the members of our Board held the aggregate

of 1 435 231 shares and ADSs in Nokia, which represented 0.04% of

our outstanding shares and total voting rights excluding shares held by

Nokia Group at that date. No Nokia Group Leadership Team member

owns more than 1% of Nokia shares.

The following table sets forth the number of shares and ADSs held

bythe members of the Board at December 31, 2014.

Name(1) Shares(2) ADSs(2)

Risto Siilasmaa 962 995 –

Vivek Badrinath 9 922 –

Bruce Brown –64 514

Elizabeth Doherty 21 421 –

Jouko Karvinen 61 056 –

Mårten Mickos 108 242 –

Elisabeth Nelson –77 975

Kari Stadigh 119 892 –

Dennis Strigl 9 214 –

(1) Henning Kagermann did not stand for re-election in the Annual General Meeting held on June 17,

2014 and he held 200 708 shares at that time. Helge Lund did not stand for re-election at the

Annual General Meeting held on June 17, 2014 and he held 57 274 shares at that time.

(2) The number of shares or ADSs includes not only shares or ADSs received as director

compensation, but also shares or ADSs acquired through any other means. Stock options or

other equity awards that are deemed as being benecially owned under the applicable SEC rules

are not included. For the number of shares or ADSs received as director compensation, refer to

Note 34, Related party transactions, of our consolidated nancial statements included in this

annual report.

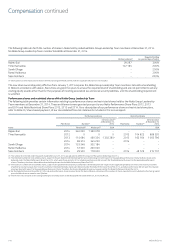

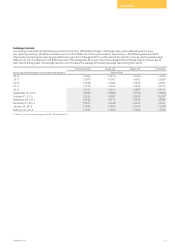

Share ownership of the Nokia Group Leadership Team

The following table sets forth the share ownership, as well as potential ownership interest through the holding of equity-based incentives, of the

Nokia Group Leadership Team members at December 31, 2014.

Shares

Shares receivable

through stock options

Shares receivable

through performance

shares at threshold(4)

Shares receivable

through performance

shares at maximum(5)

Shares receivable

through restricted

shares

Number of equity instruments held by the

Nokia Group Leadership Team (1) 176 482 910 000 753 963 3 015 846 314 912

% of the outstanding shares(2) 0.01 0.02 0.02 0.08 0.01

% of the total outstanding equity incentives

(perinstrument)(3) –0.12 0.09 0.09 0.04

(1) Includes the ve Nokia Group Leadership Team members at year-end. Figures do not include those former Nokia Group Leadership Team members who stepped down during 2014.

(2) The percentages are calculated in relation to the outstanding number of shares and total voting rights of Nokia at December 31, 2014, excluding shares held by Nokia Group. No member of the Nokia

Group Leadership Team owns more than 1% of the Nokia shares.

(3) The percentages are calculated in relation to the total outstanding equity incentives per instrument.

(4) No Nokia shares were delivered under the Nokia Performance Share Plan 2011, as Nokia’s performance did not reach the threshold level with respect to either performance criteria. Therefore the shares

deliverable at threshold equals zero for the Performance Share Plan 2011.

(5) No Nokia shares were delivered under the Nokia Performance Share Plan 2012, as Nokia’s performance did not reach the threshold level with respect to either performance criteria. Therefore the shares

deliverable at maximum equals zero for the Nokia Performance Share Plan 2012. At maximum performance under the Performance Share Plans 2013 and 2014, the number of shares deliverable equals

four times the number of performance shares at threshold. The performance period for the Performance Share Plan 2013 ended on December 31, 2014, and the threshold performance criteria for net

sales and earnings per share were met and a settlement to the participants will occur in accordance with the plan in 2016.