Nokia 2014 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

143

Financial statements

NOKIA IN 2014

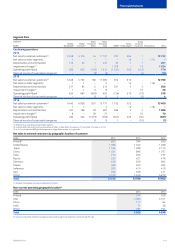

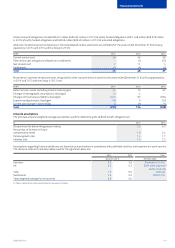

Results of Discontinued operations

EURm 2014 2013 2012

Net sales 2 458 10 735 15 152

Cost of sales (2 086) (8 526) (12 320)

Gross prot 372 2 209 2 832

Research and development expenses (354) (1 130) (1 658)

Selling, general and administrative expenses (447) (1 560) (2 143)

Gain on the Sale of the D&S Business 3 175 – –

Other income and expenses (107) (109) (510)

Operating prot/(loss) 2 639 (590) (1 479)

Financial income and expenses(1) (207) 10 18

Income tax expense(2) (127) (200) (842)

Prot/(loss) for the period 2 305 (780) (2 303)

Costs and expenses include:

Depreciation and amortization –168 238

Impairment charges 111 –39

(1) In 2014, includes foreign exchange dierences of EUR 212 million reclassied from other comprehensive income to the consolidated income statement due to the disposal.

(2) In 2014, the expense primarily includes non-resident capital gains taxes in certain jurisdictions, as well as tax impacts of legal entity restructuring carried out in connection with the Sale of the

D&S Business.

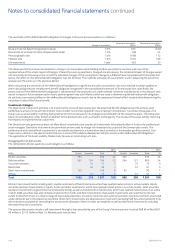

Cash ows from Discontinued operations

EURm 2014 2013 2012

Net cash used in operating activities (1 054) (1 062) (2 252)

Net cash from/(used in) investing activities 2 480 (130) (68)

Net cash used in nancing activities (9) (21) –

Net cash ow for the year 1 417 (1 213) (2 320)

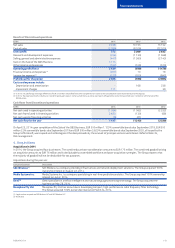

On April 25, 2014 upon completion of the Sale of the D&S Business, EUR 500 million 1.125% convertible bonds due September 2018, EUR 500

million 2.5% convertible bonds due September 2019 and EUR 500 million 3.625% convertible bonds due September 2020, all issued by the

Group to Microsoft, were repaid and netted against the deal proceeds by the amount of principal and accrued interest. Refer to Note 35,

Risk management.

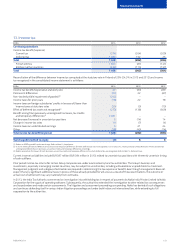

4. Acquisitions

Acquisitions in 2014

In 2014, the Group acquired four businesses. The combined purchase consideration amounts to EUR 175 million. The combined goodwill arising

on acquisition amounts to EUR 76 million and is attributable to assembled workforce and post-acquisition synergies. The Group expects that

the majority of goodwill will not be deductible for tax purposes.

Acquisitions during the year are:

Company/business Description

SAC Wireless(1) SAC Wireless is a company providing infrastructure and network deployment solutions. The Group acquired 100%

ownership interest on August 22, 2014.

Medio Systems Inc. Medio Systems Inc. is a company specializing in real-time predictive analytics. The Group acquired 100% ownership

interest on July 2, 2014.

Desti(2) Desti specializes in articial intelligence and natural language processing technology. The Group acquired the

business on May 28, 2014.

Mesaplexx Pty Ltd. Mesaplexx Pty Ltd. has know-how in developing compact, high-performance radio frequency lter technology.

The Group acquired 100% ownership interest on March 24, 2014.

(1) Legal entities acquired are SAC Wireless LLC and HCP Wireless LLC.

(2) Asset deal.