Nokia 2014 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

155

Financial statements

NOKIA IN 2014

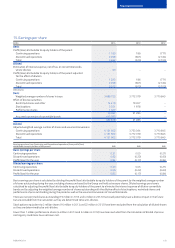

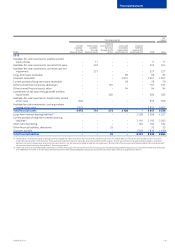

15. Earnings per share

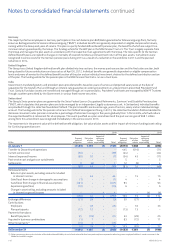

EURm 2014 2013 2012

Basic

Prot/(loss) attributable to equity holders of the parent

Continuing operations 1 163 186 (771)

Discontinued operations 2 299 (801) (2 334)

Total 3 462 (615) (3 105)

Diluted

Elimination of interest expense, net of tax, on convertible bonds,

wheredilutive 60 – –

Prot/(loss) attributable to equity holders of the parent adjusted

for the eect of dilution

Continuing operations 1 223 186 (771)

Discontinued operations 2 299 (801) (2 334)

Total 3 522 (615) (3 105)

000s shares

Basic

Weighted average number of shares in issue 3 698 723 3 712 079 3 710 845

Eect of dilutive securities

Restricted shares and other 14 419 19 307 –

Stock options 3 351 1 978 –

Performance shares 1 327 – –

19 097 21 285 –

Assumed conversion of convertible bonds 413 782 – –

432 879 21 285 –

Diluted

Adjusted weighted average number of shares and assumed conversions

Continuing operations 4 131 602 3 733 364 3 710 845

Discontinued operations 4 131 602 3 712 079 3 710 845

Total 4 131 602 3 712 079 3 710 845

Earnings per share from Continuing and Discontinued operations (from profit/(loss)

attributable to equity holders of the parent) EUR EUR EUR

Basic earnings per share

Continuing operations 0.31 0.05 (0.21)

Discontinued operations 0.62 (0.22) (0.63)

Prot/(loss) for the year 0.94 (0.17) (0.84)

Diluted earnings per share

Continuing operations 0.30 0.05 (0.21)

Discontinued operations 0.56 (0.22) (0.63)

Prot/(loss) for the year 0.85 (0.17) (0.84)

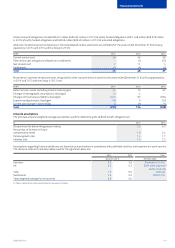

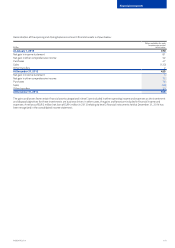

Basic earnings per share is calculated by dividing the prot/(loss) attributable to equity holders of the parent by the weighted average number

of shares outstanding during the year, excluding shares purchased by the Group and held as treasury shares. Diluted earnings per share is

calculated by adjusting the prot/(loss) attributable to equity holders of the parent to eliminate the interest expense of dilutive convertible

bonds and by adjusting the weighted average number of shares outstanding with the dilutive eect of stock options, restricted shares and

performance shares outstanding during the period as well as the assumed conversion of convertible bonds.

There are no restricted shares outstanding (19 million in 2013 and 4 million in 2012) that could potentially have a dilutive impact in the future

but are excluded from the calculation as they are determined to be anti-dilutive.

Stock options equivalent to 2 million shares (16 million in 2013 and 22 million in 2012) have been excluded from the calculation of diluted shares

as they are determined to be anti-dilutive.

Fewer than 1 million performance shares (4 million in 2013 and 2 million in 2012) have been excluded from the calculation of diluted shares as

contingency conditions have not been met.