Nokia 2014 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

183

Financial statements

NOKIA IN 2014

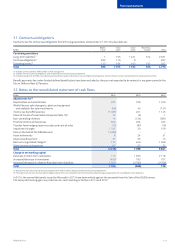

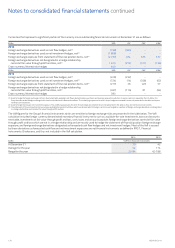

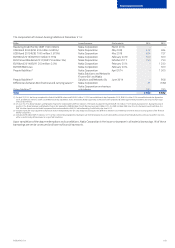

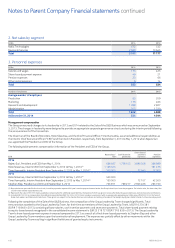

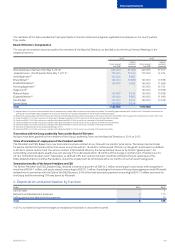

The composition of interest-bearing liabilities at December 31 is:

EURm Issuer/borrower Final maturity 2014 2013

Revolving Credit Facility (EUR 1 500 million) Nokia Corporation March 2016 ––

USD Bond 2039 (USD 500 million 6.625%) Nokia Corporation May 2039 412 364

USD Bond 2019 (USD 1000 million 5.375%) Nokia Corporation May 2019 824 727

EUR Bond 2019 (EUR 500 million 6.75%) Nokia Corporation February 2019 500 500

EUR Convertible Bond 2017 (EUR 750 million 5%) Nokia Corporation October 2017 750 750

EUR Bond 2014 (EUR 1 250 million 5.5%) Nokia Corporation February 2014 –1 250

EUR EIB R&D Loan Nokia Corporation February 2014 –500

Prepaid liabilities(1) Nokia Corporation April 2014 –1 500

Prepaid liabilities(2)

Nokia Solutions and Networks

Finance B.V. and Nokia

Solutions and Networks Oy June 2014 –958

Dierences between Bond nominal and carrying values(3) Nokia Corporation 21 (182)

Other liabilities(4)

Nokia Corporation and various

subsidiaries 185 295

Total 2 692 6 662

(1) On April 25, 2014 the Group completed the Sale of the D&S Business and EUR 500 million 1.125% convertible bonds due September 2018, EUR 500 million 2.5% convertible bonds due September

2019, and EUR 500 million 3.625% convertible bonds due September 2020, all issued by Nokia Corporation to Microsoft, were prepaid and netted against deal proceeds by the amount of principal

and accrued interest.

(2) On June 19, 2014 Nokia Solutions and Networks Finance B.V. redeemed the EUR 450 million 6.75% bonds due April 2018 and the EUR 350 million 7.125% bonds due April 2020. During the second

quarter 2014, Nokia Solutions and Networks Finance B.V. prepaid the EUR 88 million Finnish Pension Loan due October 2015, the EUR 50 million R&D Loan from the European Investment Bank, the

EUR 16 million Loan from the Nordic Investment Bank and cancelled the EUR 750 million Revolving Credit Facility due June 2015.

(3) Includes mainly fair value adjustments for bonds that are designated under fair value hedge accounting and the dierence between convertible bond nominal value and carrying value of the nancial

liability component.

(4) Includes EUR 8 million (EUR 76 million in 2013) of non-interest-bearing liabilities relating to cash held temporarily due to the divested businesses where Nokia Networks continues to perform services

within a contractually dened scope for a specied timeframe.

Upon completion of the above redemptions and cancellations, Nokia Corporation is the issuer or borrower in all material borrowings. All of these

borrowings are senior unsecured and have no nancial covenants.