Nokia 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 NOKIA IN 2014

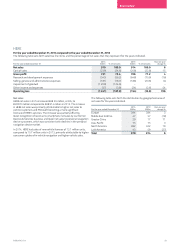

Gross margin

HERE gross margin in 2014 was 75.4% compared to 77.2% in 2013.

The decrease in HERE gross margin was primarily attributable to

certain ongoing expenses that are now recorded as HERE cost of sales,

which were previously recorded as cost of sales by our former Devices

& Services business.

Operating expenses

HERE R&D expenses in 2014 were EUR 545 million, a decrease of

EUR103 million, or 16%, compared to EUR 648 million in 2013.

The decrease was primarily attributable to signicant purchase price

accounting related items of EUR 168 million in 2013 arising from

the purchase of NAVTEQ, the majority of which were fully amortized

in 2013. The decrease was partially oset by higher investments

in targeted growth areas.

HERE selling, general and administrative expenses were

EUR 181 million in 2014, a decrease of EUR 7 million, or 4%,

compared to EUR188 million in 2013. The decrease was primarily

attributable to purchase price accounting related items in 2013

arising from the purchase of NAVTEQ, the majority of which were

fully amortized in 2013.

A goodwill impairment charge of EUR 1 209 million was recorded in

the third quarter 2014. The impairment charge was the result of an

evaluation of the projected nancial performance and net cash ows

resulting in reduced net sales projections. The evaluation incorporated

the slower than expected increase in net sales directly to consumers,

and our plans to curtail our investment in certain higher-risk and

longer-term growth opportunities. It also reected the current

assessment of risks related to the growth opportunities that we

plan to continue pursuing. Refer to Note 10, Impairment, of our

consolidated nancial statements included in this annual report.

HERE other income and expenses increased in 2014 to a net expense

of EUR 37 million from a net expense of EUR 24 million in 2013. The

increase was primarily attributable to higher charges related to the

cost reduction program.

Operating prot/loss

HERE operating loss was EUR 1 241 million in 2014, an increase of

EUR 1 087 million compared to an operating loss of EUR 154 million

in 2013. HERE operating margin in 2014 was negative 127.9%

compared to negative 16.8% in 2013. The increase in operating loss

was primarily attributable to EUR 1 209 million goodwill impairment

charge recorded in the third quarter 2014. Refer to Note 10,

Impairment, of our consolidated nancial statements included in

this annual report. The charge was partially oset by the absence

of signicant purchase price accounting related items arising from

the purchase of NAVTEQ, the majority of which were fully amortized

in 2013.

Global cost reduction program

In 2014, Nokia announced the sharpening of the HERE strategy and

an adjustment to the related long-range plan. As part of its decision

to curtail investments in certain higher risk longer term growth

opportunities, HERE initiated a cost reduction program during the

fourth quarter 2014. Related to this program, HERE recorded charges

of approximately EUR 36 million and had related cash outows of

approximately EUR 12 million in 2014. In total, we estimate the

cumulative charges will amount to approximately EUR 36 million and

related cash outows will amount to approximately EUR 24 million.

Changes in estimates regarding the timing or amount of costs to be

incurred and associated cash ows may become necessary as the

program is being completed.

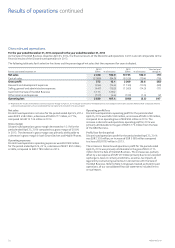

For the year ended December 31, 2013 compared to the year ended December 31, 2012

The following table sets forth selective line items and the percentage of net sales that they represent for years indicated.

For the year ended December 31

2013

EURm % of net sales

2012

EURm % of net sales

Year-on-year

change %

Net sales 914 100.0 1 103 100.0 (17)

Cost of sales (208) (22.8) (228) (20.7) (9)

Gross prot 706 77.2 875 79.3 (19)

Research and development expenses (648) (70.9) (883) (80.0) (27)

Selling and marketing expenses (119) (13.0) (186) (16.9) (36)

Administrative and general expenses (69) (7.5) (77) (7.0) (10)

Other income and expenses (24) (2.6) (30) (2.7) (20)

Operating loss (154) (16.8) (301) (27.3) (49)

Results of segments continued