Nokia 2014 Annual Report Download - page 192

Download and view the complete annual report

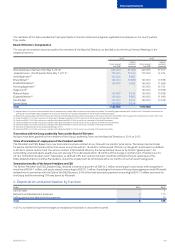

Please find page 192 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.190 NOKIA IN 2014

1. Accounting principles

Basis of presentation

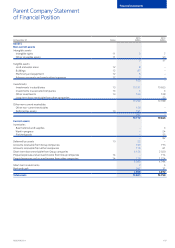

The Parent Company nancial statements are prepared in accordance with the Finnish Accounting Standards (“FAS”).

On January 1, 2014 Nokia Asset Management Oy, formerly a fully owned entity of the Parent Company, was merged into the Parent Company.

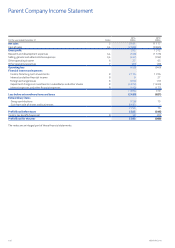

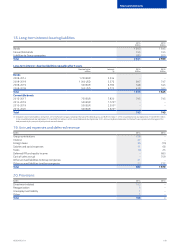

In 2014, substantially all of the Devices & Services business was sold to Microsoft. This is referred to as “the Sale of the D&S Business”.

The transaction was completed on April 25, 2014. On December 31, 2014 the Parent Company sold certain assets and liabilities related to

the Nokia Technologies business to a newly formed, fully owned entity, Nokia Technologies Oy. These transactions make up the Extraordinary

items in the income statement. The 2014 nancial information is therefore not fully comparable with the 2013 nancial information.

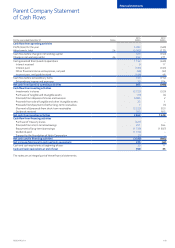

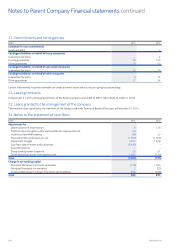

In 2014, certain items in the Parent Company statement of cash ows have been reclassied to conform to the current year presentation.

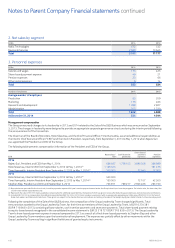

Revenue recognition

Revenue is recognized when the following criteria for the transaction have been met: signicant risks and rewards of ownership have transferred

to the buyer; continuing managerial involvement and eective control usually associated with ownership have ceased; the amount of revenue

can be measured reliably; it is probable that the economic benets associated with the transaction will ow to the Company; and the costs

incurred or to be incurred in respect of the transaction can be measured reliably.

Research and development costs

Research and development costs are expensed as they are incurred.

Pensions

Contributions to pension plans are expensed in the income statements in the period to which the contributions relate.

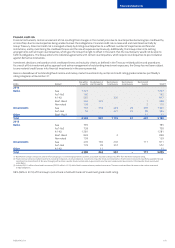

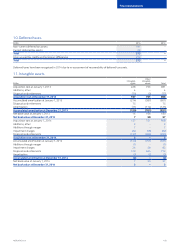

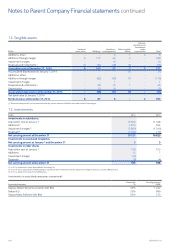

Intangible and tangible assets

Intangible and tangible assets are stated at cost less accumulated depreciation according to plan. Depreciation according to plan is recorded

on a straight-line basis over the expected useful lives of the assets as follows:

Intangible assets 3-7 years

Buildings 20-33 years

Machinery and equipment 1-10 years

Land and water areas are not depreciated. The accumulated depreciation according to plan and the change in the depreciation reserve comply

with the Finnish Business Tax Act. The change in the depreciation reserve has been treated as appropriations.

Inventories

Inventories are stated at the lower of cost and net realizable value. Cost is determined using standard cost, which approximates actual cost on

a rst-in-rst-out (“FIFO”) basis. Net realizable value is the amount that can be realized from the sale of the inventory in the normal course of

business after allowing for the costs of realization. In addition to the cost of materials and direct labor, an appropriate proportion of production

overheads is included in the inventory values. An allowance is recorded for excess inventory and obsolescence based on the lower of cost and

net realizable value.

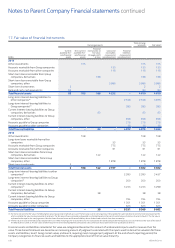

Loans receivable

Loans receivable include loans to customers and suppliers and are measured initially at fair value and subsequently at amortized cost less

impairment using the eective interest method. Loans are subject to regular review as to their collectability and available collateral. An allowance

is made if a loan is deemed not to be fully recoverable. The related cost is recognized in other expenses or nancial expenses, depending on

the nature of the receivable to reect the shortfall between the carrying amount and the present value of the expected future cash ows.

Interest income on loans receivable is recognized in other income or nancial income by applying the eective interest rate.

Bank and cash

Cash consists of cash at bank and in hand.

Accounts receivable

Accounts receivable include both amounts invoiced to customers and amounts where the Parent Company’s revenue recognition criteria have

been fullled but the customers have not yet been invoiced. Accounts receivable are carried at the original amount invoiced to customers less

allowances for doubtful accounts. Allowances for doubtful accounts are based on a periodic review of all outstanding amounts, including an

analysis of historical bad debt, customer concentrations, customer creditworthiness, past due amounts, current economic trends and changes

in customer payment terms. Impairment charges on receivables identied as uncollectible are included in other operating expenses. The Parent

Company derecognizes an accounts receivable balance only when the contractual rights to the cash ows from the asset expire or it transfers

the nancial asset and substantially all the risks and rewards of the asset to another entity.

Loans payable

Loans payable are recognized initially at fair value net of transaction costs. In subsequent periods, loans payable are presented at amortized

cost using the eective interest method. Transaction costs and loan interest are recognized in the income statement as nancial expenses

over the life of the instrument.

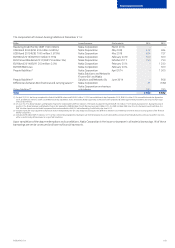

Notes to Parent Company Financial statements