Nokia 2014 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

148 NOKIA IN 2014

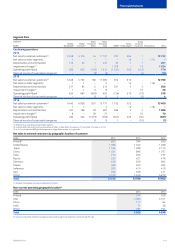

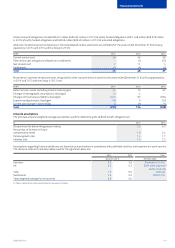

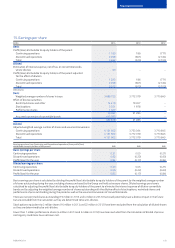

The sensitivity of the dened benet obligation to changes in the principal assumptions is as follows:

Change in assumption

Increase in assumption

EURm

Decrease in assumption

EURm

Discount rate for determining present values 1.0% 252 (332)

Annual rate of increase in future compensation levels 1.0% (28) 24

Pension growth rate 1.0% (188) 172

Ination rate 1.0% (197) 189

Life expectancy 1 year (42) 35

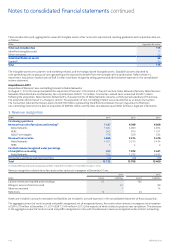

The above sensitivity analyses are based on a change in an assumption while holding all other assumptions constant and may not be

representative of the actual impact of changes. If more than one assumption is changed simultaneously, the combined impact of changes would

not necessarily be the same as the sum of the individual changes. If the assumptions change to a dierent level compared with that presented

above, the eect on the dened benet obligation may not be linear. The methods and types of assumptions used in preparing the sensitivity

analyses are the same as in the previous period.

When calculating the sensitivity of the dened benet obligation to signicant actuarial assumptions, the same method has been applied as

when calculating the post-employment benet obligation recognized in the consolidated statement of nancial position; specically, the

present value of the dened benet obligation is calculated with the projected unit credit method. Increases and decreases in the discount rate,

rate of increase in future compensation levels, pension growth rate and ination, which are used in determining the dened benet obligation,

do not have a symmetrical eect on the dened benet obligation primarily due to the compound interest eect created when determining the

net present value of the future benet.

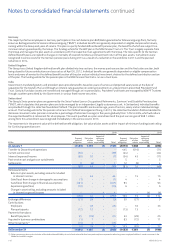

Investment strategies

The objective of investment activities is to maximize the excess of plan assets over the projected benet obligations and to achieve asset

performance at least in line with the interest costs in order to minimize required future employer contributions. To achieve these goals, the

Group uses an asset liability matching framework which forms the basis for its strategic asset allocation of the respective plans. The Group also

takes into consideration other factors in addition to the discount rate, such as ination and longevity. The results of the asset-liability matching

framework are implemented on a plan level.

The Group’s pension governance does not allow direct investments and requires all investments to be placed either in funds or by professional

asset managers. Derivative instruments are permitted and are used to change risk characteristics as part of the German plan assets. The

performance and risk prole of investments is constantly monitored on a stand-alone basis as well as in the broader portfolio context. One

major risk is a decline in the plan’s funded status as a result of the adverse development of plan assets and/or dened benet obligations.

The application of the Asset-Liability-Model study focuses on minimizing such risks.

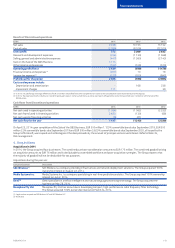

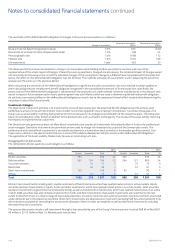

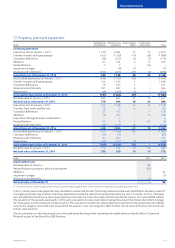

Disaggregation of plan assets

The composition of plan assets by asset category is as follows:

EURm

2014 2013

Quoted Unquoted Total %Quoted Unquoted Total %

Equity securities 296 296 22 300 300 24

Debt securities 665 104 769 55 564 121 685 54

Insurance contracts 74 74 570 70 6

Real estate 68 68 557 57 5

Short-term investments 108 108 892 92 7

Others 72 72 557 57 5

Total 1 069 318 1 387 100 956 305 1 261 100

All short-term investments including cash, equities and nearly all xed income securities have quoted market prices in active markets. Equity

securities represent investments in equity funds and direct investments, which have quoted market prices in an active market. Debt securities

represent investments in government and corporate bonds, as well as investments in bond funds, which have quoted market prices in an active

market. Debt securities may also comprise investments in funds and direct investments. Real estate investments are investments into real

estate funds which invest in a diverse range of real estate properties. Insurance contracts are customary pension insurance contracts structured

under domestic law in the respective countries. Short-term investments are liquid assets or cash which are being held for a short period of time,

with the primary purpose of controlling the tactical asset allocation. Other includes commodities as well as alternative investments, including

derivative nancial instruments.

The pension plan assets include a self-investment through a loan provided by one of the Group’s German pension funds of EUR 69 million (EUR

69 million in 2013). Refer to Note 34, Related party transactions.

Notes to consolidated nancial statements continued