Nokia 2014 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

166 NOKIA IN 2014

Notes to consolidated nancial statements continued

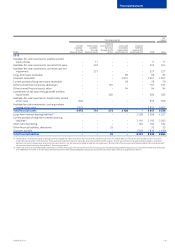

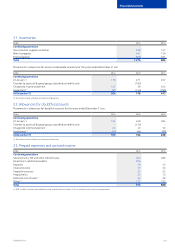

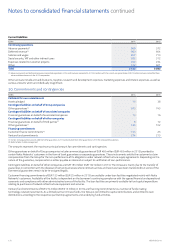

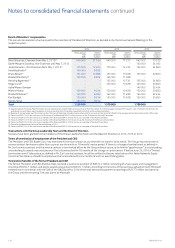

Performance criteria for the year ended December 31, 2014:

Performance criteria for 2014 plan Threshold performance Maximum performance Weight

Nokia Group employees

(excluding HERE) Average annual non-IFRS(1) net sales (Nokia Group) EURm 11 135 EURm 15 065 50%

Average annual diluted non-IFRS(1) EPS (Nokia Group) EUR 0.11 EUR 0.38 50%

HERE employees Average annual non-IFRS(1) net sales (HERE) EURm 950 EURm 1 150 50%

Average annual non-IFRS(1) operating prot (HERE) EURm 0 EURm 130 25%

Average annual diluted non-IFRS(1) EPS (Nokia Group) EUR 0.11 EUR 0.38 25%

(1) Non-IFRS measures exclude all material special items for all periods. In addition, non-IFRS results exclude intangible asset amortization and other purchase price accounting-related items arising from

business acquisitions.

Until the shares are delivered, the participants do not have any shareholder rights, such as voting or dividend rights, associated with the

performance shares. The performance share grants are generally forfeited if the employment relationship with the Group terminates prior

to vesting. Unvested performance shares for employees who have transferred to Microsoft following the Sale of the D&S Business have

been forfeited.

Restricted shares

In 2014, the Group administered four global restricted share plans, the Restricted Share Plan 2011, 2012, 2013 and 2014. From 2014,

restricted shares have been granted on a more selective basis than in previous years: only for exceptional retention and recruitment purposes

to ensure the Group is able to retain and recruit talent critical to its future success. All of the Group’s restricted share plans have a restriction

period of three years after grant. Until the shares are delivered, the participants do not have any shareholder rights, such as voting or dividend

rights, associated with the restricted shares. The restricted share grants are generally forfeited if the employment relationship with the Group

terminates prior to vesting. Unvested restricted shares for employees who have transferred to Microsoft following the Sale of the D&S Business

have been forfeited.

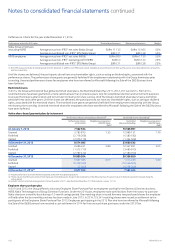

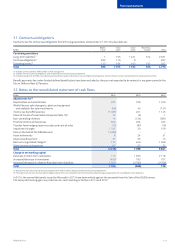

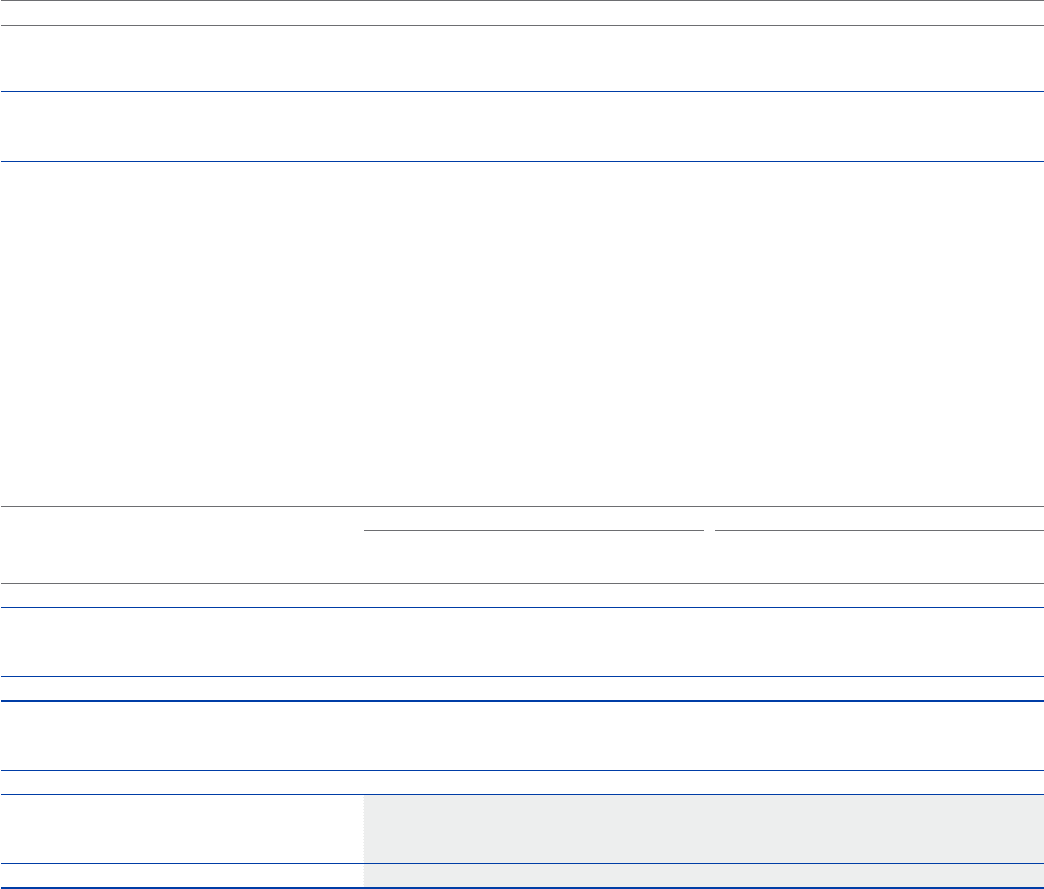

Active share-based payment plans by instrument

Performance shares outstanding at threshold(1) Restricted shares outstanding(1)

Performance shares

at threshold

Weighted average grant

date fair value

EUR(2)

Restricted

shares outstanding

Weighted average grant

date fair value

EUR(2)

At January 1, 2012 7 582 534 16 586 091

Granted 5 785 875 1.33 12 999 131 1.76

Forfeited (2 718 208) (4 580 182)

Vested (2 076 116) (1 324 508)

At December 31, 2012 8 574 085 23 680 532

Granted 6 696 241 2.96 12 347 931 3.05

Forfeited (1 512 710) (3 490 913)

Vested (2 767 412) (2 180 700)

At December 31, 2013 10 990 204 30 356 850

Granted 6 967 365 6.07 1 013 466 5.62

Forfeited (9 338 036) (19 546 605)

Vested (2 500) (4 228 306)

At December 31, 2014(3) 8 617 033 7 595 405

(1) Includes performance and restricted shares granted under other than global equity plans.

(2) The fair values of performance and restricted shares are estimated based on the grant date market price of the Nokia share less the present value of dividends expected to be paid during the

vestingperiod.

(3) Includes 249 943 restricted shares granted in the fourth quarter of 2011 under Restricted Share Plan 2011 that vested on January 1, 2015.

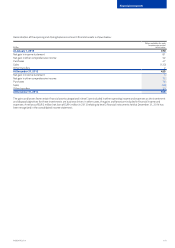

Employee share purchase plan

In 2014 and 2013, the Group oered a voluntary Employee Share Purchase Plan to employees working for the Devices & Services business,

HERE, Nokia Technologies and Group Common Functions. Under the 2014 plan, employees make contributions from their salary to purchase

Nokia shares on a monthly basis during a 12-month savings period. One matching share is issued for every two purchased shares the employee

still holds after the last monthly purchase has been made in June 2015. In 2014,133 341 matching shares were issued as settlement to the

participants of the Employee Share Purchase Plan 2013. Employees participating in the 2013 Plan who have transferred to Microsoft following

the Sale of the D&S Business have received a cash settlement in 2014 for their accrued share purchases under the 2013 Plan.