Nokia 2014 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

180 NOKIA IN 2014

Notes to consolidated nancial statements continued

Business-related credit risk

The Group aims to ensure the highest possible quality in accounts receivable and loans due from customers and other third parties. The Nokia

Group Credit Policy, approved by the Group President and CEO, and the related procedures approved by the Group CFO, lay out the framework

for the management of the business-related credit risks. The Credit Policy and related procedures set out that credit decisions are based on

credit evaluation in each business, including credit rating for larger exposures, according to dened rating principles. Material credit exposures

require Group-level approval. Credit risks are monitored in each business and, where appropriate, mitigated with the use of letters of credit,

collateral, insurance, and the sale of selected receivables.

Credit exposure is measured as the total of accounts receivable and loans outstanding due from customers and committed credits. Accounts

receivable do not include any major concentrations of credit risk by customer. The top three customers account for approximately 3.5%,

2.9% and 2.8% (4.0%, 3.6% and 3.3% in 2013) of the Group’s accounts receivable and loans due from customers and other third parties at

December 31, 2014. The top three credit exposures by country account for approximately 18.0%, 7.4% and 5.6% (20.9%, 6.3% and 5.7%

in 2013) of the Group’s accounts receivable and loans due from customers and other third parties at December 31, 2014. The 18.0% credit

exposure relates to accounts receivable in China (20.9% in 2013).

The Group has provided allowances for doubtful accounts on accounts receivable and loans due from customers and other third parties not

past due based on an analysis of debtors’ credit ratings and credit histories. The Group establishes allowances for doubtful accounts that

represent an estimate of expected losses at the end of the reporting period. All receivables and loans due from customers are considered

onanindividual basis to determine the allowances for doubtful accounts. The total of accounts receivable and loans due from customers is

EUR 3 432 million (EUR 2 929 million in 2013). The gross carrying amount of accounts receivable, related to customer balances for which

valuation allowances have been recognized, is EUR 1 200 million (EUR 1 075 million in 2013). The allowances for doubtful accounts for these

accounts receivable as well as amounts expected to be uncollectible for acquired receivables are EUR 103 million (EUR 132 million in 2013).

Refer to Note 22, Allowances for doubtful accounts.

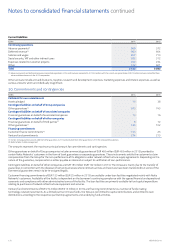

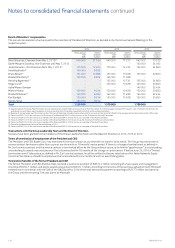

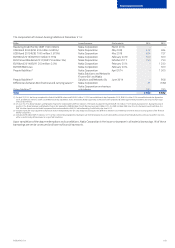

Aging of past due receivables not considered to be impaired at December 31 is as follows:

EURm 2014 2013

Past due 1-30 days 68 53

Past due 31-180 days 42 43

More than 180 days 35 13

Total 145 109

Hazard risk

The Group strives to ensure that all nancial, reputation and other losses to the Group and its customers are managed through preventive risk

management measures. Insurance is purchased for risks which cannot be internally managed eciently and where insurance markets oer

acceptable terms and conditions. The objective is to ensure that hazard risks, whether related to physical assets, such as buildings, intellectual

assets, such as the Nokia brand, or potential liabilities, such as product liabilities, are insured optimally taking into account both cost and

retention levels. The Group purchases both annual insurance policies for specic risks as well as multi-line and/or multi-year insurance policies

where available.