Nokia 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102 NOKIA IN 2014

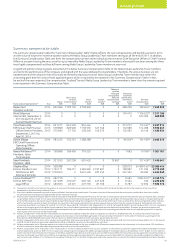

Performance criteria are set with the purpose of being challenging but

achievable to ensure that executives are motivated. The awards at the

threshold are signicantly reduced from grant level and achievement

of maximum award would require performance signicantly ahead of

current market expectations.

Achievement of the maximum performance for all criteria would

result in the vesting of a maximum of 32.2 million Nokia shares.

Achievements beyond the maximum performance level will not cause

any further shares to vest. Achievement of the threshold performance

for all criteria will result in the vesting of approximately 8.1 million

shares which is the minimum payout under the plan. Minimum payout

under the plan, even if threshold performance is not achieved, is 4.05

million shares due to the 25% minimum payout. Until Nokia shares are

delivered, the participants will not have any shareholder rights, such as

voting or dividend rights associated with these performance shares.

Restricted shares

In 2014 restricted shares were used on a selective basis to ensure

retention and recruitment of individuals deemed critical to Nokia’s

future success. The restricted shares vest on the third anniversary

of the award subject to continued employment with Nokia. Until

the restricted shares vest they carry no voting or dividend rights.

Restricted shares under the Nokia Restricted Share Plan 2015 will

be used in an increasingly targeted way. Grants will be focused on

retention and recruitment of key individuals in dened locations

wheresupported by local practice, for example in Silicon Valley and

other parts of the United States where Nokia maintains a signicant

presence. The shares will vest in three equal tranches over three

years,on the rst, second and third anniversary of the award.

Vestingis subject to continued employment with the company.

Until the shares are delivered, the participants will not have any

shareholder rights, such as voting or dividend rights, associated

with the restricted shares.

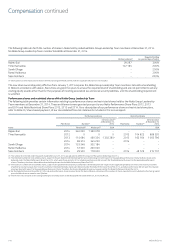

Employee Share Purchase Plan

Under the Employee Share Purchase Plan, eligible Nokia employees

can elect to make monthly contributions from their salary to

purchase Nokia shares. The contribution per employee cannot exceed

EUR 1 200 per year. The share purchases are made at market value on

predetermined dates on a monthly basis during a 12-month savings

period. Nokia will oer one matching share for every two purchased

shares the employee still holds after the last monthly purchase has

been made following the end of the 12-month savings period.

Participation in the plan is voluntary to employees.

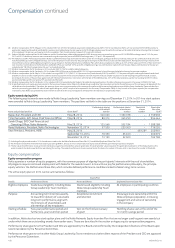

Legacy equity compensation programs

No new awards have been made under the following equity programs

in 2014 but awards made in earlier years remain in force.

Stock options

Although the granting of stock options ceased at the end of 2013,

awards under the 2007 and 2011 option plans remain in force.

Under the plans, each stock option entitles the holder to subscribe for

one new Nokia share and the stock options are non-transferable and

may be exercised for shares only. The dierence between the two

plans is in the vesting schedule as follows:

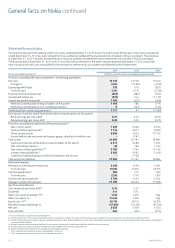

Plan Vesting schedule

2007 Stock Option Plan ■25% 12 months after grant

■ 6.25% each quarter thereafter

■ Term approximately 5 years

2011 Stock Option Plan ■ 50% on third anniversary of grant

■ 50% on fourth anniversary of grant

■Term approximately 6 years

Shares will be eligible for dividend for the nancial year in which

the share subscription takes place. Other shareholder rights will

commence on the date on which the subscribed shares are entered

in the Trade Register. The stock option grants are generally forfeited

if the employment relationship terminates with Nokia.

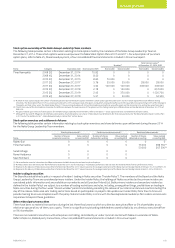

Nokia Networks Equity Incentive Plan

The Nokia Networks Equity Incentive Plan (“Nokia Networks Equity

Incentive Plan”) was established in 2012 by the board of Nokia

Siemens Networks prior to Nokia’s acquisition of full ownership of

the Nokia Networks business. Under this Plan options over Nokia

Solutions and Networks B.V. shares were granted to Mr. Suri,

Mr. Elhage and approximately 65 other Nokia Networks employees.

At that time, both Nokia and Siemens were considering a potential

exit from Nokia Siemens Networks. The plan had two objectives:

(1) increasing the value of Nokia Networks; and (2)thecreation of an

exit option for its parent companies. With the signicantly improved

performance of Nokia Networks, the rst objective has been met.

Thesecond objective has not occurred and given the change in

Nokia’sstrategy, the likelihood of a sale or IPO hasreduced.

The exercise price of the options is based on a Nokia Networks share

value on grant, as determined for the purposes of the Nokia Networks

Equity Incentive Plan. The options will be cash-settled at exercise,

unless an initial public oering has taken place, at which point they

would be converted into equity-settled options.

The actual payments, if any, under the Nokia Networks Equity Incentive

Plan will be determined based on the value of the Nokia Networks

business and could ultimately decline to zero if the value of the

business falls below a certain level. There is also a cap that limits

potential gain for all plan participants.

If the second objective of the plan is not achieved and there is no

exit event, options are cash-settled and the holder will be entitled

tohalf of the share appreciation based on the exercise price and the

estimated value of shares on the exercise date. In the unlikely event of

an IPO or exit event the holder is entitled to the full value of the share

appreciation. As the likelihood of a sale or IPO has reduced, the value

of any payouts under the Nokia Networks Equity Incentive Plan is

expected to be reduced by 50%.

Compensation continued