Nokia 2014 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216

|

|

173

Financial statements

NOKIA IN 2014

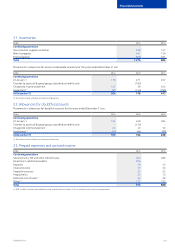

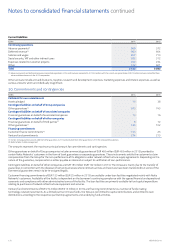

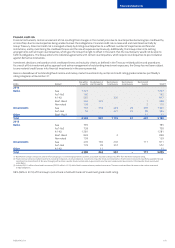

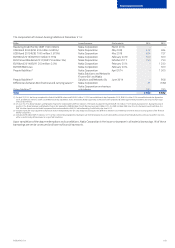

31. Contractual obligations

Payments due for contractual obligations for Continuing operations at December 31, 2014 by due date are:

EURm

Within

1 year

1 to 3

years

3 to 5

years

More than

5 years Total

Continuing operations

Long-term liabilities(1) 1735 1 421 514 2 671

Purchase obligations(2) 832 116 9 – 957

Operating leases(3) 133 164 103 142 542

Total 966 1 015 1 533 656 4 170

(1) Includes current maturities. Refer to Note 35, Risk management.

(2) Includes inventory purchase obligations, service agreements and outsourcing arrangements.

(3) Includes leasing costs for oce, manufacturing and warehouse space under various non-cancellable operating leases. Certain contracts contain renewal options for various periods oftime.

Benet payments for under-funded dened benet plans have been excluded as they are not expected to be material in any given period in the

future. Refer to Note 8, Pensions.

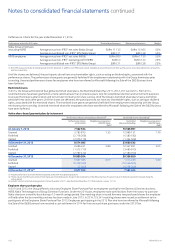

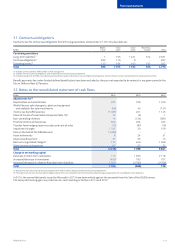

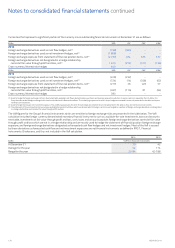

32. Notes to the consolidated statement of cash ows

EURm 2014 2013 2012

Adjustments for(1)

Depreciation and amortization 297 728 1 326

(Prot)/loss on sale of property, plant and equipment

and available-for-sale investments (56) 40 (131)

Income tax (benet)/expense (1 281) 401 1 145

Share of results of associated companies (Note 18) 12 (4) 1

Non-controlling interests 14 (124) (681)

Financial income and expenses 600 264 333

Transfer from hedging reserve to sales and cost of sales (10) (87) (16)

Impairment charges 1 335 20 109

Gain on the Sale of the D&S Business (3 386) – –

Asset retirements 824 31

Share-based payment 37 56 13

Restructuring related charges(2) 115 446 1 659

Other income and expenses 67 25 52

Total (2 248) 1 789 3 841

Change in net working capital

Decrease in short-term receivables 115 1 655 2 118

(Increase)/decrease in inventories (462) 193 707

Increase/(decrease) in interest-free short-term liabilities 1 500 (2 793) (2 706)

Total 1 153 (945) 119

(1) Adjustments for Continuing and Discontinued operations. Refer to Note 3, Disposals treated as discontinued operations.

(2) The adjustments for restructuring-related charges represent the non-cash portion of the restructuring-related charges recognized in the consolidated income statement.

In 2014, the convertible bonds issued to Microsoft in 2013 have been netted against the proceeds from the Sale of the D&S Business.

TheGroup did not engage in any material non-cash investing activities in 2013 and 2012.