Nokia 2014 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

198 NOKIA IN 2014

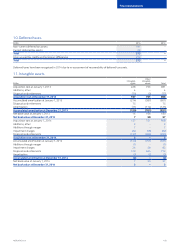

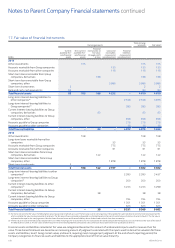

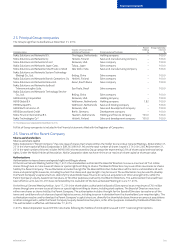

17. Fair value of nancial instruments

EURm

Carrying amounts

Total carrying

amounts Fair value(1)

Current

available-for-

sale financial

assets

Non-current

available-for-

sale financial

assets

Financial

instruments at

fair value

through profit

or loss

Loans and

receivables

measured at

amortized cost

Financial

liabilities

measured at

amortized cost

2014

Other investments 105 105 105

Accounts receivable from Group companies 150 150 150

Accounts receivable from other companies 116 116 116

Short-term loans receivable from Group

companies, derivatives 168 168 168

Short-term loans receivable from Group

companies, other 3 986 3 986 3 986

Short-term investments 2 2 2

Bank and cash, cash equivalents 83 83 83

Total nancial assets 85 105 168 4 252 –4 610 4 610

Long-term interest-bearing liabilities to

other companies(2) 2 558 2 558 3 976

Long-term interest-bearing liabilities to

Group companies(2) 283 283 283

Current interest-bearing liabilities to Group

companies, derivatives 63 63 63

Current interest-bearing liabilities to Group

companies, other 939 939 939

Accounts payable to Group companies 216 216 216

Accounts payable to other companies 16 16 16

Total nancial liabilities – – 63 –4 012 4 075 5 493

2013

Other investments 108 108 108

Long-term loans receivable from other

companies 53 53 53

Accounts receivable from Group companies 775 775 775

Accounts receivable from other companies 61 61 61

Short-term loans receivables from Group

companies, derivatives 142 142 142

Short-term loans receivables from Group

companies, other 1 878 1 878 1 878

Short-term investments 5 5 5

Total nancial assets 5108 142 2 767 –3 022 3 022

Long-term interest-bearing liabilities to other

companies(2) 2 390 2 390 3 457

Long-term interest-bearing liabilities to Group

companies(2) 200 200 200

Current interest-bearing liabilities to other

companies(2) 3 253 3 253 3 299

Current interest-bearing liabilities to Group

companies, derivatives 38 38 38

Current interest-bearing liabilities to Group

companies, other 764 764 764

Accounts payable to Group companies 1 301 1 301 1 301

Accounts payable to other companies 623 623 623

Total nancial liabilities – – 38 –8 531 8 569 9 682

(1) For items not carried at fair value, the following fair value measurement methods are used. The fair value is set to carrying amount for available-for-sale investments carried at cost less impairment for

which no reliable fair value has been possible to estimate. The fair value of loans receivable and payable is estimated based on the current market values of similar instruments (level 2). The fair value is

estimated to be equal to the carrying amount for short-term nancial assets and nancial liabilities due to limited credit risk and short time to maturity.

(2) The fair value of euro convertible bonds (total of EUR 1 500 million maturing 2018-2020) at end of 2013 was based on the bonds being redeemed at par plus accrued interest at the close of the Sale of

the D&S Business (Level 3). The fair values of other long-term interest-bearing liabilities are based on discounted cash ow analysis (level 2) or quoted prices (level 1).

Financial assets and liabilities recorded at fair value are categorized based on the amount of unobservable inputs used to measure their fair

value. Three hierarchical levels are based on an increasing amount of judgment associated with the inputs used to derive fair valuation for these

assets and liabilities, level 1 being market values and level 3, requiring most management judgment. At the end of each reporting period, the

Company categorizes its nancial assets and liabilities to the appropriate level of the fair value hierarchy.

Notes to Parent Company Financial statements continued