Nokia 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOKIA IN 2014 75

Board review

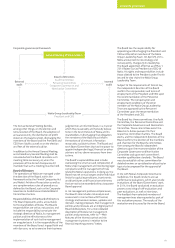

Nokia’s outlook

■Nokia continues to expect Nokia Networks’

net sales to grow on a year-on-year basis

for the full year 2015.

■Nokia continues to expect Nokia Networks’

operating margin for the full year 2015 to

be in-line with Nokia Networks’ long-term

operating margin range of 8% to 11%,

excluding special items and purchase price

accounting related items.

■Nokia’s outlook for Nokia Networks net sales

and operating margin, excluding special

items and purchase price accounting

related items, is based on expectations

regarding a number of factors, including:

– competitive industry dynamics;

– product and regional mix;

– the timing of major network

deployments; and

– expected continued operational

improvement.

■Nokia continues to expect HERE’s net sales

to grow on a year-on-year basis for the full

year 2015.

■Nokia continues to expect HERE’s operating

margin, excluding special items and

purchase price accounting related items,

for the full year 2015 to be between 7%

and 12%, based on HERE’s leading market

position, positive industry trends and

improved focus on cost efficiency.

■Nokia continues to expect Nokia

Technologies’ net sales to grow on a

year-on-year basis for the full year 2015,

excluding potential amounts related to the

expected resolution of our ongoing

arbitration with Samsung, which is expected

to be concluded during 2015.

■Nokia continues to expect Nokia

Technologies’ operating expenses,

excluding special items and purchase price

accounting related items, to increase

meaningfully on a year-on-year basis for

the full year 2015. More specifically, Nokia

expects Nokia Technologies’ quarterly

operating expenses in 2015, excluding

special items and purchase price accounting

related items, to be approximately in-line

with the fourth quarter 2014 level. This is

related to higher investments in licensing

activities, licensable technologies, and

business enablers including go-to-market

capabilities, which target new and

significant long-term growth opportunities.

■Nokia continues to expect Nokia Group

capital expenditures to be approximately

EUR 200 million in 2015, primarily

attributable to capital expenditures by

Nokia Networks.

■Nokia continues to expect Nokia Group

financial income and expenses, including

net interest expenses and the impact from

changes in foreign exchange rates on

certain balance sheet items, to amount

to an expense of approximately EUR 160

million in 2015, subject to changes in

foreign exchange rates and the level of

interest-bearing liabilities.

■Nokia continues to expect Group Common

Functions operating expenses, excluding

special items and purchase price accounting

related items, to be approximately EUR 120

million in 2015.

■Nokia continues to target to record tax

expenses in Nokia Group’s Consolidated

Income Statements at a long-term effective

tax rate of approximately 25%. However,

Nokia targets Nokia Group’s cash tax

obligations to continue at approximately

EUR 250 million annually until Nokia Group’s

deferred tax assets have been fully utilized.

The cash tax amount may vary depending

on profit levels in different jurisdictions and

the amount of license income potentially

subject to withholding tax.