Nokia 2014 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

179

Financial statements

NOKIA IN 2014

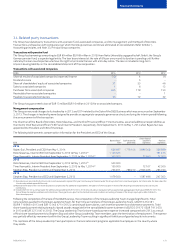

Interest rate risk

The Group is exposed to interest rate risk either through market value uctuations of the consolidated statement of nancial position items

(price risk) or through changes in interest income or expenses (renancing or reinvestment risk). Interest rate risk mainly arises through

interest-bearing liabilities and assets. Estimated future changes in cash ows and the statement of nancial position structure also expose

the Group to interest rate risk. The objective of interest rate risk management is to mitigate the impact of interest rate uctuations on the

consolidated income statement, cash ow, and nancial assets and liabilities whilst taking into consideration the Group’s target capital structure

and the resulting net interest rate exposure.

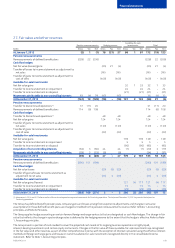

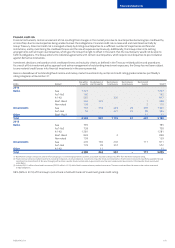

The interest rate prole of interest-bearing assets and liabilities at December 31 is:

EURm

2014 2013

Fixed rate Floating rate Fixed rate Floating rate

Assets 3 494 4 243 4 400 4 739

Liabilities (2 681) (1) (5 947) (630)

Assets and liabilities before derivatives 813 4 242 (1 547) 4 109

Interest rate derivatives 552 (469) 954 (926)

Assets and liabilities after derivatives 1 365 3 773 (593) 3 183

The interest rate exposure is monitored and managed centrally. The Group uses the VaR methodology complemented by selective shock

sensitivity analyses to assess and measure the Group’s interest rate exposure comprising the interest rate risk of interest-bearing assets,

interest-bearing liabilities and related derivatives. The VaR for the interest rate exposure in the investment and debt portfolios is presented in

the table below. Sensitivities to credit spreads are not reected in the below numbers.

EURm 2014 2013

At December 31 31 42

Average for the year 32 45

Range for the year 25—54 20—84

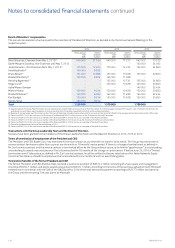

Equity price risk

The Group’s exposure to equity price risk is related to certain publicly listed equity shares. The fair value of these investments is EUR 12 million

(EUR 11 million in 2013). The VaR for the Group’s equity investments in publicly traded companies is insignicant. The private funds where

the Group has investments may, from time to time, have investments in public equity. Such investments have not been included in the

above number.

Other market risk

In certain emerging market countries, there are local exchange control regulations that provide for restrictions on making cross-border transfers

of funds as well as other regulations that impact the Group’s ability to control its net assets in those countries.

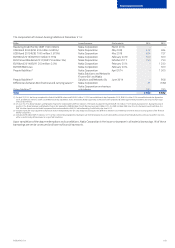

Credit risk

Credit risk refers to the risk that a counterparty will default on its contractual obligations resulting in nancial loss to the Group. Credit risk arises

from credit exposures to customers, including outstanding receivables, nancial guarantees and committed transactions, as well as nancial

institutions, including bank and cash, xed income and money-market investments, and derivative nancial instruments. Credit risk is managed

separately for business-related and nancial credit exposures.

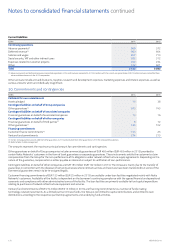

Except for the rst two items in the following table, the maximum exposure to credit risk is limited to the book value of nancial assets as

included in the consolidated statement of nancial position:

EURm 2014 2013

Financial guarantees given on behalf of customers and other third parties 612

Loan commitments given but not used 155 25

Outstanding customer nance loans 139

Total 162 76