Nokia 2014 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

182 NOKIA IN 2014

Notes to consolidated nancial statements continued

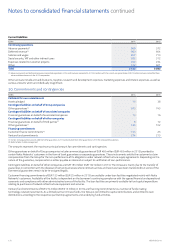

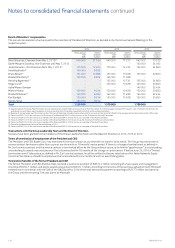

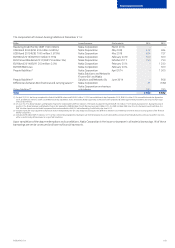

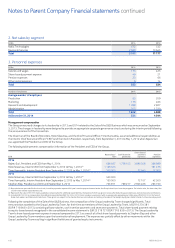

Financial assets and liabilities subject to osetting under enforceable master netting agreements and similar arrangements at December 31 are:

EURm

Gross amounts of

financial assets/

(liabilities)

Gross amounts of

financial liabilities/

(assets) set off

in the statement

of financial position

Net amounts of

financial assets/

(liabilities) presented

in the statement of

financial position

Related amounts not set off in the

statement of financial position

Net amount

Financial instruments

assets/(liabilities)

Cash collateral

received/(pledged)

2014

Derivative assets 241 241 124 85 32

Derivative liabilities (174) (174) (124) (50)

Total 67 –67 –85 (18)

2013

Derivative assets 191 191 34 66 91

Derivative liabilities (35) (35) (34) (1)

Total 156 –156 –66 90

The nancial instruments subject to enforceable master netting agreements and similar arrangements are not oset in the consolidated

statement of nancial position where there is no intention to settle net or realize the asset and settle the liability simultaneously.

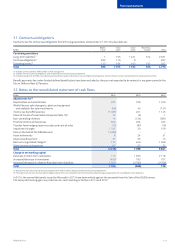

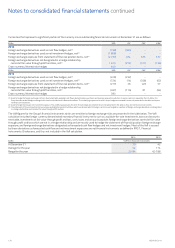

Liquidity risk

Liquidity risk is dened as nancial distress or extraordinarily high nancing costs arising from a shortage of liquid funds in a situation where

outstanding debt needs to be renanced or where business conditions unexpectedly deteriorate and require nancing. Transactional liquidity

risk is dened as the risk of executing a nancial transaction below fair market value or not being able to execute the transaction at all within a

specic period of time. The objective of liquidity risk management is to maintain sucient liquidity, and to ensure that it is available fast enough

without endangering its value in order to avoid uncertainty related to nancial distress at all times.

The Group aims to secure sucient liquidity at all times through ecient cash management and by investing in short-term liquid

interest-bearing securities. Depending on its overall liquidity position, the Group may pre-nance or renance upcoming debt maturities before

contractual maturity dates. The transactional liquidity risk is minimized by entering into transactions where proper two-way quotes can be

obtained from the market.

Due to the dynamic nature of the underlying business, the Group aims to maintain exibility in funding by maintaining committed and

uncommitted credit lines. At December 31, 2014 the Group’s committed revolving credit facilities totaled EUR 1 500 million (EUR 2 250 million

in 2013).

Signicant current long-term funding programs at December 31, 2014 are outlined below:

Issuer: Program: Issued

Nokia Corporation Euro Medium-Term Note Program, totaling EUR 5 000 million EUR 1 750 million

Signicant current short-term funding programs at December 31, 2014 are outlined below:

Issuer(s): Program: Issued

Nokia Corporation Local commercial paper program in Finland, totaling EUR 750 million –

Nokia Corporation US Commercial Paper program, totaling USD 4 000 million –

Nokia Corporation andNokia Finance

International B.V.

Euro Commercial Paper program, totaling USD 4 000 million –

Nokia Solutions and Networks Finance B.V. Local commercial paper program in Finland, totaling EUR 500 million –