Nokia 2014 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

154 NOKIA IN 2014

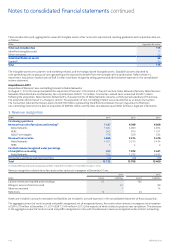

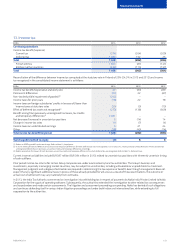

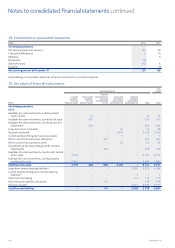

14. Deferred taxes

EURm 2014 2013

Continuing operations

Deferred tax assets:

Tax losses carried forward and unused tax credits(1) 967 446

Pensions(2) 332 211

Provisions(3) 246 126

Depreciation dierences(1) (2) 1 386 451

Intercompany prot in inventory 87 48

Other temporary dierences(2) 156 100

Reclassication due to netting of deferred tax assets and liabilities (454) (492)

Total deferred tax assets 2 720 890

Deferred tax liabilities:

Pensions(2) (177) (180)

Depreciation dierences(2) (266) (433)

Undistributed earnings (18) (68)

Other temporary dierences(2) (25) (6)

Reclassication due to netting of deferred tax assets and liabilities 454 492

Total deferred tax liabilities (32) (195)

Net balance 2 688 695

(1) The increase from 2013 is primarily due to the recognition of deferred tax assets, partially oset by the subsequent utilization of tax losses carried forward in Finland.

(2) Pension-related deferred tax has been reclassied from depreciation dierences and other temporary dierences to pensions and reclassied for comparability purposes in 2013.

(3) Warranty provision and other provisions have been combined and shown as provisions and reclassied for comparability purposes in 2013.

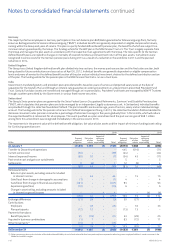

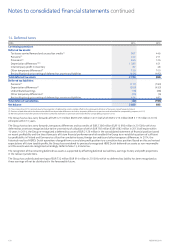

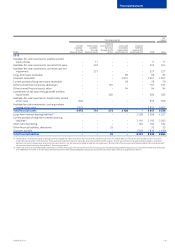

The Group has tax loss carry forwards of EUR 3 213 million (EUR 6 295 million in 2013) of which EUR 2 215 million (EUR 5 117 million in 2013)

will expire within 10 years.

The Group has tax loss carry forwards, temporary dierences and tax credits of EUR 2 386 million (EUR 10 693 million in 2013) for which no

deferred tax asset was recognized due to the uncertainty of utilization of which EUR 792 million (EUR 4 882 million in 2013) will expire within

10 years. In 2014, the Group re-recognized a deferred tax asset of EUR 2 126 million in the consolidated statement of nancial position based

on recent protability and the latest forecasts of future nancial performance which enabled the Group to re-establish a pattern of sucient

tax protability in Finland and Germany to utilize the cumulative losses, foreign tax credits and other temporary dierences. In 2014, the

historical results of HERE’s Dutch operations changed from a cumulative prot position to a cumulative loss position. Based on this and revised

expectations of future taxable prots,the Group has considered its previously recognized HERE Dutch deferred tax assets as non-recoverable

and the assets were de-recognized accordingly. Refer to Note 13, Income tax.

The recognition of the remaining deferred tax assets is supported by osetting deferred tax liabilities, earnings history and prot projections

in the relevant jurisdictions.

The Group has undistributed earnings of EUR 732 million (EUR 614 million in 2013) for which no deferred tax liability has been recognized as

these earnings will not be distributed in the foreseeable future.

Notes to consolidated nancial statements continued