Nokia 2014 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

153

Financial statements

NOKIA IN 2014

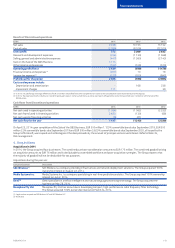

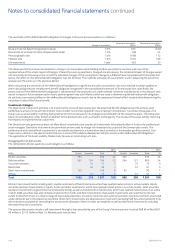

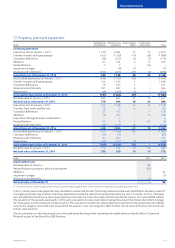

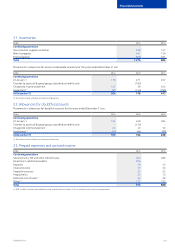

13. Income tax

EURm 2014 2013 2012

Continuing operations

Income tax benet/(expense)

Current tax (374) (354) (329)

Deferred tax 1 782 152 25

Total 1 408 (202) (304)

Finnish entities 1 840 (87) (147)

Entities in other countries (432) (115) (157)

Total 1 408 (202) (304)

Reconciliation of the dierence between income tax computed at the statutory rate in Finland of 20% (24.5% in 2013 and 2012) and income

tax recognized in the consolidated income statement is as follows:

EURm 2014 2013 2012

Income tax benet/(expense) atstatutory rate 47 (60) 289

Permanent dierences (23) 22 (67)

Non-tax deductible impairment ofgoodwill(1) (242) – –

Income taxes for prior years (18) 22 78

Income taxes on foreign subsidiaries’ prots in (excess of)/lower than

income taxes at statutory rates (35) (5) (15)

Eect of deferred taxassets not recognized(2) (373) (138) (609)

Benet arising from previously unrecognized tax losses, tax credits

and temporary dierences(3) 2 081 – –

Net decrease/(increase) in uncertain tax positions 5(14) 14

Change in income tax rates (1) (7) (4)

Income taxes on undistributed earnings 521 24

Other (38) (43) (14)

Total income tax benet/(expense) 1 408 (202) (304)

Tax (charged)/credited to equity (7) 6 3

(1) Relates to HERE’s goodwill impairment charge. Refer to Note 10, Impairment.

(2) In 2014, relates primarily to HERE’s Dutch tax losses and temporary dierences for which deferred tax was not recognized. In 2013 and 2012, relates primarily to Nokia Networks’ Finnish and German

unrecognized deferred tax on tax losses, unused tax credits and temporary dierences accordingly.

(3) Relates primarily to the Group’s Finnish tax losses, unused tax credits and temporary dierences for which deferred tax was recognized. Refer to Note 14, Deferred taxes.

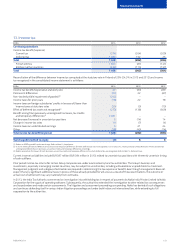

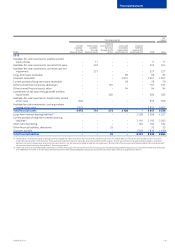

Current income tax liabilities include EUR 387 million (EUR 394 million in 2013) related to uncertain tax positions with inherently uncertain timing

of cash outows.

Prior period income tax returns for certain Group companies are under examination by local tax authorities. The Group’s business and

investments, especially in emerging market countries, may be subject to uncertainties, including unfavorable or unpredictable tax treatment.

Management judgment and a degree of estimation are required in determining the tax expense or benet. Even though management does not

expect that any signicant additional taxes in excess of those already provided for will arise as a result of these examinations, the outcome or

actual cost of settlement may vary materially from estimates.

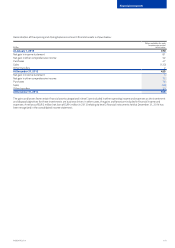

In 2013, the India Tax Authority commenced an investigation into withholding tax in respect of payments by Nokia India Private Limited to Nokia

Corporation for the supply of operating software. Subsequently, the authorities extended the investigation to other related tax consequences

and issued orders and made certain assessments. The litigation and assessment proceedings are pending. Nokia has denied all such allegations

and continues defending itself in various Indian litigation proceedings and under both Indian and international law, while extending its full

cooperation to the authorities.