Nokia 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

Corporate governance

NOKIA IN 2014

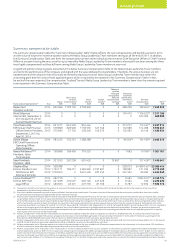

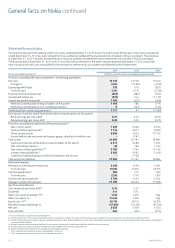

Stock option ownership of the Nokia Group Leadership Team members

The following table provides certain information relating to stock options held by the members of the Nokia Group Leadership Team at

December 31, 2014. These stock options were issued pursuant to Nokia Stock Option Plans 2007 and 2011. For a description of our stock

option plans, refer to Note 25, Share based payment, of our consolidated nancial statements included in this annual report.

Name

Number(1)

Total intrinsic value(2)

at December 31, 2014, EUR

Category Expiration date Exercise price EUR Exercisable Unexercisable Exercisable Unexercisable

Timo Ihamuotila 2009 2Q December 31, 2014 10.92 0 0 0 0

2009 4Q December 31, 2014 8.50 0 0 0 0

2010 2Q December 31, 2015 8.60 70 000 0 0 0

2011 2Q December 27, 2017 5.76 35 000 35 000 28 000 28 000

2011 3Q December 27, 2017 3.50 100 000 100 000 306 000 306 000

2012 2Q December 27, 2018 2.18 0150 000 0657 000

2013 2Q December 27, 2019 2.45 0370 000 01 520 700

2013 4Q December 27, 2019 5.51 050 000 052 500

(1) Number of stock options equals the number of underlying shares represented by the option entitlement. Stock options granted under 2007 and 2011 Stock Option Plans have dierent vesting

schedules. The Stock Option Plan 2007 has a vesting schedule with a 25% vesting one year after grant, and quarterly vesting thereafter, each of the quarterly lots representing 6.25% of the total grant.

The grants vest fully in four years. The Stock Option Plan 2011 has a vesting schedule with 50% of stock options vesting three years after grant and the remaining 50% vesting four years from grant.

(2) The intrinsic value of the stock options is based on the dierence between the exercise price of the options and the closing market price of Nokia shares on Nasdaq Helsinki at December 30, 2014 of

EUR 6.56.

* For gains realized upon exercise of stock options for the Nokia Group Leadership Team members, refer to the table in “—Stock option exercises and settlement of shares” below.

** Although Mr. Suri and Mr. Elhage do not hold Nokia stock options, they hold options over shares in Nokia Solutions and Networks B.V. that were granted under the Nokia Networks Equity Incentive Plan

in 2012 as further detailed in the “—Nokia Networks Equity Incentive Plan” section above.

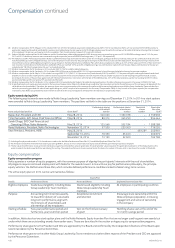

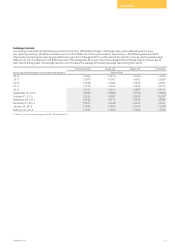

Stock option exercises and settlement of shares

The following table provides certain information relating to stock option exercises and share deliveries upon settlement during the year 2014

for the Nokia Group Leadership Team members.

Name

Stock options awards(1) Performance shares awards(2) Restricted shares awards

Number of shares

acquired on exercise

Value realized

on exercise EUR

Number of shares

delivered on vesting

Value realized

on vesting EUR

Number of shares

delivered on vesting

Value realized

on vesting EUR

Rajeev Suri 0 0 0 0 0 0

Timo Ihamuotila 0 0 0 0 75 000

50 000 399 750(3)

267 500(4)

Samih Elhage 0000

Ramzi Haidamus 0 0 0 0

Sean Fernback 0 0 0 0

(1) Value realized on exercise is based on the dierence between the Nokia share price and exercise price of options.

(2) No Nokia shares were delivered under the Performance Share Plan 2011 and 2012 during 2014 as Nokia’s performance did not reach the threshold level of either performance criteria.

(3) Represents the delivery of Nokia shares vested from the Restricted Share Plan 2010. Value is based on the average market price of the Nokia share on Nasdaq Helsinki at February 19, 2014 of EUR 5.33.

(4) Represents the delivery of Nokia shares vested from the Restricted Share Plan 2011. Value is based on the average market price of the Nokia share on Nasdaq Helsinki at April 23, 2014 of EUR 5.35.

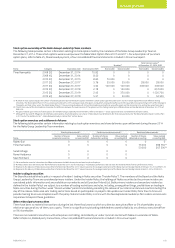

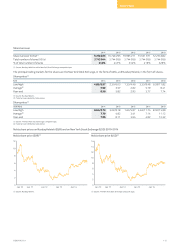

Insider trading in securities

The Board has established a policy in respect of insiders’ trading in Nokia securities (“Insider Policy”). The members of the Board and the Nokia

Group Leadership Team are considered primary insiders. Under the Insider Policy, the holdings of Nokia securities by the primary insiders are

considered public information and are available on our website and at Euroclear Finland Ltd. Both primary insiders and secondary insiders (as

dened in the Insider Policy) are subject to a number of trading restrictions and rules, including, among other things, prohibitions on trading in

Nokia securities during the four-week “closed-window” period immediately preceding the release of our interim and annual results including the

day of the release. Nokia also sets trading restrictions based on participation in projects. We update our Insider Policy from time to time and

provide training to ensure compliance with the policy. Nokia’s Insider Policy is in line with the Nasdaq Helsinki Guidelines for Insiders and also sets

requirements beyond those guidelines.

Other related party transactions

There have been no material transactions during the last three scal years to which any director, executive ocer or 5% shareholder, or any

relative or spouse of any of them, was a party. There is no signicant outstanding indebtedness owed to Nokia by any director, executive ocer

or 5% shareholder.

There are no material transactions with enterprises controlling, controlled by or under common control with Nokia or associates of Nokia.

Refer to Note 34, Related party transactions, of our consolidated nancial statements included in this annual report.