Nokia 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nokia in 2014

Table of contents

-

Page 1

Nokia in 2014 -

Page 2

...with our partners, customers, and across our businesses, to create human technology that helps people thrive. Effortless, simple, and intuitive technology, designed to enable new and extraordinary experiences in people's lives each day. We see the possibilities of technology. The human possibilities... -

Page 3

... Directors Members of the Nokia Group Leadership Team Compensation 44 47 54 64 66 70 72 73 74 74 75 76 78 80 86 89 92 General facts on Nokia History of Nokia Memorandum and Articles of Association Selected financial data Shares and shareholders Key ratios Financial statements Consolidated financial... -

Page 4

...fields, key participants in the rapidly evolving world of technology which is as much about connecting things as about connecting people. Our focus We are focused on three businesses: network infrastructure software, hardware and services, which we offer through Nokia Networks; mapping and location... -

Page 5

... efficient mobile networks. Ranked third in terms of market share in mobile radio networks and telecommunications services, Nokia Networks is a significant player in its chosen markets and, with sales in over 120 countries, served by approximately 54 600 employees, it has the global reach and scale... -

Page 6

... and Chief Executive Officer ("President and CEO") of Nokia Corporation and announced the appointment of the Nokia Group Leadership Team effective as of May 1, 2014. â- Nokia announced its new strategy that builds on its three businesses: Nokia Networks, HERE and Nokia Technologies. â- Nokia... -

Page 7

...'s mapping and location intelligence business, and as a member of the Nokia Group Leadership Team. November November 14, 2014 Nokia held its Capital Markets Day event in London, the United Kingdom, where the company shared its updated vision, strategic priorities and long-term financial targets... -

Page 8

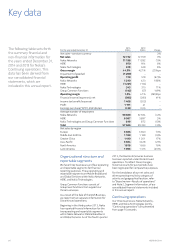

Key data The following table sets forth the summary financial and non-financial information for the years ended December 31, 2014 and 2013 for Nokia's Continuing operations. This data has been derived from our consolidated financial statements, which are included in this annual report. For the ... -

Page 9

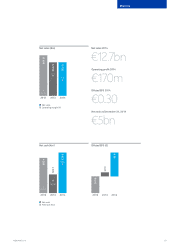

Overview Net sales (â,¬m) Net sales 2014 â,¬12.7bn 12 732 4.1 1.3 12 709 (5.3) 2012 2013 2014 Net sales Operating margin(%) Net cash (â,¬m) (815) 2012 2013 2014 2012 2013 2014 Net cash Free cash flow 15 400 4 360 Operating profit 2014 â,¬170m Diluted EPS 2014 â,¬0.30 Net cash at December... -

Page 10

... sell the Devices & Services business to Microsoft, a transaction that made particular sense in light of our earlier acquisition of Siemens' share of what was then Nokia Siemens Networks. These two transactions were central to the creation of the strong Nokia of today, a company with three powerful... -

Page 11

... our three businesses; put in place the Nokia Business System to help optimize our investments, manage performance and develop our talent and future leaders; and honed our portfolio management approach to allocate resources based on their value creation potential. With these actions, I believe that... -

Page 12

... and exponential increases in data traffic; â- location services that seamlessly bridge between the real and virtual worlds; and â- innovation across a number of technology areas including sensing, radio and low-power operation. Nokia's vision is to be a leader over the long term in these three... -

Page 13

... but also provide, under "Business overview-discontinued operations," information about the Devices & Services business, which was part of the Nokia Group until its sale on April 25, 2014. The human benefits of connecting things More leisure time as technology automates the many little things which... -

Page 14

... a technology leader in the Programmable World and, in turn, to create long-term shareholder value. Our aim, which builds on our three businesses, is to optimize our business structure to enable each one to efficiently meet its strategic goals. Where financially prudent, we will pursue shared... -

Page 15

... investments and improve long-term profitability. Nokia Technologies Our Nokia Technologies business aims to bolster the further development of our industry-leading innovation portfolio by: â- expanding our successful patent licensing program; â- helping other companies and organizations benefit... -

Page 16

... 2013 adding the role of Chief Financial Officer to his responsibilities. Samih serves on both the Nokia Group Leadership Team and the Nokia Networks Leadership Team. Sean Fernback b. 1963 President, HERE Ramzi Haidamus b. 1964 President, Nokia Technologies Since training as an engineer 25 years... -

Page 17

... Africa region to profitable growth and heading the Care and Network Planning & Optimization business lines. Prior to joining the company in 2007, Igor held various management roles for telecom operators and services companies in several countries. Marc has over 20 years of international management... -

Page 18

Technology that thinks ahead Adapti 16 NOKIA IN 2014 -

Page 19

... over social networks. At the packed Hartwall Arena in Helsinki, Nokia's Centralized RAN solution delivered data uploads significantly faster than using traditional radio solutions available in the market, while cutting smartphone power consumption by one third. 2.5 times faster Data uploads 17 -

Page 20

...provides Operations Support Systems to the world's top ten operators. Its Global Services teams have so far delivered 400 multi-vendor projects; they put a new site on air every 100 seconds and manage networks serving 550 million subscribers. Nokia Networks takes its customers' investments seriously... -

Page 21

... the third-largest company in its target market of mobile infrastructure and related services. Nokia Networks has a strong position in all generations of radio network technologies (2G, 3G and 4G) and the underlying core networks software. In 3G, Nokia Networks serves more operators than any of its... -

Page 22

... and Wi-Fi technologies to handle the large proportion of mobile data traffic that is generated by users indoors. Another example of how Nokia Networks is developing its portfolio is the use of its LTE capabilities to target new market areas, such as LTE-based public safety solutions. 2. Growing... -

Page 23

... picocell base stations, which was introduced in November 2013 and enhanced throughout 2014. Another example is Nokia Networks' cloudready Operations Support Systems-where during 2014, the number of customers using its virtualized NetAct solution for network management exceeded 200. To support the... -

Page 24

... cloud computing, analytics, big data and multimedia content. The new partnering unit, which is part of Mobile Broadband, exists to help Nokia Networks achieve its goals through partnering with recognized market leaders- the best of the up-and-coming technology innovators and companies that have... -

Page 25

... Republic of China Friendship Award in 2014. â- In India, Nokia Networks is a strong player, with operator customers such as Bharti Airtel, Idea Cellular and Vodafone. In fact, we count ten Indian telecom operators, both public and private, among our customers in the market, along with the Indian... -

Page 26

... chain management of all its hardware, software and original equipment manufacturer products. This includes supply planning, manufacturing, distribution, procurement, logistics, supply, network design and delivery capability creation in product programs. On December 31, 2014, Nokia Networks had... -

Page 27

... solutions for mobile network infrastructure. Building a Radio Cloud Nokia Radio Cloud is a highly scalable, flexible and efficient architecture for cloud-based networks. It allocates processing capacity from almost anywhere in the network, such as an adjacent cell or a centralized data center... -

Page 28

Grounded in real life Releva 26 NOKIA IN 2014 -

Page 29

Business overview nt NOKIA IN 2014 HERE True Cars HERE's fleet of True Cars is driving 50 000 km across six continents each week. Why? Using proprietary technology, the cars are collecting information to create an accurate 3D digital representation of the real world. These high-definition maps ... -

Page 30

...Global new embedded navigation licenses 13 In-car navigation systems in North America and Europe powered by HERE's map content 970 11 914 79.3 8 77.2 75.4 Employees at December 31, 2014 (27.3) (16.8) (127.9) 2012 2013 2014 2012 2013 2014 Net sales (â,¬m) Gross margin (%) Operating... -

Page 31

... Nokia name. The business has developed organically and through acquisitions, the most significant of which were the acquisition of location software provider Gate5 in 2006, digital mapping provider NAVTEQ in 2008, and data capture company earthmine in 2012. For over 25 years, HERE has been driving... -

Page 32

... in the emerging field of real-time predictive analytics, to enable HERE to innovate in contextual mapmaking and deliver on its vision to create maps and location services across screens and operating systems that change according to the situation. Strategy HERE already aggregates data related to... -

Page 33

...on the development of software, cloud and data analytical capabilities in preparation for the anticipated emergence of highly automated driving before the end of the decade. HERE's investments are focusing on addressing what it sees as three of the most critical technological challenges: the vehicle... -

Page 34

Making sophisticated technology simple Huma 32 NOKIA IN 2014 -

Page 35

Business overview Nokia Technologies Z Launcher Z Launcher from Nokia Technologies learns and adapts to user preferences, and enables one-touch access to apps: faster, easier, more intuitive navigation using scribble letter recognition to find what users want. n NOKIA IN 2014 500 000+ ... -

Page 36

...right moment. Any app can be accessed in one second through an exceedingly simple handwriting feature. Nokia Technologies is a leading innovator in key cellular standards, as well as wireless LAN, NFC and various audio, speech and video codecs. The technology standards developed by our core R&D team... -

Page 37

... Technologies in the future. Business overview Nokia Technologies develops and licenses technologies we believe will enable the Programmable World. We seek to create value from our investments by expanding our successful patent licensing program and helping other companies and organizations benefit... -

Page 38

... world-class R&D team. For examples of Nokia Technologies' progress relative to its strategy refer to "Board review-Main events in 2014- Nokia Technologies operating highlights". Research and development The Nokia Technologies team consists of a great number of world-class scientists and engineers... -

Page 39

... R&D team. Breakdown of Nokia Technologies' IP portfolio 3 1 Competition Our current patent portfolio spans a number of technology categories including radio connectivity and networking, multimedia, user interface ("UI") and software, hardware, product, and mapping and location services. As Nokia... -

Page 40

... and services are optimized for-and not compromised by-low price points. As part of the Sale of the D&S Business, Microsoft has licensed, for a limited time, the Nokia brand for use with certain products from the Mobile Phones unit as well as acquired the Asha brand under which Nokia marketed some... -

Page 41

Business overview Production of mobile devices Until the closing of the Sale of the D&S Business, Nokia operated a total of eight production facilities with the purpose of production and customization of mobile devices. The production facilities were located in Manaus, Brazil; Beijing and Dongguan,... -

Page 42

... by network operators to software solutions supporting the efficient interaction of networks, as well as services to plan, optimize, implement, run and upgrade mobile operators' networks. Nokia Networks is investing in the innovative products and services needed by telecom operators to manage the... -

Page 43

...' targeted long-term operating margin range of 8% to 11%, excluding special items and purchase price accounting related items. In addition, Nokia expects Nokia Networks' net sales to grow on a year-on-year basis for the full year 2015. This outlook is based on Nokia's expectations regarding a number... -

Page 44

... value-adding services to the automotive industry. Targets and priorities Nokia expects HERE's net sales to grow on a year-on-year basis for the full year 2015, and HERE's operating margin for the full year 2015 to be between 7% and 12%, excluding special items and purchase price accounting related... -

Page 45

... refer to Note 35, Risk management, of our consolidated financial statements included in this annual report. Refer also to "Board review-Risk Factors-Risks relating to Nokia". Trends affecting our businesses Exchange rates Nokia is a company with global operations and net sales derived from various... -

Page 46

Board review Collabo 44 NOKIA IN 2014 -

Page 47

... 69 Board of Directors and management Sustainability and corporate responsibility at Nokia Respecting people in everything we do Protecting the environment Improving people's lives with technology Making change happen together Reporting on our performance Employees Shares and share capital Dividend... -

Page 48

... Leadership Team. The Board also decided on a new Nokia strategy and a EUR 5 billion program to optimize Nokia's capital structure, including the recommencement of dividend payments and a plan to repurchase Nokia shares. All of this was announced on April 29, 2014, and at the Annual General Meeting... -

Page 49

...of operations The financial data included in this "Board review" section at and for the year ended December 31, 2013 and 2014 and for each of the years in the three-year period ended December 31, 2014 has been derived from our audited consolidated financial statements included in this annual report... -

Page 50

... in Nokia Technologies was primarily attributable to investments in business activities, such as the Technology and Brand licensing opportunities, which target new and significant long-term growth opportunities. R&D expenses included purchase price accounting related items of EUR 36 million in 2014... -

Page 51

...to our acquisition of Siemens' stake in Nokia Networks (formerly Nokia Siemens Networks) in August 2013, which significantly reduced the non-controlling interests in that business. Profit/loss attributable to equity holders of the parent and earnings per share Nokia Group's total profit attributable... -

Page 52

... 7.7% of our net sales in 2013 compared to 8.9% in 2012. The decrease in selling and marketing expenses was due to lower purchase price accounting items and generally lower expenses in Nokia Networks and HERE. Selling and marketing expenses included purchase price accounting items of EUR 93... -

Page 53

... in 2012. This change was primarily due to an improvement in Nokia Networks results and our acquisition of Siemens' stake in Nokia Networks. Profit/loss attributable to equity holders of the parent and earnings per share Nokia Group's total loss attributable to equity holders of the parent in 2013... -

Page 54

... table sets forth selective line items and the percentage of net sales that they represent for years indicated. For the year ended December 31 2014(1) EURm % of net sales 2013 EURm % of net sales Year-on-year change % Net sales Cost of sales Gross profit Research and development expenses Selling... -

Page 55

... 31 2013 EURm % of net sales 2012 EURm % of net sales Year-on-year change % Net sales Cost of sales Gross profit Research and development expenses Selling and marketing expenses Administrative and general expenses Other income and expenses Operating loss Net sales Discontinued operations net sales... -

Page 56

...Nokia Networks' Optical business until May 6, 2013, when its divestment was completed. It also includes restructuring and associated charges for Nokia Networks business. Refer to Note 2, Segment information, of our consolidated financial statements included in this annual report. 54 NOKIA IN 2014 -

Page 57

... of managed services and a higher proportion of systems integration in the sales mix, as well as margin improvement in systems integration. The increase was partially offset by lower gross margin in care, network implementation and network planning and optimization. Operating expenses Nokia Networks... -

Page 58

..., Nokia Networks announced its strategy to focus on mobile broadband and related services, and also launched an extensive global restructuring program, targeting a reduction of its annualized operating expenses and production overhead, excluding special items and purchase price accounting related... -

Page 59

... of the customer focus on radio technologies. Global Services net sales declined 17% to EUR 5 753 million in 2013, compared to EUR 6 929 million in 2012 primarily due to the exiting of certain customer contracts and countries as part of Nokia Networks strategy to focus on more profitable business as... -

Page 60

...focused strategy, most notably LTE. Nokia Networks sales and marketing expenses decreased 29% year-on-year in 2013 to EUR 821 million from EUR 1 158 million in 2012, primarily due to structural cost savings from Nokia Networks restructuring program and a decrease in purchase price accounting related... -

Page 61

... table sets forth selective line items and the percentage of net sales that they represent for the years indicated. For the year ended December 31 2014 EURm % of net sales 2013 EURm % of net sales Year-on-year change % Net sales Cost of sales Gross profit Research and development expenses Selling... -

Page 62

... our consolidated financial statements included in this annual report. The charge was partially offset by the absence of significant purchase price accounting related items arising from the purchase of NAVTEQ, the majority of which were fully amortized in 2013. Global cost reduction program In 2014... -

Page 63

... customers, which generally carry a lower gross margin, partially offset by lower costs related to service delivery. Operating expenses HERE R&D expenses decreased 27% to EUR 648 million in 2013 compared to EUR 883 million in 2012, primarily due to a decrease in purchase price accounting related... -

Page 64

... in 2013. The increase in R&D expenses was primarily attributable to investments in business activities, such as building the Technology and Brand licensing units, which target new and significant long-term growth opportunities. Nokia Technologies selling, general and administrative expenses in 2014... -

Page 65

... 31 2013 EURm % of net sales 2012 EURm % of net sales Year-on-year change % Net sales Cost of sales Gross profit Research and development expenses Selling and marketing expenses Administrative and general expenses Other income and expenses Operating profit Net sales Nokia Technologies net sales was... -

Page 66

... in 2012 equaled EUR 461 million. Major items of capital expenditure in 2014 included production lines, test equipment and computer hardware used primarily in R&D, office and manufacturing facilities as well as services and software related intangible assets. In 2013, Nokia's cash used in investing... -

Page 67

... under such guarantees are released upon the earlier of expiration of the guarantee or early payment by the customer or other third party. Refer to Note 30, Commitments and contingencies, of our consolidated financial statements included in this annual report for further information regarding... -

Page 68

...2014, Nokia held its Capital Markets Day event in London, United Kingdom, where the company shared its updated vision, strategic priorities and long-term financial targets. â- Effective on January 2, 2014, one of Nokia's Finnish subsidiaries, Nokia Asset Management Oy, merged into Nokia Corporation... -

Page 69

... key LTE radio network supplier to 15 of the world's top 20 LTE operators. â- Nokia Networks also added a large number of other mobile broadband contracts including two 3G networks and services contracts in India. â- Nokia Networks continued to show leadership in 4G radio technology, demonstrating... -

Page 70

... annual Best Global Green Brands report for 2014 $100m Connected Car Fund to identify and invest in companies whose innovations are deemed important for a world of connected and intelligent vehicles 44 countries Have access to HERE Traffic, which is HERE's real-time traffic data offering 68 NOKIA... -

Page 71

...the Sale of the D&S Business. Shortly after the end of 2014, Nokia's original equipment manufacturer ("OEM") partner began selling the Nokia N1 Android tablet in the first quarter 2015 in China, with other markets to follow. â- Later in the fourth quarter, the H.265 video coding technology standard... -

Page 72

...shares and stock options held by the members of the Board, the President and CEO and the other members of the Nokia Group Leadership Team, refer to "Compensation". For more information regarding Corporate Governance at Nokia, refer to "Corporate Governance Statement" or to Nokia's website at company... -

Page 73

... as an advisor to the President and CEO of Nokia Corporation on technology issues. "The Board has the responsibility for appointing and discharging the President and Chief Executive Officer, Group Chief Financial Officer and other members of the Nokia Group Leadership Team." NOKIA IN 2014 71 -

Page 74

...reinforced in our Human Rights Policy, which underpins our commitment to help prevent potential misuse of our products and services in issues related to freedom of expression and privacy. In 2014, we provided training to our employees on human rights through ethical business training programs and we... -

Page 75

...products and services. Billions of people are connected through our networks. Mobile technology plays a fundamental role in giving people a voice and access to knowledge, information and education. In 2014, Nokia started a three-year global partnership with Save the Children to help improve children... -

Page 76

..., stock options, shareholders' equity per share, dividend yield, price per earnings ratio, share prices, market capitalization, share turnover and average number of shares are available in the "Compensation of the Board of Directors and the Nokia Group Leadership Team", "Financial Statements... -

Page 77

... be in-line with Nokia Networks' long-term operating margin range of 8% to 11%, excluding special items and purchase price accounting related items. â- Nokia's outlook for Nokia Networks net sales and operating margin, excluding special items and purchase price accounting related items, is based on... -

Page 78

...efforts aimed at managing and improving financial or operational performance, cost savings and competitiveness may not lead to targeted results or improvements. â- We may not be able to optimize our capital structure as planned and re-establish our investment grade credit rating. 76 NOKIA IN 2014 -

Page 79

...high-quality products, services, upgrades and technologies and to bring them to market in a timely manner. â- Nokia Networks is dependent on a limited number of customers and large multi-year agreements and accordingly a loss of a single customer, further operator consolidation or issues related to... -

Page 80

Corporate governance Reliabl 78 NOKIA IN 2014 -

Page 81

...internal control and risk management systems in relation to the financial reporting process Members of the Board of Directors Members of Nokia Group Leadership Team Compensation Board of Directors Executive compensation Compensation governance practices 80 80 80 85 86 89 92 92 93 97 Service contract... -

Page 82

... time of the delivery of the shares, unless the shareholder approval has been granted through an authorization to the Board, a maximum of five years earlier. The New York Stock Exchange corporate governance standards require that the equity compensation plans be approved by a company's shareholders... -

Page 83

... the management of risks related to Nokia's operations. In doing so, the Board may set annual ranges and/or individual limits for capital expenditures, investments and divestitures and financial commitments that are not to be exceeded without separate Board approval. In risk management policies and... -

Page 84

...Chairman of the Board and the President and CEO, but the leadership structure is dependent on the company needs, shareholder value and other relevant factors applicable from time to time, while respecting the highest corporate governance standards. In 2014, through to April 30, 2014, Timo Ihamuotila... -

Page 85

...'s website at company.nokia. com/en/about-us/corporate-governance. Furthermore, Nokia has a Code of Conduct which is equally applicable to all Nokia employees, directors and management and, in addition, Nokia has a Code of Ethics applicable to the President and CEO, Group Chief Financial Officer and... -

Page 86

... plans. The Committee is responsible for overseeing compensation philosophy and principles and ensuring the above compensation programs are performance-based, designed to contribute to the long-term shareholder value creation and alignment to shareholders' interests, properly motivate management... -

Page 87

...More information on the members of the Nokia Group Leadership Team is available on pages 90 and 91 of this annual report and on our website at company.nokia.com/en/ about-us/corporate-governance. The management is responsible for establishing and maintaining adequate internal control over financial... -

Page 88

... Chief Executive Officer of Orange 2013-2014. Head of Business Services of Orange 2010-2013. CEO of Thomson India in 2000-2004. Various technical positions with the long-distance networks division of Orange Group 1996-2000. Vice Chairman Jouko Karvinen, b. 1957 Independent Director. Board member... -

Page 89

... of the Cloud Business, Hewlett-Packard Company. Board member since 2012. Master of Science (Eng.) (Helsinki University of Technology). Chief Executive Officer of Eucalyptus Systems, Inc. 2010-2014. Senior Vice President, Database Group, Sun Microsystems 2008-2009. CEO, MySQL AB 2001-2008. Chairman... -

Page 90

... Inc. and PNC Financial Services Group and PNC Bank. Adjunct Professor, Princeton University. Member of the Board of Directors of Eastman Kodak Company 2008-2013. Helge Lund, b. 1962 Board member 2011-2014. Served as a member of the Personnel Committee and as a member of the Corporate Governance and... -

Page 91

...and CEO of Nokia Corporation on technology issues. President and Chief Financial and Operating Officer of Nokia Networks and member of the Nokia Group Leadership Team as of May 1, 2014; â- Ramzi Haidamus was appointed President, Nokia Technologies and member of the Nokia Group Leadership Team as... -

Page 92

... Board of Directors of Central Chamber of Commerce of Finland. Samih Elhage, b. 1961 Executive Vice President and Chief Financial and Operating Officer of Nokia Networks. Nokia Group Leadership Team member since 2014. Joined Nokia Siemens Networks (NSN) in 2012. Bachelor of Electrical Engineering... -

Page 93

... Chief Information Officer, Pogo Technology Ltd/ Pogo Mobile Solutions Ltd, London 2000-2003. Founder and CEO, Motionworks 1989-2000. Ramzi Haidamus, b. 1964 President, Nokia Technologies. Nokia Group Leadership Team member since 2014. Joined Nokia in 2014. Master of Science (electrical engineering... -

Page 94

...compensation paid to the members of the Board for their services in 2014, as resolved by shareholders at the Annual General Meeting on June 17, 2014. For more details on Nokia shares held by the members of the Board, refer to "-Share ownership of the Board of Directors and the Nokia Group Leadership... -

Page 95

...-Nokia Networks, HERE and Nokia Technologies. As a result of these changes and the new Nokia strategy we have introduced new corporate values and reviewed and refreshed our executive pay practices and policies for the Nokia Group Leadership Team. Key updates made to our executive compensation... -

Page 96

...EVP, Chief Financial and Operating Officer, Nokia Networks Ramzi Haidamus President, Nokia Technologies Sean Fernback President, HERE May 1, 2014 September 1, 2011 May 1, 2014 September 3, 2014 November 1, 2014 Compensation philosophy, design and strategy Our compensation programs are designed to... -

Page 97

...on target short-term incentive award, when taken together with base salary, is designed to provide a median annual total cash compensation comparable to that of our peer group. The equity-based portion of compensation that is tied to Nokia's long-term success and delivered through performance shares... -

Page 98

... and CEO 0% 125% 250% Other Nokia Group Leadership Team members 0% 75%-100% 150%-200% Key financial targets (including net sales, operating profit and free cash flow) and key strategic objectives focusing on the strategy, culture and infrastructure of the new Nokia operating model Corporate... -

Page 99

... in the "-Equity compensation" section below. In addition to the target level of long-term incentive awards, additional one-time performance share awards were made to Mr. Suri and Mr. Elhage. Pension arrangements for the members of the Nokia Group Leadership Team The President and CEO and other... -

Page 100

... of compensation (including annual base salary, benefits, and target incentive) and cash payment (or payments) for the pro-rated value of his outstanding unvested equity awards, including equity awards under the Nokia Networks Equity Incentive Plan, restricted shares, performance shares and stock... -

Page 101

...benefits earned in 2014 and the value of long-term incentive awards made to the Nokia Group Leadership Team members serving as of the end of 2014. In addition, the Summary Compensation Table sets forth the compensation of each other individual who served as Chief Executive Officer or Chief Financial... -

Page 102

...linked to Nokia's long-term success. The active equity plans in 2014 can be summarized as follows: Equity Plan Details Performance Shares Restricted Shares Employee Share Purchase Plan Eligible employees Purpose Grade based eligibility including Nokia Group Leadership Team members Annual long-term... -

Page 103

...the business operations of Nokia Group (excluding Nokia Networks) in relation to 2013 and for Nokia Networks, HERE and Nokia Technologies in relation to 2014, expressed as a percentage of the annual target set for each year. A separate Annual Net Sales Index will be calculated for 2013 and 2014, and... -

Page 104

... monthly purchase has been made following the end of the 12-month savings period. Participation in the plan is voluntary to employees. Legacy equity compensation programs No new awards have been made under the following equity programs in 2014 but awards made in earlier years remain in force. Stock... -

Page 105

... SEC rules are not included. For the number of shares or ADSs received as director compensation, refer to Note 34, Related party transactions, of our consolidated financial statements included in this annual report. Share ownership of the Nokia Group Leadership Team The following table sets forth... -

Page 106

... Plans 2012, 2013 and 2014 and Nokia Restricted Share Plans 2012, 2013 and 2014. For a description of our performance share and restricted share plans, refer to Note 25, Share based payment, of our consolidated financial statements included in this annual report. Performance shares Intrinsic value... -

Page 107

... officer or 5% shareholder. There are no material transactions with enterprises controlling, controlled by or under common control with Nokia or associates of Nokia. Refer to Note 34, Related party transactions, of our consolidated financial statements included in this annual report. NOKIA IN 2014... -

Page 108

General facts on Nokia Conne 106 NOKIA IN 2014 -

Page 109

General facts cted Contents History of Nokia Memorandum and Articles of Association Selected financial data Shares and shareholders Key ratios 108 110 112 114 121 NOKIA IN 2014 107 -

Page 110

... operator called Radiolinja, and in the same year, Nokia won contracts to supply GSM networks to other European countries. In the early 1990s, Nokia made a strategic decision to focus on telecommunications as its core business, with the goal of establishing leadership in every major global market... -

Page 111

...-leading design team, operations including Nokia Devices & Services production facilities, Devices & Services-related sales and marketing activities, and related support functions, pursuant to Stock and Asset Purchase Agreement by and between Nokia Corporation and Microsoft International Holdings... -

Page 112

... costs relating to the acquisition of the shares, including taxes). Share rights, preferences and restrictions Each share confers the right to one vote at general meetings. According to Finnish law, a company generally must hold an Annual General Meeting called by the Board within six months from... -

Page 113

... price, weighted by the number of shares, which the purchaser has paid for the shares it has acquired during the last 12 months preceding the date referred to in (a). Under the Finnish Securities Market Act, a shareholder whose voting power exceeds 30% or 50% of the total voting rights in a company... -

Page 114

... Research and development expenses % of net sales Capital expenditures(5) % of net sales Salaries and social expenses Average number of employees Key financial indicators Cash dividends per share, EUR(6) Dividends Return on capital employed, %** Return on equity, % Equity ratio, %** Net debt... -

Page 115

... sets forth information concerning the noon buying rate for the years 2010 through to 2014 and for each of the months in the six-month period ended February 27, 2015, expressed in US dollars per euro. The average rate for a year means the average of the exchange rates on the last day of each month... -

Page 116

...by Group companies representing approximately 2.6% of the total number of shares and the total voting rights. Under the Articles of Association of Nokia, Nokia Corporation does not have minimum or maximum share capital or a par value of a share. At December 31 2014 2013 2012 2011 2010 Share capital... -

Page 117

...% 534% 418% 328% The principal trading markets for the shares are the New York Stock Exchange, in the form of ADSs, and Nasdaq Helsinki, in the form of shares. Share prices(1) EUR 2014 2013 2012 2011 2010 Low/high Average(2) Year-end (1) Source: Nasdaq Helsinki. (2) Total turnover divided by total... -

Page 118

... 2010-2014 Year Stock option category Subscription price EUR Number of new shares 000s Date of payment Net proceeds EURm New share capital EURm 2010 2011 Nokia Stock Option Plan 2005 2Q Nokia Stock Option Plan 2005 3Q Nokia Stock Option Plan 2005 4Q Nokia Stock Option Plan 2006 1Q Nokia Stock... -

Page 119

... Year Stock option category Subscription price EUR Number of new shares 000s Date of payment Net proceeds EURm New share capital EURm 2012 2013 2014 Nokia Stock Option Plan 2007 2Q Nokia Stock Option Plan 2007 3Q Nokia Stock Option Plan 2007 4Q Nokia Stock Option Plan 2008 1Q Nokia Stock... -

Page 120

... 31, 2014. Each account operator (18) is included in this figure as only one registered shareholder. Largest shareholders registered in Finland at December 31, 2014(1) Shareholder Total number of shares 000s % of all shares % of all voting rights Varma Mutual Pension Insurance Company Ilmarinen... -

Page 121

...At the Annual General Meeting held on June 17, 2014 Nokia shareholders authorized the Board to repurchase a maximum of 370 million Nokia shares. The amount corresponds to less than 10% of the total number of Company's shares. The shares may be repurchased in order to develop the capital structure of... -

Page 122

... low quoted prices for the ADSs, as reported on the New York Stock Exchange composite tape. Nasdaq OMX Helsinki price per share High EUR Low New York Stock Exchange price per ADS High USD Low 2010 2011 2012 2013 First Quarter Second Quarter Third Quarter Fourth Quarter Full year 2014 First Quarter... -

Page 123

... short-term borrowings Return on capital employed % Profit before taxes + interest and other financial expenses Average capital and reserves attributable to the Company's equity holders + average non-controlling interests + average interest-bearing liabilities Return on shareholders' equity % Profit... -

Page 124

... flows Consolidated statement of changes in shareholders' equity Notes to consolidated financial statements 1. Accounting principles 2. Segment information 3. Disposals treated as discontinued operations 4. Acquisitions 5. Revenue recognition 6. Expenses by nature 7. Personnel expenses 8. Pensions... -

Page 125

... granted to the management of the company 24. Notes to the statement of cash flows 25. Principal Group companies 26. Shares of the Parent Company Signing of the Annual Accounts 2014 and proposal by the Board of Directors for distribution of profit Auditor's report Auditor fees and services 200 200... -

Page 126

... expenses Operating profit/(loss) Share of results of associated companies Financial income and expenses (Loss)/profit before tax Income tax benefit/(expense) Profit/(loss) for the year from continuing operations Attributable to: Equity holders of the parent Non-controlling interests Profit/(loss... -

Page 127

...of comprehensive income Financial statements For the year ended December 31 Notes 2014 EURm 2013 EURm 2012 EURm Profit/(loss) for the year Other comprehensive income Items that will not be reclassified to profit or loss: Remeasurements on defined benefit plans Income tax related to items that... -

Page 128

Consolidated statement of financial position At December 31 Notes 2014 EURm 2013 EURm ASSETS Non-current assets Goodwill Other intangible assets Property, plant and equipment Investments in associated companies Available-for-sale investments Deferred tax assets Long-term loans receivable Other ... -

Page 129

...Financial statements For the year ended December 31 Notes 2014 EURm 2013 EURm 2012 EURm Cash flow from operating activities Profit/(loss) attributable to equity holders of the parent Adjustments, total Change in net working capital Cash generated from operations Interest received Interest paid... -

Page 130

...year Total comprehensive loss for the year Share-based payment Excess tax benefit on share-based payment Settlement of performance and restricted shares 796 Dividends Convertible bond-equity component Total other equity movements At December 31, 2012 3 710 985 Remeasurements of defined benefit plans... -

Page 131

... 669 Dividend declared per share is EUR 0.14 for 2014, subject to shareholders' approval (EUR 0.11 for 2013). Special dividend per share of EUR 0.26 was paid for 2013. No dividends were declared for 2012. The notes are an integral part of these consolidated financial statements. NOKIA IN 2014 129 -

Page 132

... New York stock exchange. The Group is a leading global provider of network infrastructure and related services, with a focus on mobile broadband, location and mapping services as well as advanced technology development and licensing. On March 19, 2015 the Board of Directors authorized the financial... -

Page 133

.... Significant influence is the power to participate in the financial and operating policy decisions of the entity, but is not control or joint control over those policies. The Group's share of profits and losses of associates is included in the consolidated income statement in accordance with the... -

Page 134

... and accounted for as a defined benefit arrangement as described in the pensions section above. Share-based payment The Group offers three types of global equity-settled share-based compensation plans for employees: stock options, performance shares and restricted shares. Employee services received... -

Page 135

..., plant and equipment are included in operating profit or loss. Leases The Group has entered into various operating lease contracts. The related payments are treated as rental expenses and recognized in the consolidated income statement on a straight-line basis over the lease terms unless another... -

Page 136

... maturities at acquisition of longer than three months, classified in the consolidated statement of financial position as current available-for-sale investments, liquid assets. (3) Investments in technology-related publicly quoted equity shares or unlisted private equity shares and unlisted funds... -

Page 137

... paid. For option structures, the critical terms of the bought and sold options are the same and the nominal amount of the sold option component is no greater than that of the bought option. Cash flow hedges: hedging of forecast foreign currency denominated sales and purchases The Group applies... -

Page 138

... currency sales and purchases affect the consolidated income statement at various dates up to approximately one year from the consolidated statement of financial position date. If the forecasted transaction is no longer expected to take place, all deferred gains or losses are released immediately... -

Page 139

... of equity at cost of acquisition. When cancelled, the acquisition cost of treasury shares is recognized in retained earnings. Dividends Dividends proposed by the Board of Directors are recognized in the consolidated financial statements when they have been approved by the shareholders at the Annual... -

Page 140

... for unlisted shares, the fair value is based on a number of factors including, but not limited to, the current market value of similar instruments; prices established from recent arm's length transactions; and/or analysis of market prospects and operating performance of target companies with... -

Page 141

Financial statements Amendments to IAS 19, Defined Benefit Plans: Employee Contributions, require an entity to consider contributions from employees or third parties when accounting for defined benefit plans. Where the contributions are linked to service, they should be attributed to periods of ... -

Page 142

..., HERE and Nokia Technologies consists of net sales, cost of sales and operating expenses. The operating profit of Mobile Broadband and Global Services excludes restructuring and associated charges, purchase price accounting-related charges and certain other items not directly related to these... -

Page 143

...Networks Total Nokia HERE(1) Technologies(1) Group Common Functions Eliminations Total Continuing operations 2014 Net sales to external customers(2) Net sales to other segments Depreciation and amortization Impairment charges(3) Operating profit/(loss) Share of results of associated companies 2013... -

Page 144

... market entry, feature phones and affordable smart phones. Devices & Services Other included spare parts, the divested Vertu business and major restructuring programs related to the Devices & Services business. The Sale of the D&S Business was completed on April 25, 2014. The total purchase price... -

Page 145

Financial statements Results of Discontinued operations EURm 2014 2013 2012 Net sales Cost of sales Gross profit Research and development expenses Selling, general and administrative expenses Gain on the Sale of the D&S Business Other income and expenses Operating profit/(loss) Financial income ... -

Page 146

... Revenue recognition EURm 2014 2013 2012 Continuing operations Revenue from sale of products and licensing(1) Nokia Networks HERE Nokia Technologies Revenue from services Nokia Networks HERE Contract revenue recognized under percentage of completion accounting Nokia Networks Eliminations and Group... -

Page 147

... multi-employer, insured and defined contribution plans is EUR 162 million (EUR 160 million in 2013 and EUR 193 million in 2012). Expenses related to defined benefit plans comprise the remainder. Average number of employees 2014 2013 2012 Continuing operations Nokia Networks HERE Nokia Technologies... -

Page 148

...15 4 93 6 (4) 114 3 33 - 25 11 - 72 (199) (1) Other movements relate to the inclusion of the defined benefit liability of end of service benefits that have previously been reported as other long-term employee liabilities in certain countries in the Middle East and Africa region. 146 NOKIA IN 2014 -

Page 149

... the defined benefit obligation are: % 2014 2013 Discount rate for determining present values Annual rate of increase in future compensation levels Pension growth rate Inflation rate 2.6 1.9 1.4 1.6 4.0 2.4 1.7 2.0 Assumptions regarding future mortality are set based on actuarial advice... -

Page 150

...-Model study focuses on minimizing such risks. Disaggregation of plan assets The composition of plan assets by asset category is as follows: 2014 EURm Quoted Unquoted Total % Quoted Unquoted Total 2013 % Equity securities Debt securities Insurance contracts Real estate Short-term investments... -

Page 151

... benefits paid from the defined benefit plans of the Continuing operations is shown here: EURm 2015 2016 2017 2018 2019 2020-2024 Pension benefits 42 43 45 48 50 316 9. Depreciation and amortization by function EURm 2014 2013 2012 Continuing operations Cost of sales Research and development... -

Page 152

... market acceptance. Actual short- and long-term performance could vary from management's forecasts and impact future estimates of recoverable amount. Management has determined the discount rate and the terminal growth rate to be the key assumptions for the Nokia Networks Radio Access Networks group... -

Page 153

Financial statements 11. Other income and expenses EURm 2014 2013 2012 Continuing operations Other income Interest income from customer receivables and overdue payments Rental income Distributions from unlisted venture funds Subsidies and government grants Gain on sale of real estate Profit on ... -

Page 154

...well as expenses related to funding the purchase of Nokia Networks' non-controlling interest from Siemens. (3) Positively impacted by a reduction in hedging costs. In 2013, positively impacted by lower hedging costs compared with 2012 as well as lower volatility of certain emerging market currencies... -

Page 155

...394 million in 2013) related to uncertain tax positions with inherently uncertain timing of cash outflows. Prior period income tax returns for certain Group companies are under examination by local tax authorities. The Group's business and investments, especially in emerging market countries, may be... -

Page 156

... million in 2013) will expire within 10 years. In 2014, the Group re-recognized a deferred tax asset of EUR 2 126 million in the consolidated statement of financial position based on recent profitability and the latest forecasts of future financial performance which enabled the Group to re-establish... -

Page 157

Financial statements 15. Earnings per share EURm 2014 2013 2012 Basic Profit/(loss) attributable to equity holders of the parent Continuing operations Discontinued operations Total Diluted Elimination of interest expense, net of tax, on convertible bonds, where dilutive Profit/(loss) attributable ... -

Page 158

... a net book value of EUR 10 million (EUR 5 million in 2013). The remaining amortization periods range from approximately three to seven years for customer relationships, one to six years for developed technology and one to seven years for licenses to use tradename and trademark. 156 NOKIA IN 2014 -

Page 159

... 12 months. In 2014, the Group has concluded that there are no real estate properties that meet the criteria for assets held for sale (the fair value in 2013 was EUR 89 million). The valuation of these assets was based on third-party evaluations by real estate brokers taking into account the Group... -

Page 160

... consolidated financial statements continued 18. Investments in associated companies EURm 2014 2013 Continuing operations Net carrying amount at January 1 Translation differences Additions Deductions Share of results Dividend Net carrying amount at December 31 Shareholdings in associated companies... -

Page 161

...loans receivable and loans payable is estimated based on the current market values of similar instruments (level 2). The fair value is estimated to equal the carrying amount for short-term financial assets and financial liabilities due to limited credit risk and short time to maturity. Refer to Note... -

Page 162

... unlisted equities and unlisted venture funds where the fair value is determined based on relevant information such as operating performance, recent transactions and available market data on peer companies. No individual input has a significant impact on the total fair value. 160 NOKIA IN 2014 -

Page 163

Financial statements Reconciliation of the opening and closing balances on level 3 financial assets is shown below: Other available-for-sale investments carried at fair value EURm At January 1, 2013 Net gain in income statement Net gain in other comprehensive income Purchases Sales Other ... -

Page 164

Notes to consolidated financial statements continued 20. Derivative financial instruments Assets EURm Fair value(1) Notional(2) Liabilities Fair value(1) Notional(2) Continuing operations 2014 Hedges on net investment in foreign subsidiaries: Forward foreign exchange contracts Currency options ... -

Page 165

... 22. Allowances for doubtful accounts Movements in allowances for doubtful accounts for the years ended December 31 are: EURm 2014 2013 2012 Continuing operations At January 1 Transfer to assets of disposal groups classified as held for sale Charged to income statement Deductions(1) At December 31... -

Page 166

... shareholder base, finance or carry out acquisitions or other arrangements, settle the Parent Company's equity-based incentive plans, or for other purposes resolved by the Board of Directors. The authorization is effective until December 17, 2015. In 2014, Nokia Corporation issued 49 904 new shares... -

Page 167

... plans, restricted share plans, employee share purchase plans, and stock option plans. Both executives and employees participate in these programs. In 2011 to 2013 of the years presented, Nokia global equity-based incentive programs have been offered to the employees of Devices & Services, Group... -

Page 168

... price of the Nokia share less the present value of dividends expected to be paid during the vesting period. (3) Includes 249 943 restricted shares granted in the fourth quarter of 2011 under Restricted Share Plan 2011 that vested on January 1, 2015. Employee share purchase plan In 2014 and 2013... -

Page 169

... a share-based incentive program in 2012 under which options for Nokia Solutions and Networks B.V. shares were granted to selected key employees and Nokia Networks' senior management, some of whom became members of the Nokia Group Leadership Team in 2014. Following the Group's acquisition of Siemens... -

Page 170

...Net investment hedging losses Movements attributable to non-controlling interests At December 31, 2012 Exchange differences on translating foreign operations Net investment hedging gains Acquisition of non-controlling interests Movements attributable to non-controlling interests At December 31, 2013... -

Page 171

Financial statements 27. Fair value and other reserves Pension remeasurements EURm Gross Tax Net Hedging reserve Gross Tax Net Available-for-sale investments Gross Tax Net Gross Total Tax Net At January 1, 2012 Pension remeasurements: Remeasurements of defined benefit plans Cash flow hedges: Net ... -

Page 172

... years. Restructuring and other associated expenses incurred by Nokia Networks totaled EUR 57 million (EUR 570 million in 2013) including mainly personnel-related expenses and expenses arising from country and contract exits based on Nokia Networks' strategy that focuses on key markets and product... -

Page 173

... Group as an additional plaintiff. In 2011, Nokia Siemens Networks acquired certain assets and liabilities including this matter from Motorola Solutions Inc. ("Motorola"). Among other things, IBB claims that WiMax network equipment purchased from Motorola failed to perform as promised. The Group... -

Page 174

... relating to purchases of network infrastructure equipment and services. Venture fund commitments of EUR 274 million (EUR 215 million in 2013) are financing commitments to a number of funds making technology-related investments. As a limited partner in these funds, the Group is committed to capital... -

Page 175

... 8, Pensions. 32. Notes to the consolidated statement of cash flows EURm 2014 2013 2012 Adjustments for(1) Depreciation and amortization (Profit)/loss on sale of property, plant and equipment and available-for-sale investments Income tax (benefit)/expense Share of results of associated companies... -

Page 176

...consolidated financial statements continued 33. Principal Group companies The Group's significant subsidiaries at December 31, 2014 are: Country of incorporation and place of business Parent holding % Group ownership interest % Company name Primary nature of business Nokia Solutions and Networks... -

Page 177

... a 90-day notice. The loan is included in long-term interest-bearing liabilities in the consolidated statement of financial position. Transactions with associated companies EURm 2014 2013 2012 Share of results of associated companies (expense)/income Dividend income Share of shareholders' equity of... -

Page 178

... the Group Leadership Team and the Board of Directors in 2014, 2013 or 2012. Terms of termination of employment of the President and CEO The President and CEO, Rajeev Suri, may terminate his service contract at any time with six months' prior notice. The Group may terminate his service contract for... -

Page 179

... part of long- and short-term planning. Key risks and opportunities are analyzed, managed, monitored and identified as part of business performance management with the support of risk management personnel. The Group's overall risk management concept is based on managing the key risks that would... -

Page 180

... statement of financial position items and some probable forecasted cash flows which are denominated in foreign currencies are hedged by a portion of foreign exchange derivatives not designated in a hedge relationship and carried at fair value through profit and loss. The VaR figures for the Group... -

Page 181

... traded companies is insignificant. The private funds where the Group has investments may, from time to time, have investments in public equity. Such investments have not been included in the above number. Other market risk In certain emerging market countries, there are local exchange control... -

Page 182

..., or potential liabilities, such as product liabilities, are insured optimally taking into account both cost and retention levels. The Group purchases both annual insurance policies for specific risks as well as multi-line and/or multi-year insurance policies where available. 180 NOKIA IN 2014 -

Page 183

... Parent Company rating. (2) Fixed income and money-market investments include term deposits, structured deposits, investments in liquidity funds and investments in fixed income instruments classified as available-for-sale investments and investments at fair value through profit and loss. Liquidity... -

Page 184

...fast enough without endangering its value in order to avoid uncertainty related to financial distress at all times. The Group aims to secure sufficient liquidity at all times through efficient cash management and by investing in short-term liquid interest-bearing securities. Depending on its overall... -

Page 185

...2018 and the EUR 350 million 7.125% bonds due April 2020. During the second quarter 2014, Nokia Solutions and Networks Finance B.V. prepaid the EUR 88 million Finnish Pension Loan due October 2015, the EUR 50 million R&D Loan from the European Investment Bank, the EUR 16 million Loan from the Nordic... -

Page 186

... Due beyond 5 years 2014 Non-current financial assets Long-term loans receivable Current financial assets Current portion of long-term loans receivable Short-term loans receivable Investments at fair value through profit and loss Available-for-sale investments(1) Bank and cash Cash flows related to... -

Page 187

...Due beyond 5 years 2013 Non-current financial assets Long-term loans receivable Current financial assets Current portion of long-term loans receivable Short-term loans receivable Investments at fair value through profit and loss Available-for-sale investments(1) Bank and cash Cash flows related to... -

Page 188

... the year ended December 31 Notes 2014 EURm 2013 EURm Net sales Cost of sales Gross profit Research and development expenses Selling, general and administrative expenses Other operating income Other operating expenses Operating loss Financial income and expenses Income from long-term investments... -

Page 189

Parent Company Statement of Financial Position Financial statements At December 31 Notes 2014 EURm 2013 EURm ASSETS Non-current assets Intangible assets Intangible rights Other intangible assets Tangible assets Land and water areas Buildings Machinery and equipment Advance payments and ... -

Page 190

Parent Company Statement of Financial Position continued At December 31 Notes 2014 EURm 2013 EURm SHAREHOLDERS' EQUITY AND LIABILITIES Capital and reserves Share capital Share issue premium Treasury shares at cost Fair value reserve Reserve for invested non-restricted equity Retained earnings ... -

Page 191

Parent Company Statement of Cash Flows Financial statements For the year ended December 31 Notes 2014 EURm 2013 EURm Cash flow from operating activities Profit/(loss) for the year Adjustments, total Cash flow before change in net working capital Change in net working capital Cash generated ... -

Page 192

...25, 2014. On December 31, 2014 the Parent Company sold certain assets and liabilities related to the Nokia Technologies business to a newly formed, fully owned entity, Nokia Technologies Oy. These transactions make up the Extraordinary items in the income statement. The 2014 financial information is... -

Page 193

...value due to the short-term nature of the Parent Company's accounts payable. Derivative financial instruments Interest income or expense on interest rate derivatives is accrued in the income statement during the financial year. In the financial statements, outstanding interest rate forward contracts... -

Page 194

Notes to Parent Company Financial statements continued 2. Net sales by segment EURm 2014 2013 Nokia Technologies Devices & Services Total 572 2 569 3 141 532 10 645 11 177 3. Personnel expenses EURm 2014 2013 Salaries and wages Share-based payment expense Pension expenses Other social expenses... -

Page 195

Financial statements The members of the Group Leadership Team participate in the local retirement programs applicable to employees in the country where they reside. Board of Directors' Compensation The annual remuneration structure paid to the members of the Board of Directors, as decided on by the... -

Page 196

... charges Write-down of shares and loan receivables from other investments Onerous contracts Other Total 10 (44) (16) (30) (80) (31) - - (8) (39) 8. Financial income and expenses EURm 2014 2013 Income from long-term investments Dividend income from Group companies Interest income from other... -

Page 197

... and retirements Acquisition cost at December 31, 2013 Accumulated amortization at January 1, 2013 Disposals and retirements Amortization Accumulated amortization at December 31, 2013 Net book value at January 1, 2013 Net book value at December 31, 2013 Acquisition cost at January 1 , 2014 Additions... -

Page 198

... in associated companies Net carrying amount at January 1 and December 31 Investments in other shares Acquisition cost at January 1 Additions Impairment charges Disposals Net carrying amount at December 31 (1) In 2014, relates to the newly formed Nokia Technology Oy. (2) In 2014, the carrying values... -

Page 199

...income EURm 2014 2013 Accrued royalty income Prepaid taxes Interest receivable Accrued dividend income Other Total 55 3 1 - 59 118 54 32 3 701 1 148 1 938 15. Shareholders' equity EURm Share capital Share issue premium Treasury shares Reserve for invested Fair value non-restricted equity reserve... -

Page 200

...at fair value through profit or loss Loans and receivables measured at amortized cost Financial liabilities measured at amortized cost Total carrying amounts Fair value(1) EURm 2014 Other investments Accounts receivable from Group companies Accounts receivable from other companies Short-term loans... -

Page 201

Financial statements 18. Long-term interest-bearing liabilities 2014 EURm 2013 EURm Bonds Convertible bonds Liabilities to Group companies Total Long-term interest-bearing liabilities repayable after 5 years Nominal value million Interest % 1 813 745 283 2 841 1 645 745 200 2 590 2014 EURm ... -

Page 202

... of the Group Leadership Team and Board of Directors at December 31, 2014. 24. Notes to the statement of cash flows EURm 2014 2013 Adjustments for Depreciation and amortization Profit on sale of tangible assets and available-for-sale investment Income tax (benefit)/expense Financial income and... -

Page 203

... shareholder base, finance or carry out acquisitions or other arrangements, settle the Parent Company's equity-based incentive plans, or for other purposes resolved by the Board of Directors. The authorization is effective until December 17, 2015. In 2014, Nokia Corporation issued 49 904 new shares... -

Page 204

... new shares or treasury shares held by the Parent Company. The Board of Directors proposes that the authorization may be used to develop the Parent Company's capital structure, diversify the shareholder base, finance or carry out acquisitions or other arrangements, settle the Parent Company's equity... -

Page 205

... of profit Financial statements The distributable funds in the statement of financial position of the Parent company at December 31, 2014 amounted to EUR 8 288 million. The Board proposes to the Annual General Meeting that from the retained earnings a dividend of EUR 0.14 per share be paid out... -

Page 206

...'s report To the Annual General Meeting of Nokia Corporation We have audited the accounting records, the financial statements, the review by the Board of Directors and the administration of Nokia Corporation for the year ended 31 December 2014. The financial statements comprise the consolidated... -

Page 207

... and planning (advice on stock-based remuneration, local employer tax laws, social security laws, employment laws and compensation programs and tax implications on short-term international transfers). (4) Other fees include fees billed for company establishment, forensic accounting, data security... -

Page 208

Other information Contents Forward-looking statements Glossary of terms Investor information Contact information 207 209 212 212 206 NOKIA IN 2014 -

Page 209

... and Nokia Technologies; C) expectations, plans or benefits related to changes in our management and other leadership, operational structure and operating model; D) expectations regarding market developments, general economic conditions and structural changes; E) expectations and targets regarding... -

Page 210

... invest in new competitive high-quality products, services, upgrades and technologies and bring them to market in a timely manner; 18) Nokia Networks' dependence on a limited number of customers and large multi-year agreements and adverse effects as a result of further operator consolidation... -

Page 211

... software capabilities are generally less powerful than those of smartphones. The feature phones manufactured by Nokia before the sale of our Devices & Services business were mostly based on the Series 30+ operating system. Flexi Multiradio base station: A system module platform developed to support... -

Page 212

...From 2007, NSN was known as Nokia Siemens Networks until Nokia acquired Siemens' 50% stake in the joint venture in 2013. OS (Operating system): Software that controls the basic operation of a computer or a mobile device, such as managing the processor and memory. The term is also often used to refer... -

Page 213

... not under the operator's exclusive control. TD-LTE (Time Division Long Term Evolution, also known as TDD, Time Division Duplex): An alternative standard for LTE mobile broadband networks. Time Division means that a single connection is used alternately to carry data from the base station to the... -

Page 214

... Board of Directors proposes to the Annual General Meeting an ordinary dividend of EUR 0.14 per share for the year 2014. Financial reporting Nokia's interim reports in 2015 are planned for April 30, July 30, and October 29. The 2015 results are planned to be published in January 2016. Information... -

Page 215

Designed and produced by Printed by CPI Colour This Report is printed on material derived from sustainable sources, and printed using vegetable based inks. Both the manufacturing paper mill and printer are registered to the Environmental Management System ISO 14001 and are Forest Stewardship Council... -

Page 216

Copyright © 2015 Nokia Corporation. All rights reserved. Nokia is a registered trademark of Nokia Corporation. company.nokia.com