Nokia 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

between the threshold and maximum performance levels, the vesting follows a linear scale. If the

required performance levels are achieved, the vesting will take place in 2010. Until the Nokia shares

are transferred and delivered, the recipients will not have any shareholder rights, such as voting or

dividend rights associated with these performance shares.

Stock Option Plan 2007

The Board of Directors will make a proposal for Stock Option Plan 2007 to be approved by the

shareholders at the Annual General Meeting on May 3, 2007. The stock option grants in 2007 are

expected to be made primarily out of the Stock Option Plan 2007, which is proposed to be a four

year plan amounting to a maximum of 20 million stock options to be granted from 2007 to 2010.

Each stock option would entitle the option holder to subscribe for one Nokia share. The exercise

price of the stock options would be determined at the time of grant on a quarterly basis and would

be based on the trade volume weighted average price of a Nokia share on the Helsinki Stock

Exchange for the first whole week of the second month of the calendar quarter (i.e. February, May,

August or November). The stock options would have a vesting schedule with a 25% vesting one year

after grant and quarterly vesting thereafter. The subcategories of stock options expected to be issued

under the plan would generally have a term of five years, with the last of the subcategories expiring

as of December 31, 2015. The determination of exercise price is defined in the terms and conditions

of the stock option plan to be presented for shareholders’ approval at the Annual General Meeting.

The Board of Directors would not have right to amend the above described determination of exercise

price.

Restricted Share Plan 2007

The restricted shares to be granted under the Restricted Share Plan 2007 will have a threeyear

restriction period. The restricted shares will vest and the payable Nokia shares be delivered mainly in

2010, subject to fulfillment of the service period criteria. Recipients will not have any shareholder

rights or voting rights during the restriction period, until the Nokia shares are transferred and

delivered to plan participants at the end of the restriction period.

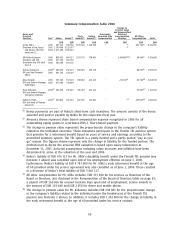

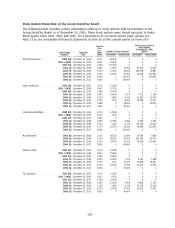

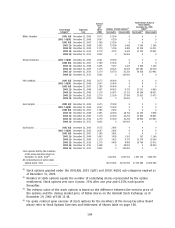

Maximum Planned Grants

The maximum number of planned grants under the 2007 Equity Program (i.e., performance shares,

stock options and restricted shares) are set forth in the table below. The planned amounts for 2007

are less than the total amounts approved and disclosed in 2006.

Maximum Number of Planned Grants under

Plan type the 2007 Equity Program in 2007

Stock Options ******************************************* 5 million

Restricted Shares **************************************** 4 million

Performance Shares at Threshold(1) ************************ 3 million

(1) The maximum number of shares to be delivered at maximum performance is four times the

number originally granted (at threshold), i.e. a total of 12 million Nokia shares.

As of December 31, 2006, the total dilutive effect of Nokia’s stock options, performance shares and

restricted shares outstanding, assuming full dilution, was approximately 3.4% in the aggregate. The

potential maximum effect of the proposed equity program 2007, would be approximately another

0.8%.

96