Nokia 2006 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

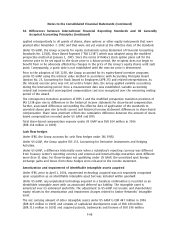

38. Differences between International Financial Reporting Standards and US Generally

Accepted Accounting Principles (Continued)

applied retrospectively to all grants of shares, share options or other equity instruments that were

granted after November 7, 2002 and that were not yet vested at the effective date of the standard.

Under US GAAP, the Group accounts for equity instruments using Statement of Financial Accounting

Standards No. 123(R), Share Based Payment (‘‘FAS 123R’’) which was adopted using the modified

prospective method at January 1, 2005. Since the terms of Nokia’s stock option plans call for the

exercise price to be set equal to the share price in a future period, the recipient does not begin to

benefit from or be adversely affected by changes in the price of the Group’s equity shares until such

point. Consequently, a grant date is not established until the exercise price is determined.

Prior to the adoption of FAS 123R, the Group accounted for its equitybased incentive programs

under US GAAP using the intrinsic value method in accordance with Accounting Principles Board

Opinion No. 25, Accounting for Stock Issued to Employees (APB 25) and related interpretations. As

the relevant exercise price was not set until a future date, the Group applied variable accounting

during the intervening period. Once a measurement date was established, variable accounting

ceased and incremental unrecognized compensation cost was recognized over the remaining vesting

period of the award.

The retrospective transition provision of IFRS 2 and the modified prospective transition provision of

FAS 123R give rise to differences in the historical income statement for sharebased compensation.

Further, associated differences surrounding the effective date of application of the standards to

unvested shares give rise to both current and historical income statement differences in sharebased

compensation. Share issue premium reflects the cumulative difference between the amount of share

based compensation recorded under US GAAP and IFRS.

Total sharebased compensation expense under US GAAP was EUR 204 million in 2006

(EUR 134 million in 2005).

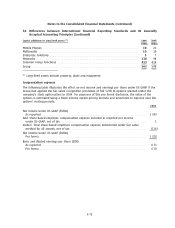

Cash flow hedges

Under IFRS, the Group accounts for cash flow hedges under IAS 39(R).

Under US GAAP, the Group applies FAS 133, Accounting for Derivative Instruments and Hedging

Activities.

Under US GAAP, a difference historically arose when a subsidiary’s reporting currency was different

from Treasury Center’s reporting currency and external and internal hedge maturities were different

more than 31 days. For those hedges not qualifying under US GAAP, the unrealized spot foreign

exchange gains and losses from those hedges were released to the income statement.

Amortization and impairment of identifiable intangible assets acquired

Under IFRS, prior to April 1, 2004, unpatented technology acquired was not separately recognized

upon acquisition as an identifiable intangible asset but was included within goodwill.

Under US GAAP, any unpatented technology acquired in a business combination is recorded as an

identifiable intangible asset with an associated deferred tax liability. The intangible asset is

amortized over its estimated useful life. The adjustment to US GAAP net income and shareholders’

equity relates to the amortization and impairment charges related to Amber Networks’ intangible

asset.

The net carrying amount of other intangible assets under US GAAP is EUR 447 million in 2006

(EUR 425 million in 2005) and consists of capitalized development costs of EUR 149 million

(EUR 213 million in 2005) and acquired patents, trademarks and licenses of EUR 298 million

F68