Nokia 2006 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

38. Differences between International Financial Reporting Standards and US Generally

Accepted Accounting Principles (Continued)

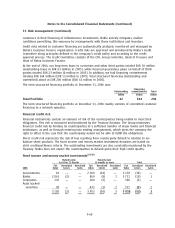

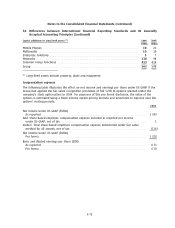

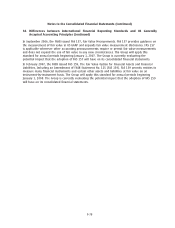

Below is a roll forward of US GAAP goodwill during 2006 and 2005:

Common

Mobile Enterprise Group

Phones Multimedia Solutions Networks Functions Group

EURm EURm EURm EURm EURm EURm

Balance as of January 1, 2005******* 57 5 35 249 9 355

Goodwill disposed ***************** — — — — (9) (9)

Translation adjustment************* 45 — 4 28 — 77

Balance as of December 31, 2005**** 102 5 39 277 — 423

Additions ************************* 51 147 290 — — 488

Translation adjustment************* 29 7 (28) (23) — (15)

Balance as of December 31, 2006**** 182 159 301 254 — 896

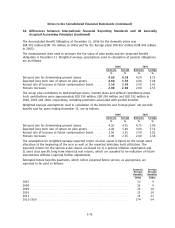

Translation of goodwill

Under IFRS, goodwill is translated at the closing rate of the balance sheet date for all transactions

subsequent to the adoption of IAS 21 (revised 2004) as of January 1, 2005. Prior to the adoption of

IAS 21, the Group historically translated goodwill arising on the acquisition of foreign subsidiaries at

historical rates.

Under US GAAP, goodwill is translated at the closing rate on the balance sheet date with gains and

losses recorded as a component of other comprehensive income.

The US GAAP translation of goodwill adjustment reflects cumulative translation differences between

historical and current rates on goodwill arising from acquisitions of foreign subsidiaries.

Other differences

Other differences in the reconciliation of profit attributable to equity holders of the parent under

IFRS and net income under US GAAP of EUR 22 million (EUR 1 million in 2005 and EUR 6 million in

2004) relate to social security cost on sharebased payments, a sale and leaseback transaction, an

adjustment to goodwill and a loss on disposal.

Other differences in the reconciliation of total equity under IFRS to total shareholders’ equity under

US GAAP of EUR 29 million (EUR 6 million in 2005) relate to marketable securities and unlisted

investments, acquisition purchase price, social security cost on sharebased payments, a sale and

leaseback transaction, an adjustment to goodwill and a loss on disposal.

Disclosures required by US GAAP

Dependence on limited sources of supply

Nokia’s manufacturing operations depend to a certain extent on obtaining adequate supplies of fully

functional components and subassemblies on a timely basis. In mobile devices, our principal supply

requirements are for electronic components, mechanical components and software, which all have a

wide range of applications in Nokia’s products. Electronic components include integrated circuits,

microprocessors, standard components, memory devices, cameras, displays, batteries and chargers

while mechanical components include covers, connectors, key mats and antennas. Software includes

various thirdparty software that enables various new features and applications to be added, like

thirdparty email, into our products. In networks business, components and subassemblies sourced

F70