Nokia 2006 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

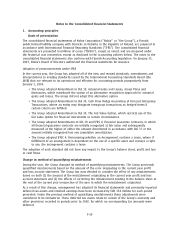

1. Accounting principles (Continued)

Transactions in foreign currencies

Transactions in foreign currencies are recorded at the rates of exchange prevailing at the dates of

the individual transactions. For practical reasons, a rate that approximates the actual rate at the date

of the transaction is often used. At the end of the accounting period, the unsettled balances on

foreign currency receivables and liabilities are valued at the rates of exchange prevailing at the year

end. Foreign exchange gains and losses arising from balance sheet items, as well as fair value

changes in the related hedging instruments, are reported in Financial Income and Expenses.

Foreign Group companies

In the consolidated accounts all income and expenses of foreign subsidiaries are translated into euro

at the average foreign exchange rates for the accounting period. All assets and liabilities of foreign

Group companies are translated into euro at the yearend foreign exchange rates with the exception

of goodwill arising on the acquisition of foreign companies prior to the adoption of IAS 21 (revised

2004) on January 1, 2005, which is translated to euro at historical rates. Differences resulting from

the translation of income and expenses at the average rate and assets and liabilities at the closing

rate are treated as an adjustment affecting consolidated shareholders’ equity. On the disposal of all

or part of a foreign Group company by sale, liquidation, repayment of share capital or abandonment,

the cumulative amount or proportionate share of the translation difference is recognized as income

or as expense in the same period in which the gain or loss on disposal is recognized.

Fair valuing principles

Financial assets and liabilities

Under IAS 39(R), Financial Instruments: Recognition and Measurement, the Group classifies its

investments in marketable debt and equity securities and investments in unlisted equity securities

into the following categories: heldtomaturity, held for trading, or availableforsale depending on

the purpose for acquiring the investments as well as ongoing intentions. All investments of the

Group are currently classified as availableforsale. Availableforsale investments are fair valued by

using quoted market rates, discounted cash flow analyses or other appropriate valuation models at

each balance sheet date. Certain unlisted equities for which fair values cannot be measured reliably

are reported at cost less impairment. All purchases and sales of investments are recorded on the

trade date, which is the date that the Group commits to purchase or sell the asset.

The fair value changes of availableforsale investments are recognized in shareholders’ equity. When

the investment is disposed of, the related accumulated fair value changes are released from

shareholders’ equity and recognized in profit or loss. The weighted average method is used when

determining the costbasis of publicly listed equities being disposed of. The Firstin Firstout (FIFO)

method is used to determine the cost basis of fixed income securities being disposed of. An

impairment is recorded when the carrying amount of an availableforsale investment is greater than

the estimated fair value and there is objective evidence that the asset is impaired. The cumulative

net loss relating to that investment is removed from equity and recognized in the profit and loss

account for the period. If, in a subsequent period, the fair value of the investment increases and the

increase can be objectively related to an event occurring after the loss was recognized, the loss is

reversed, with the amount of the reversal recognized in the profit and loss account.

The fair values of other financial assets and financial liabilities are assumed to approximate their

carrying values, due either to their short maturities or that their fair values cannot be measured

reliably.

F12