Nokia 2006 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

38. Differences between International Financial Reporting Standards and US Generally

Accepted Accounting Principles (Continued)

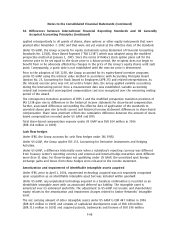

The following table reconciles the net pension asset recognized under IFRS with the net pension

liability recognized under US GAAP and reflects the impact of the adoption of FAS 158 as of

December 31, 2006:

2006

EURm

Net pension asset recognized for IFRS************************************************* 108

Difference in unrecognized amounts ************************************************** (53)

Additional minimum liability ********************************************************* (1)

Net pension asset recognized for US GAAP before adoption of FAS 158 ******************** 54

Adoption of FAS 158 **************************************************************** (222)

Net pension liability recognized for US GAAP after adoption of FAS 158 ******************* (168)

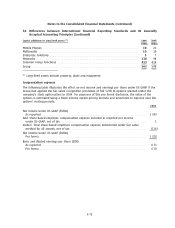

Development costs

Development costs are capitalized under IFRS after the product involved has reached a certain degree

of technical feasibility. Capitalization ceases and depreciation begins when the product becomes

available to customers. The depreciation period of these capitalized assets is between two and five

years.

Under US GAAP, software development costs are similarly capitalized after the product has reached a

certain degree of technological feasibility. However, certain nonsoftware related development costs

capitalized under IFRS are not capitalizable under US GAAP and therefore are expensed as incurred.

Under IFRS, whenever there is an indication that capitalized development costs may be impaired the

recoverable amount of the asset is estimated. An asset is impaired when the carrying amount of the

asset exceeds its recoverable amount. Recoverable amount is defined as the higher of an asset’s net

selling price and value in use. Value in use is the present value of estimated discounted future cash

flows expected to arise from the continuing use of an asset and from its disposal at the end of its

useful life.

Under US GAAP, the unamortized capitalized costs of a software product are compared at each

balance sheet date to the net realizable value of that product with any excess written off. Net

realizable value is defined as the estimated future gross revenues from that product reduced by the

estimated future costs of completing and disposing of that product, including the costs of

performing maintenance and customer support required to satisfy the enterprise’s responsibility set

forth at the time of sale.

The amount of unamortized capitalized software development costs under US GAAP is

EUR 149 million in 2006 (EUR 213 million in 2005).

The US GAAP development cost adjustment reflects the reversal of capitalized nonsoftware related

development costs under US GAAP net of the reversal of associated amortization expense and

impairments under IFRS. The adjustment also reflects differences in impairment methodologies under

IFRS and US GAAP for the determination of the recoverable amount and net realizable value of

software related development costs.

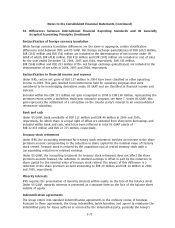

Sharebased compensation

The Group maintains several sharebased employee compensation plans, which are described more

fully in Note 23. Under IFRS, the Group accounts for equity instruments under IFRS 2 which was

F67