Nokia 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

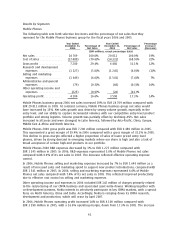

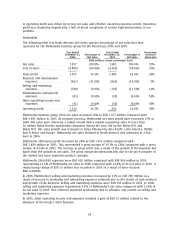

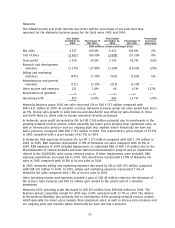

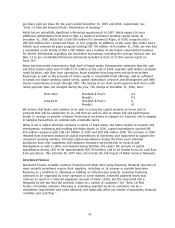

Year Ended Year Ended Percentage

December 31, Percentage of December 31, Percentage of Increase/

2005 Net Sales 2004 Net Sales (Decrease)

(EUR millions, except percentage data)

Net sales ****************** 34 191 100.0% 29 371 100.0% 16%

Cost of sales *************** (22 209) (65.0)% (18 179) (61.9)% 22%

Gross profit **************** 11 982 35.0% 11 192 38.1% 7%

Research and development

expenses **************** (3 825) (11.2)% (3 776) (12.9)% 1%

Selling and marketing

expenses **************** (2 961) (8.7)% (2 564) (8.7)% 15%

Administrative and general

expenses **************** (609) (1.8)% (611) (2.1)% —

Other operating income and

expenses **************** 52 0.2% 181 0.6% (71)%

Amortization of goodwill **** — — (96) (0.3)% (100)%

Operating profit ************ 4 639 13.6% 4 326 14.7% 7%

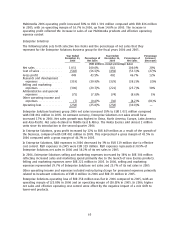

For 2005, Nokia’s net sales increased 16% to EUR 34.2 billion compared with EUR 29.4 billion in

2004. At constant currency, group net sales would have grown 20% in 2005. Our gross margin in

2005 was 35.0% compared with 38.1% in 2004. This reflected the higher proportion of entry level

devices in our product mix in 2005 due to strong volume growth in emerging markets, which have

the industry’s lowest ASPs. Our gross margin in 2005 was also affected by intense price competition

in both the device and infrastructure markets, as well as by the lower margin services business and

emerging markets representing an increased share of Networks sales.

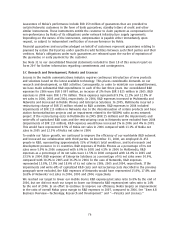

Research and development, or R&D, expenses were EUR 3.8 billion in both 2005 and 2004. R&D

expenses represented 11.2% of net sales in 2005, down from 12.9% in 2004. R&D expenses

increased in Mobile Phones and Enterprise Solutions and decreased in Multimedia and Networks. In

2005, Multimedia incurred a restructuring charge of EUR 15 million related to R&D activities.

Networks R&D expenses included impairments of EUR 115 million in 2004. If these items were

excluded, R&D expenses would have increased 4% in 2005 and would have represented 11.1% of

Nokia net sales in 2005 compared with 12.5% of Nokia net sales in 2004.

Selling and marketing expenses increased in Mobile Phones, Multimedia and Enterprise Solutions due

to increased marketing spend in the device business groups and decreased spending in Networks. In

2005, selling and marketing expenses were EUR 3.0 billion, up 15% from EUR 2.6 billion in 2004.

Selling and marketing expenses were equal to 8.7% of Nokia net sales in both 2005 and 2004.

Administrative and general expenses were EUR 0.6 billion in both 2005 and 2004. Administrative and

general expenses were equal to 1.8% of net sales in 2005 and 2.1% in 2004.

In 2005, other operating income and expenses included a gain of EUR 61 million relating to the

divesture of the Group’s Tetra business, a gain of EUR 18 million related to the partial sale of a

minority investment, and a gain of EUR 45 million related to qualifying sales and leaseback

transactions for real estate. In 2005, Enterprise Solutions recorded a charge of EUR 29 million for

personnel expenses and other costs in connection with the restructuring taken in light of general

downturn in market conditions. In 2004, other operating income and expenses included a return of

an insurance premium of EUR 160 million and a EUR 12 million loss from the divestiture of Nextrom.

Nokia Group’s operating profit for 2005 increased 7% to EUR 4 639 million compared with

EUR 4 326 million in 2004. A substantial increase in Multimedia’s operating profit in 2005 more than

offset operating profit declines in the other business groups. Our operating margin was 13.6% in

2005 compared with 14.7% in 2004.

66