Nokia 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

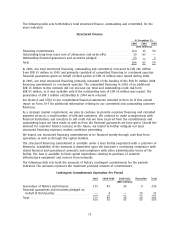

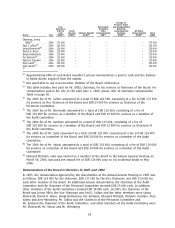

The following table sets forth Nokia’s total structured finance, outstanding and committed, for the

years indicated.

Structured Finance

At December 31,

2006 2005 2004

(EUR millions)

Financing commitments ************************************************** 164 13 56

Outstanding longterm loans (net of allowances and writeoffs) *************** 19 63 —

Outstanding financial guarantees and securities pledged ********************* 23 — 3

Total ******************************************************************* 206 63 59

In 2006, our total structured financing, outstanding and committed, increased to EUR 206 million

from EUR 63 million in 2005 and primarily consisted of committed financing to a network operator.

Financial guarantees given on behalf of third parties of EUR 23 million were issued during 2006.

In 2005, our total structured financing primarily consisted of the funding of the EUR 56 million 2004

financing commitment to a network operator. The committed financing in 2005 of an additional

EUR 13 million to this network did not increase our total and outstanding credit risk from

EUR 63 million, as it was available only if the outstanding loan of EUR 56 million was repaid. The

guarantees of EUR 3 million outstanding in 2004 were released.

See Notes 8 and 37(b) to our consolidated financial statements included in Item 18 of this annual

report on Form 20F for additional information relating to our committed and outstanding customer

financing.

As a strategic market requirement, we plan to continue to provide customer financing and extended

payment terms to a small number of selected customers. We continue to make arrangements with

financial institutions and investors to sell credit risk we have incurred from the commitments and

outstanding loans we have made as well as from the financial guarantees we have given. Should the

demand for customer finance increase in the future, we intend to further mitigate our total

structured financing exposure, market conditions permitting.

We expect our structured financing commitments to be financed mainly through cash flow from

operations as well as through the capital markets.

The structured financing commitment is available under a loan facility negotiated with a customer of

Networks. Availability of the amounts is dependent upon the borrower’s continuing compliance with

stated financial and operational covenants and compliance with other administrative terms of the

facility. The loan is available to fund capital expenditure relating to purchase of network

infrastructure equipment and services from networks.

The following table sets forth the amounts of Nokia’s contingent commitments for the periods

indicated. The amounts represent the maximum principal amount of commitments.

Contingent Commitments Expiration Per Period

2007 20082009 20102011 Thereafter Total

(EUR millions)

Guarantees of Nokia’s performance ************** 175 45 30 9 259

Financial guarantees and securities pledged on

behalf of third parties *********************** —4 — 1923

Total ***************************************** 175 49 30 28 282

75