Nokia 2006 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

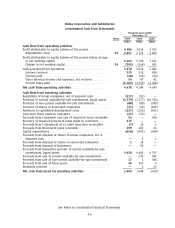

Nokia Corporation and Subsidiaries

Consolidated Cash Flow Statements

Financial year ended

December 31

Notes 2006 2005 2004

EURm EURm EURm

Cash flow from operating activities

Profit attributable to equity holders of the parent ************** 4 306 3 616 3 192

Adjustments, total **************************************** 34 1 857 1 774 2 059

Profit attributable to equity holders of the parent before change

in net working capital ************************************* 6 163 5 390 5 251

Change in net working capital****************************** 34 (793) (366) 241

Cash generated from operations ****************************** 5 370 5 024 5 492

Interest received ****************************************** 235 353 204

Interest paid ********************************************* (18) (26) (26)

Other financial income and expenses, net received************ 54 47 41

Income taxes paid **************************************** (1 163) (1 254) (1 368)

Net cash from operating activities ************************** 4 478 4 144 4 343

Cash flow from investing activities

Acquisition of Group companies, net of acquired cash *********** (517) (92) —

Purchase of current availableforsale investments, liquid assets ** (3 219) (7 277) (10 318)

Purchase of noncurrent availableforsale investments ********** (88) (89) (388)

Purchase of shares in associated companies******************** (15) (16) (109)

Additions to capitalized development costs ******************** (127) (153) (101)

Longterm loans made to customers ************************** (11) (56) —

Proceeds from repayment and sale of longterm loans receivable 56 — 368

Recovery of impaired longterm loans made to customers ******* 276 ——

Proceeds from (+)/payment of () other longterm receivables **** (3) 14 2

Proceeds from shortterm loans receivable ********************* 199 182 66

Capital expenditures***************************************** (650) (607) (548)

Proceeds from disposal of shares in Group companies, net of

disposed cash ******************************************** —51

Proceeds from disposal of shares in associated companies ******* 118 —

Proceeds from disposal of businesses ************************* —95 —

Proceeds from maturities and sale of current availableforsale

investments, liquid assets********************************** 5 058 9 402 9 737

Proceeds from sale of current availableforsale investments ***** —247 587

Proceeds from sale of noncurrent availableforsale investments 17 3 346

Proceeds from sale of fixed assets **************************** 29 167 6

Dividends received ****************************************** —122

Net cash from (used in) investing activities ***************** 1 006 1 844 (329)

See Notes to Consolidated Financial Statements.

F6