Nokia 2006 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

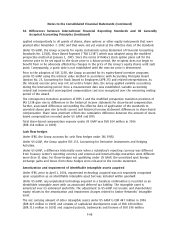

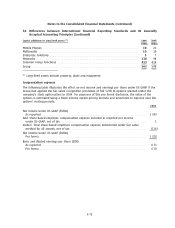

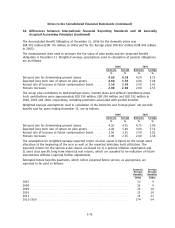

38. Differences between International Financial Reporting Standards and US Generally

Accepted Accounting Principles (Continued)

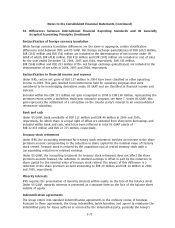

Reclassification of foreign currency translation

While foreign currency translation differences are the same in aggregate, certain classification

differences exist between IFRS and US GAAP. Net foreign exchange gains/(losses) of EUR (202) million,

EUR (161) million and EUR (54) million are included in the determination of net income under US

GAAP of which EUR (414) million, EUR 418 million and EUR (345) million are included in cost of sales

for the year ended December 31, 2006, 2005 and 2004, respectively. EUR 243 million,

EUR (568) million and EUR 283 million of the net foreign exchange gains/(losses) are included in the

determination of net sales in 2006, 2005 and 2004, respectively.

Reclassification to financial income and expense

Under IFRS, certain net gains of EUR 137 million in 2004 have been classified as other operating

income in 2004. This gain resulted from instruments held for operating purposes that were

considered to be nonhedging derivatives under US GAAP and are classified as financial income and

expense.

Included within the EUR 137 million net gain recognized in 2004 is EUR 160 million, representing the

premium return under a multiline, multiyear insurance program, see Note 7. Under US GAAP, this

gain represents the settlement of a call option on the counter party’s interest in an unconsolidated

reinsurance subsidiary.

Bank and cash

Under US GAAP, bank overdrafts of EUR 112 million and EUR 46 million in 2006 and 2005,

respectively, for which there is a legal right of offset are excluded from shortterm borrowings and

included within bank and cash, which has been reflected in total US GAAP assets of

EUR 22 835 million and EUR 22 725 million, respectively.

Treasury stock retirement

Under IFRS, the accounting treatment for treasury stock retirement involves an increase in the share

premium account corresponding to the reduction in share capital for the nominal value of treasury

stock retired. Treasury stock is reduced by the acquisition cost of retired treasury stock with a

corresponding reduction in retained earnings.

Under US GAAP, the accounting treatment for treasury stock retirement does not affect the share

premium account. Instead, the reduction in retained earnings is offset in part by the reduction in

share capital for the nominal value of treasury stock retired. The impact of this difference is a

reduction in the share premium account amounting to EUR 20 million and EUR 14 million in 2006

and 2005, respectively.

Minority interests

IFRS requires the presentation of minority interests within equity on the face of the balance sheet.

Under US GAAP, minority interests is presented as a separate item on the face of the balance sheet

outside of equity.

Indemnification agreements

The Group enters into standard indemnification agreements in the ordinary course of business.

Pursuant to these agreements, the Group indemnifies, holds harmless, and agrees to reimburse the

indemnified party for losses suffered or incurred by the indemnified party, generally the Group’s

F77