Nokia 2006 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

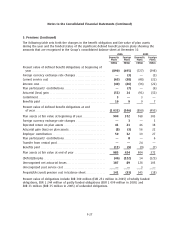

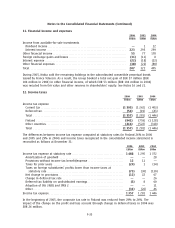

12. Income taxes (Continued)

Income taxes include a tax benefit from received and accrued tax refunds from previous years of

EUR 84 million in 2006 (EUR 48 million in 2005).

Certain of the Group companies’ income tax returns for periods ranging from 2001 through 2005 are

under examination by tax authorities. The Group does not believe that any significant additional

taxes in excess of those already provided for will arise as a result of the examinations.

During 2004, the Group analyzed its future foreign investment plans with respect to certain foreign

investments. As a result of this analysis, the Group concluded that it could no longer represent that

all foreign earnings may be permanently reinvested. Accordingly, the Group recognized a

EUR 60 million deferred tax liability in 2004. In 2006, the deferred tax liability was EUR 65 million

(EUR 68 million in 2005) in respect of undistributed foreign earnings.

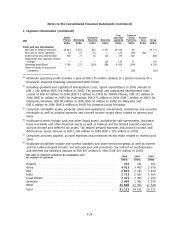

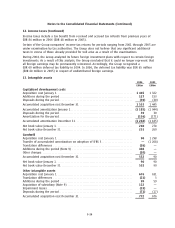

13. Intangible assets

2006 2005

EURm EURm

Capitalized development costs

Acquisition cost January 1 *************************************************** 1 445 1 322

Additions during the period ************************************************* 127 153

Disposals during the period************************************************** (39) (30)

Accumulated acquisition cost December 31 ************************************ 1 533 1 445

Accumulated amortization January 1****************************************** (1 185) (1 044)

Disposals during the period************************************************** 39 30

Amortization for the period************************************************** (136) (171)

Accumulated amortization December 31*************************************** (1 282) (1 185)

Net book value January 1**************************************************** 260 278

Net book value December 31 ************************************************ 251 260

Goodwill

Acquisition cost January 1 *************************************************** 90 1 298

Transfer of accumulated amortization on adoption of IFRS 3********************* —(1 208)

Translation differences ****************************************************** (26) —

Additions during the period (Note 9) ***************************************** 488 —

Other changes ************************************************************* (20) —

Accumulated acquisition cost December 31 ************************************ 532 90

Net book value January 1**************************************************** 90 90

Net book value December 31 ************************************************ 532 90

Other intangible assets

Acquisition cost January 1 *************************************************** 676 631

Translation differences ****************************************************** (21) 3

Additions during the period ************************************************* 99 59

Acquisition of subsidiary (Note 9) ******************************************** 122 —

Impairment losses ********************************************************** (33) —

Disposals during the period************************************************** (71) (17)

Accumulated acquisition cost December 31 ************************************ 772 676

F34