Nokia 2006 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

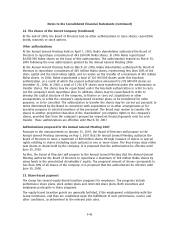

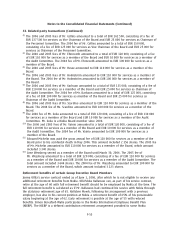

23. Sharebased payment (Continued)

(3) Includes a minor number of performance shares granted under other employee equity plans than

the global plans.

(4) Based on the performance of the Group during the Interim Measurement Period 20042005, under

the 2004 Performance Share Plan, both performance criteria were met. Hence, 3 595 339 Nokia

shares equalling the threshold number were delivered in 2006 with an intrinsic value of

EUR 66 million. The performance shares related to the interim settlement of the 2004

Performance Share Plan are included in the number of performance shares outstanding at

December 31, 2006 as these performance shares will remain outstanding until the final settlement

in 2008. The final payout, in 2008, if any, will be adjusted by the shares delivered based on the

Interim Measurement Period.

Based on the performance of the Group during the Interim Measurement Period 20052006, under

the 2005 Performance Share Plan, both performance criteria were met. Hence 4.1 million Nokia

shares equalling the threshold number are expected to vest in 2007. The shares will vest as of the

date of the Annual General Meeting on May 3, 2007.

Restricted shares

Since 2003, the Group has granted restricted shares to recruit, retain, reward and motivate selected

high potential employees, who are critical to the future success of the Group. The restricted share

plans 2003, 2004, 2005 and 2006 have been approved by the Board of Directors. A valid

authorization from the Annual General Meeting is required, when the plans are settled using the

Company’s newly issued shares or transfer of existing own shares. The Group may also settle the

plans by using Nokia shares purchased on the open market or by using cash settlement. All of our

restricted share grants have a restriction period of three years after grant, after which period the

granted shares will vest.

As soon as practicable after vesting, the Nokia shares are delivered to the recipients. Until the Nokia

shares are delivered, the recipients will not have any shareholder rights, such as voting or dividend

rights associated with the restricted shares.

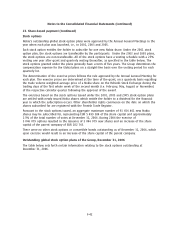

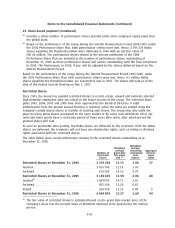

The table below gives certain information relating to the restricted shares outstanding as at

December 31, 2006.

Weighted

Weighted average

average remaining Aggregate

Number of grant date contractual intrinsic

Restricted fair value term value

Shares EUR (1) (years) EURm

Restricted Shares at December 31, 2004********** 2 319 430 11.55 2.06 27

Granted ***************************************** 3 016 746 12.14 2.76

Forfeited **************************************** 150 500 14.31 0.74

Restricted Shares at December 31, 2005********** 5 185 676 11.59 2.06 80

Granted(2) *************************************** 1 669 050 14.71 2.65

Forfeited **************************************** 455 100 12.20 0.87

Vested ****************************************** 334 750 12.33 0.00 5

Restricted Shares at December 31, 2006********** 6 064 876 12.27 1.69 94

(1) The fair value of restricted shares is estimated based on the grant date market price of the

Company’s share less the present value of dividends expected to be paid during the vesting

period.

F47