Nokia 2006 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

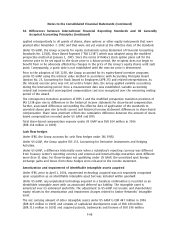

37. Risk management (Continued)

Nokia uses the ValueatRisk (‘‘VaR’’) methodology to assess the foreign exchange risk related to the

Treasury management of the Group exposures. The VaR figure represents the potential fair value

losses for a portfolio resulting from adverse changes in market factors using a specified time period

and confidence level based on historical data. To correctly take into account the nonlinear price

function of certain derivative instruments, Nokia uses Monte Carlo simulation. Volatilities and

correlations are calculated from a oneyear set of daily data.

Since Nokia has subsidiaries outside the Eurozone, the eurodenominated value of the shareholders’

equity of Nokia is also exposed to fluctuations in exchange rates. Equity changes caused by

movements in foreign exchange rates are shown as a translation difference in the Group

consolidation. Nokia uses, from time to time, foreign exchange contracts and foreign currency

denominated loans to hedge its equity exposure arising from foreign net investments.

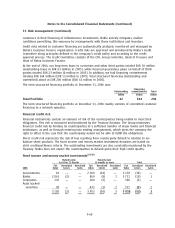

Interest rate risk

The Group is exposed to interest rate risk either through market value fluctuations of balance sheet

items (i.e. price risk) or through changes in interest income or expenses (i.e. reinvestment risk).

Interest rate risk mainly arises through interestbearing liabilities and assets. Estimated future

changes in cash flows and balance sheet structure also expose the Group to interest rate risk.

Treasury is responsible for monitoring and managing the interest rate exposure of the Group. Due to

the current balance sheet structure of Nokia, emphasis is placed on managing the interest rate risk

of investments.

Nokia uses the VaR methodology to assess and measure the interest rate risk in the investment

portfolio, which is benchmarked against a combination of threemonth and onetothreeyear

investment horizon. The VaR figure represents the potential fair value losses for a portfolio resulting

from adverse changes in market factors using a specified time period and confidence level based on

historical data. For interest rate risk VaR, Nokia uses variancecovariance methodology. Volatilities

and correlations are calculated from a oneyear set of daily data.

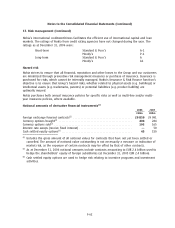

Equity price risk

Nokia has certain strategic minority investments in publicly traded companies. These investments are

classified as availableforsale. The fair value of the equity investments at December 31, 2006 was

EUR 8 million (EUR 8 million in 2005).

There are currently no outstanding derivative financial instruments designated as hedges of these

equity investments.

In addition to the listed equity holdings, Nokia invests in private equity through Nokia Venture

Funds. The fair value of these availableforsale equity investments at December 31, 2006 was

USD 220 million (USD 177 million in 2005).

Nokia is exposed to equity price risk on social security costs relating to stock compensation plans.

Nokia hedges this risk by entering into cash settled equity swap and option contracts.

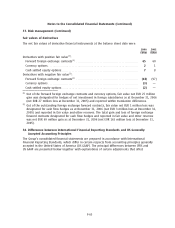

b) Credit risk

Structured Finance Credit Risk

Network operators in some markets sometimes require their suppliers to arrange or provide term

financing in relation to infrastructure projects. Nokia has maintained a financing policy aimed at

close cooperation with banks, financial institutions and Export Credit Agencies to support selected

F59