Nokia 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216

|

|

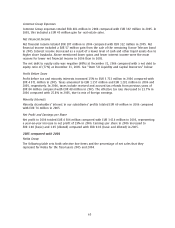

Common Group Expenses

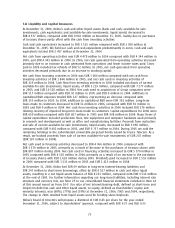

Common Group expenses totaled EUR 481 million in 2006 compared with EUR 392 million in 2005. In

2005, this included a EUR 45 million gain for real estate sales.

Net Financial Income

Net financial income totaled EUR 207 million in 2006 compared with EUR 322 million in 2005. Net

financial income included a EUR 57 million gain from the sale of the remaining France Telecom bond

in 2005. Interest income decreased as a result of a lower level of cash and other liquid assets due to

higher share buybacks. Above mentioned lower gains and lower interest income were the main

reasons for lower net financial income in 2006 than in 2005.

The net debt to equity ratio was negative (68%) at December 31, 2006 compared with a net debt to

equity ratio of (77%) at December 31, 2005. See ‘‘Item 5.B Liquidity and Capital Resources’’ below.

Profit Before Taxes

Profit before tax and minority interests increased 15% to EUR 5 723 million in 2006 compared with

EUR 4 971 million in 2005. Taxes amounted to EUR 1 357 million and EUR 1 281 million in 2006 and

2005, respectively. In 2006, taxes include received and accrued tax refunds from previous years of

EUR 84 million compared with EUR 48 million in 2005. The effective tax rate decreased to 23.7% in

2006 compared with 25.8% in 2005, due to mix of foreign earnings.

Minority Interests

Minority shareholders’ interest in our subsidiaries’ profits totaled EUR 60 million in 2006 compared

with EUR 74 million in 2005.

Net Profit and Earnings per Share

Net profit in 2006 totaled EUR 4 306 million compared with EUR 3 616 million in 2005, representing

a yearonyear increase in net profit of 19% in 2006. Earnings per share in 2006 increased to

EUR 1.06 (basic) and 1.05 (diluted) compared with EUR 0.83 (basic and diluted) in 2005.

2005 compared with 2004

Nokia Group

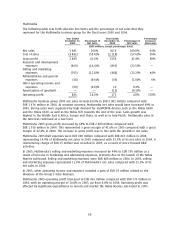

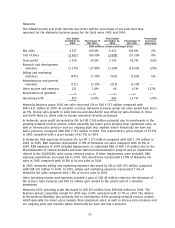

The following table sets forth selective line items and the percentage of net sales that they

represent for Nokia for the fiscal years 2005 and 2004.

65