Nokia 2006 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

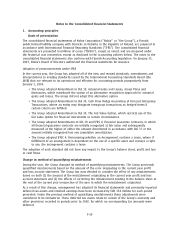

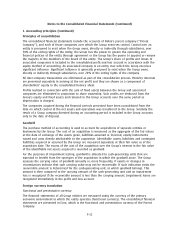

1. Accounting principles (Continued)

The principal temporary differences arise from intercompany profit in inventory, warranty and other

provisions, untaxed reserves and tax losses carried forward. Deferred tax assets are recognized to the

extent that it is probable that future taxable profit will be available against which the unused tax

losses can be utilized. Deferred tax liabilities are recognized for temporary differences that arise

between the fair value and tax base of identifiable net assets acquired in business combinations.

Provisions

Provisions are recognized when the Group has a present legal or constructive obligation as a result

of past events, it is probable that an outflow of resources will be required to settle the obligation

and a reliable estimate of the amount can be made. Where the Group expects a provision to be

reimbursed, the reimbursement is recognized as an asset only when the reimbursement is virtually

certain.

The Group recognizes the estimated liability to repair or replace products still under warranty at

each balance sheet date. The provision is calculated based on historical experience of the level of

repairs and replacements.

The Group recognizes the estimated liability for noncancellable purchase commitments for inventory

in excess of forecasted requirements at each balance sheet date.

The Group recognizes a provision for the estimated future settlements related to asserted and

unasserted Intellectual Property Rights (IPR) infringements, based on the probable outcome of each

case as of each balance sheet date.

The Group recognizes a provision for pension and other social costs on unvested equity instruments

based upon local statutory law. In accordance with the requirements applying to cashsettled share

based payment transactions, this provision is measured at fair value and remeasurement of the fair

value of the provision is recognized in profit or loss for the period.

The Group recognizes a provision for tax contingencies based upon the estimated future settlement

amount at each balance sheet date.

Sharebased compensation

The Group offers three types of equity settled sharebased compensation schemes for employees:

stock options, performance shares and restricted shares. Employee services received, and the

corresponding increase in equity, are measured by reference to the fair value of the equity

instruments as of the date of grant, excluding the impact of any nonmarket vesting conditions. Non

market vesting conditions attached to the performance shares are included in assumptions about the

number of shares that the employee will ultimately receive. On a regular basis, the Group reviews

the assumptions made and, where necessary, revises its estimates of the number of performance

shares that are expected to be settled. Sharebased compensation is recognized as an expense in the

profit and loss account over the service period. When stock options are exercised, the proceeds

received net of any transaction costs are credited to share capital (nominal value) and share

premium.

Treasury shares

The Group recognizes acquired treasury shares as a deduction from equity at their acquisition cost.

When cancelled, the acquisition cost of treasury shares is recognized in retained earnings and the

par value of the corresponding share capital is recognized in share issue premium.

Dividends

Dividends proposed by the Board of Directors are not recorded in the financial statements until they

have been approved by the shareholders at the Annual General Meeting.

F18