Nokia 2006 Annual Report Download - page 94

Download and view the complete annual report

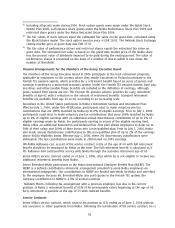

Please find page 94 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.no longer eligible for incentives, bonuses, stock options or other equity grants or additional

retirement benefits from Nokia. Mr. Ollila was entitled to retain all vested and unvested stock

options and other equity compensation granted to him prior to June 1, 2006.

OlliPekka Kallasvuo’s service contract covers his current position as President and CEO and Chairman

of the Group Executive Board. The contract also covered his prior position as President and COO.

Mr. Kallasvuo’s annual total gross base salary, which is subject to an annual review by the Board of

Directors, was EUR 750 000 from January 1, 2006 until May 31, 2006, and is EUR 1 000 000 from

June 1, 2006. His incentive targets under the Nokia shortterm incentive plan were 125% of annual

gross base salary, starting from January 1, 2006 and are 150% of annual gross base salary, starting

June 1, 2006. In case of termination by Nokia for reasons other than cause, including a change of

control, Mr. Kallasvuo is entitled to a severance payment of up to 18 months of compensation (both

annual total gross base salary and target incentive). In case of termination by Mr. Kallasvuo, the

notice period is 6 months and he is entitled to a payment for such notice period (both annual total

gross base salary and target incentive for 6 months). Mr. Kallasvuo is subject to a 12month non

competition obligation after termination of the contract. Unless the contract is terminated for cause,

Mr. Kallasvuo may be entitled to compensation during the noncompetition period or a part of it.

Such compensation amounts to the annual total gross base salary and target incentive for the

respective period during which no severance payment is paid.

EquityBased Compensation Programs

General

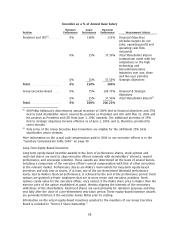

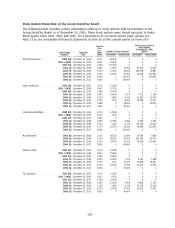

During the year ended December 31, 2006, Nokia sponsored three global stock option plans, three

global performance share plans and four global restricted share plans. Both executives and

employees participate in these plans. In 2004, Nokia introduced performance shares as the main

element to the company’s broadbased equity compensation program to further emphasize the

performance element in employees’ longterm incentives. Thereafter, the number of stock options

granted has been significantly reduced. The rationale for using both performance shares and stock

options for employees in higher job grades is to build an optimal and balanced combination of

equitybased incentives. The program intends to align the potential value received by participants

directly with the performance of Nokia. Since 2003, Nokia has also granted restricted shares to a

small selected number of employees each year.

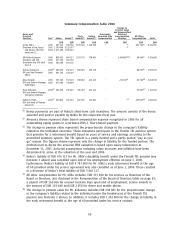

The broadbased equity incentive program in 2006, which was approved by the Board of Directors,

followed the structure of the program in 2005. The target group for the 2006 equitybased incentive

program continued to be broad, with a wide number of employees in many levels of the

organization eligible to participate. The aggregate number of participants in all of Nokia’s equity

based programs in 2006 was approximately 30 000, which is similar to the number in 2005.

The equitybased incentive grants are generally conditional upon continued employment with Nokia,

as well as the fulfillment of performance and other conditions, as determined in the relevant plan

rules.

For a more detailed description of all of Nokia’s equitybased incentive plans, see Note 23 to our

consolidated financial statements included in Item 18 of this annual report on Form 20F.

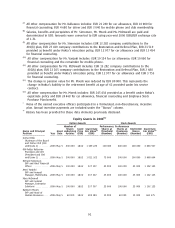

Performance Shares

We have granted performance shares under the global 2004, 2005 and 2006 plans, each of which

has been approved by the Board of Directors.

The performance shares represent a commitment by Nokia to deliver Nokia shares to employees at a

future point in time, subject to Nokia’s fulfillment of predefined performance criteria. No

performance shares will vest unless Nokia’s performance reaches at least one of the threshold levels

measured by two independent, predefined performance criteria: Nokia’s average annual net sales

93