Nokia 2006 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

1. Accounting principles (Continued)

Fair value of derivatives and other financial instruments

The fair value of financial instruments that are not traded in an active market (for example, unlisted

equities, currency options and embedded derivatives) are determined using various valuation

techniques. The Group uses judgment to select an appropriate valuation methodology as well as

underlying assumptions based on existing market practice and conditions. Changes in these

assumptions may cause the Group to recognize impairments or losses in future periods.

Income taxes

Management judgment is required in determining provisions for income taxes, deferred tax assets

and liabilities and the extent to which deferred tax assets can be recognized. If the final outcome of

these matters differs from the amounts initially recorded, differences will impact the income tax and

deferred tax provisions in the period in which such determination is made.

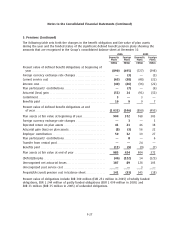

Pensions

The determination of pension benefit obligation and expense for defined benefit pension plans is

dependent on the selection of certain assumptions used by actuaries in calculating such amounts.

Those assumptions include, among others, the discount rate, expected longterm rate of return on

plan assets and annual rate of increase in future compensation levels. A portion of plan assets is

invested in equity securities which are subject to equity market volatility. Changes in assumptions

and actuarial conditions may materially affect the pension obligation and future expense.

Sharebased compensation

The Group operates various types of equity settled sharebased compensation schemes for

employees. Fair value of stock options is based on certain assumptions, including, among others,

expected volatility and expected life of the options. Nonmarket vesting conditions attached to

performance shares are included in assumptions about the number of shares that the employee will

ultimately receive relating to projections of net sales and earnings per share. Significant differences

in equity market performance, employee option activity and the Group’s projected and actual net

sales and earnings per share performance, may materially affect future expense.

New accounting pronouncements under IFRS

The Group will adopt the following new and revised standards, amendments and interpretations to

existing standards issued by the IASB that are expected to be relevant to its operations:

)IFRIC 8, Scope of IFRS 2, requires consideration of transactions involving the issuance of equity

instruments where the identifiable consideration received is less than the fair value of the

equity instruments issued to establish whether or not they fall within the scope of IFRS 2. The

Group will apply IFRIC 8 from annual periods beginning January 1, 2007, but it is not expected

to have any impact on the Group’s accounts.

)IFRIC 9, Reassessment of Embedded Derivatives, requires an entity to assess whether an

embedded derivative is required to be separated from the host contract and accounted for as a

derivative when the entity first becomes a party to the contract. The Group will apply IFRIC 9

from January 1, 2007, but it is not expected to have a material impact on the Group’s accounts;

)IAS 1 (Amendment), Presentation of Financial Statements: Capital Disclosures, requires

qualitative and quantitative disclosures to enable users to evaluate an entity’s objectives,

policies and processes for managing capital. The Group will adopt IAS 1 on January 1, 2007 and

does not expect the adoption of this amendment to have a material impact on the disclosures.

F21