Nokia 2006 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

(2) In 2005, reported deductions inadvertently excluded certain items. The previously reported 2005

deductions of EUR 249 million were adjusted to the current amount of EUR 372 million and the

reported ending balance was similarly adjusted. This matter affected the disclosure only and had

no impact on the balance sheet, profit and loss or cash flow.

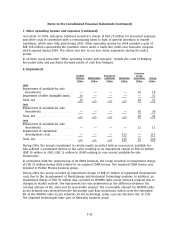

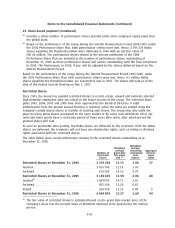

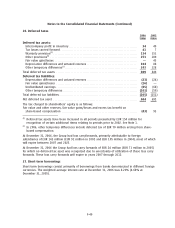

21. Fair value and other reserves

Hedging Availableforsale

reserve investments Total

Gross Tax Net Gross Tax Net Gross Tax Net

Balance at December 31, 2003 ********** 14 (2) 12 83 (14) 69 97 (16) 80

Cash flow hedges:

Fair value losses in period************** — (1) (1) — — — — (1) (1)

Availableforsale investments:

Net fair value gains/(losses) ************ — — — 18 (1) 17 18 (1) 17

Transfer to profit and loss account on

impairment************************* — — — 11 — 11 11 — 11

Transfer of fair value gains to profit and

loss account on disposal ************* — — — (105) 10 (95) (105) 10 (95)

Transfer of fair value losses to profit and

loss account on disposal ************* —— — ——— —— —

Balance at December 31, 2004 ********** 14 (3) 11 7 (5) 2 21 (8) 13

Cash flow hedges:

Fair value gains/(losses) in period ******* (177) 45 (132) — — — (177) 45 (132)

Availableforsale investments:

Net fair value gains/(losses) ************ — — — (69) 6 (63) (69) 6 (63)

Transfer to profit and loss account on

impairment************************* —— — 9— 9 9— 9

Transfer of fair value gains to profit and

loss account on disposal ************* — — — (5) — (5) (5) — (5)

Transfer of fair value losses to profit and

loss account on disposal ************* —— — 2— 2 2— 2

Balance at December 31, 2005 ********** (163) 42 (121) (56) 1 (55) (219) 43 (176)

Cash flow hedges:

Fair value gains/(losses) in period ******* 232 (61) 171 — — — 232 (61) 171

Availableforsale investments:

Net fair value gains/(losses) ************ — — — (42) 1 (41) (42) 1 (41)

Transfer to profit and loss account on

impairment************************* — — — 18 — 18 18 — 18

Transfer of fair value losses to profit and

loss account on disposal ************* — — — 14 — 14 14 — 14

Balance at December 31, 2006 ********** 69 (19) 50 (66) 2 (64) 3 (17) (14)

In order to ensure that amounts deferred in the cash flow hedging reserve represent only the

effective portion of gains and losses on properly designated hedges of future transactions that

remain highly probable at the balance sheet date, Nokia has adopted a process under which all

derivative gains and losses are initially recognized in the profit and loss account. The appropriate

reserve balance is calculated at the end of each period and posted to the Hedging reserve.

The Group continuously reviews the underlying cash flows and the hedges allocated thereto, to

ensure that the amounts transferred to the Hedging reserve do not include gains/losses on forward

exchange contracts that have been designated to hedge forecasted sales or purchases that are no

longer expected to occur. Because of the number of transactions undertaken during each period and

F39