Nokia 2006 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

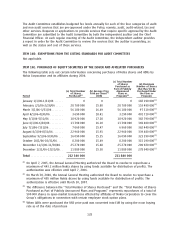

Table 3 Equity investments ValueatRisk

VaR 2006 2005

EURm EURm

At December 31 *********************************************************** 0.1 0.1

Average for the year ******************************************************* 0.1 0.2

Range for the year ********************************************************* 0.10.2 0.10.2

In addition to the listed equity holdings, Nokia invests in private equity through Nokia Venture

Funds. The fair value of these availableforsale equity investments at December 31, 2006 was

USD 220 million (USD 177 million in 2005).

Nokia is exposed to equity price risk on social security costs relating to equitybased compensation

plans. Nokia hedges this risk by entering into cash settled equity swap and option contracts.

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

Not applicable.

PART II

ITEM 13. DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES

None.

ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS

None.

ITEM 15. CONTROLS AND PROCEDURES

(a)

Disclosure Controls and Procedures.

Our President and Chief Executive Officer and our Executive

Vice President, Chief Financial Officer, after evaluating the effectiveness of the Group’s disclosure

controls and procedures (as defined in US Exchange Act Rule 13a15(e)) as of the end of the period

covered by this annual report on Form 20F, have concluded that, as of such date, the Group’s

disclosure controls and procedures were effective.

(b)

Management’s Annual Report on Internal Control Over Financial Reporting.

Our management is

responsible for establishing and maintaining adequate internal control over financial reporting for

the company. Nokia’s internal control over financial reporting is designed to provide reasonable

assurance to the company’s management and the Board of Directors regarding the reliability of

financial reporting and the preparation and fair presentation of published financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or

detect misstatements. Therefore, even those systems determined to be effective can provide only

reasonable assurances with respect to financial statement preparation and presentation. Also,

projections of any evaluation of effectiveness to future periods are subject to the risk that controls

may become inadequate because of changes in conditions, or that the degree of compliance with

the policies or procedures may decline.

The company’s management evaluated the effectiveness of our internal control over financial

reporting based on the Committee of Sponsoring Organizations of the Treadway Commission

(‘‘COSO’’) framework. Based on this evaluation, management has assessed the effectiveness of the

company’s internal control over financial reporting, as at December 31, 2006, and concluded that

such internal control over financial reporting is effective.

125