Nokia 2006 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Market risk

Foreign exchange risk

Nokia operates globally and is thus exposed to foreign exchange risk arising from various currency

combinations. Foreign currency denominated assets and liabilities together with expected cash flows

from highly probable purchases and sales give rise to foreign exchange exposures. These transaction

exposures are managed against various local currencies because of Nokia’s substantial production

and sales outside the Eurozone.

Due to the changes in the business environment, currency combinations may also change within the

financial year. The most significant noneuro sales currencies during the year were US dollar (USD),

UK pound sterling (GBP) and Chinese yuan (CNY). In general, depreciation of another currency relative

to the euro has an adverse effect on Nokia’s sales and operating profit, while appreciation of

another currency has a positive effect, with the exception of Japanese yen (JPY), being the only

significant foreign currency in which Nokia has more purchases than sales.

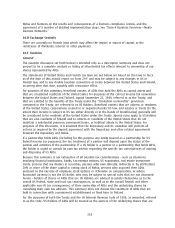

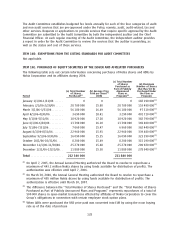

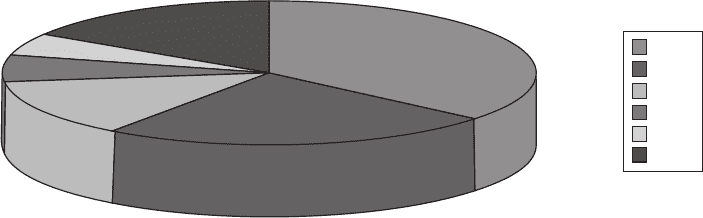

The following chart shows the breakdown by currency of the underlying net foreign exchange

transaction exposure as of December 31, 2006 (in some of the currencies, especially the US dollar,

Nokia has both substantial sales as well as cost, which have been netted in the chart).

Net Exposures

GBP

6%

USD

36%

Others

16%

INR

5%

CNY

13% JPY

24%

USD

JPY

CNY

GBP

INR

Others

According to the foreign exchange policy guidelines of the Group, material transaction foreign

exchange exposures are hedged. Exposures are mainly hedged with derivative financial instruments

such as forward foreign exchange contracts and foreign exchange options. The majority of financial

instruments hedging foreign exchange risk have a duration of less than a year. The Group does not

hedge forecasted foreign currency cash flows beyond two years.

Nokia uses the ValueatRisk (‘‘VaR’’) methodology to assess the foreign exchange risk related to the

Treasury management of the Group exposures. The VaR figure represents the potential fair value

losses for a portfolio resulting from adverse changes in market factors using a specified time period

and confidence level based on historical data. To correctly take into account the nonlinear price

function of certain derivative instruments, Nokia uses Monte Carlo simulation. Volatilities and

correlations are calculated from a oneyear set of daily data. The VaR figures assume that the

forecasted cash flows materialize as expected. The annualized VaRbased FX risk figures for the Group

transaction foreign exchange exposure, including hedging transactions and Treasury exposures for

netting and risk management purposes, calculated from oneweek horizon and 95% confidence level,

are shown in Table 1, below.

123