Nokia 2006 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

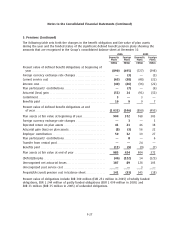

5. Pensions (Continued)

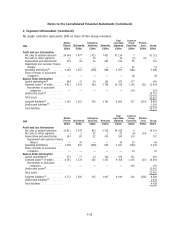

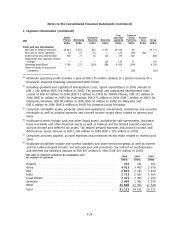

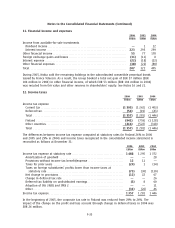

The amounts recognized in the profit and loss account are as follows:

2006 2005 2004

EURm EURm EURm

Current service cost ***************************************************** 101 69 62

Interest cost************************************************************ 66 58 56

Expected return on plan assets ******************************************* (62) (64) (56)

Net actuarial losses recognized in year ************************************ 89—

Past service cost gain () loss (+)****************************************** 31 (1)

Transfer from central pool************************************************ —(24) —

Curtailment ************************************************************ (4) (3) —

Total, included in personnel expenses ************************************* 112 46 61

Movements in prepaid pension costs recognized in the balance sheet are as follows:

2006 2005

EURm EURm

Prepaid pension costs at beginning of year *************************************** 127 126

Net income (expense) recognized in the profit and loss account********************* (112) (46)

Contributions paid ************************************************************* 91 46

Foreign currency exchange rate changes****************************************** 21

Prepaid pension costs at end of year(1) ******************************************* 108 127

(1) included within prepaid expenses and accrued income

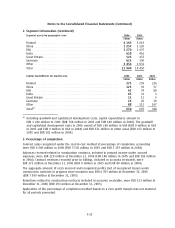

The prepaid pension cost above consists of a prepayment of EUR 206 million (EUR 207 million in

2005) and an accrual of EUR 98 million (EUR 80 million in 2005).

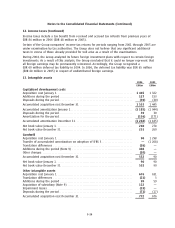

2006 2005 2004 2003 2002

EURm EURm EURm EURm EURm

Present value of defined benefit obligation ************* (1 577) (1 385) (1 125) (1 009) (800)

Plan assets at fair value******************************* 1 409 1 276 1 071 887 762

Deficit ********************************************** (168) (109) (54) (122) (38)

Experience adjustments arising on plan obligations amount to a loss of EUR 25 million in 2006.

Experience adjustments arising on plan assets amount to a loss of EUR 11 million in 2006.

The principal actuarial weighted average assumptions used were as follows:

2006 2005

Domestic Foreign Domestic Foreign

%%%%

Discount rate for determining present values **************** 4.60 4.78 4.20 4.55

Expected longterm rate of return on plan assets ************ 4.60 5.50 4.44 5.49

Annual rate of increase in future compensation levels ******** 3.50 3.59 3.50 3.91

Pension increases **************************************** 2.00 2.69 2.00 2.55

F28