Nokia 2006 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.exchange transfers. Otherwise, the transfer tax would be payable at the rate of 1.6% of the transfer

value of the security traded.

Finnish Inheritance and Gift Taxes

A transfer of an underlying share by gift or by reason of the death of a US Holder and the transfer of

an ADS are not subject to Finnish gift or inheritance tax provided that none of the deceased person,

the donor, the beneficiary of the deceased person or the recipient of the gift is resident in Finland.

NonResidents of the United States

Beneficial owners of ADSs that are not US Holders will not be subject to US federal income tax on

dividends received with respect to ADSs unless this dividend income is effectively connected with the

conduct of a trade or business within the United States. Similarly, nonUS Holders generally will not

be subject to US federal income tax on the gain realized on the sale or other disposition of ADSs,

unless (a) the gain is effectively connected with the conduct of a trade or business in the United

States or (b) in the case of an individual, that individual is present in the United States for 183 days

or more in the taxable year of the disposition and other conditions are met.

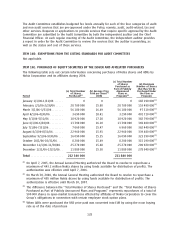

US Information Reporting and Backup Withholding

Dividend payments with respect to shares or ADSs and proceeds from the sale or other disposition of

shares or ADSs may be subject to information reporting to the IRS and possible US backup

withholding at the current rate of 28%. Backup withholding will not apply to a Holder, however, if

the Holder furnishes a correct taxpayer identification number or certificate of foreign status and

makes any other required certification or if it is a recipient otherwise exempt from backup

withholding (such as a corporation). Any US person required to establish its exempt status generally

must furnish a duly completed IRS Form W9 (Request for Taxpayer Identification Number and

Certification). NonUS Holders generally are not subject to US information reporting or backup

withholding. However, such Holders may be required to provide certification of nonUS status

(generally on IRS Form W8BEN) in connection with payments received in the United States or

through certain USrelated financial intermediaries. Backup withholding is not an additional tax.

Amounts withheld as backup withholding may be credited against a Holder’s US federal income tax

liability, and the Holder may obtain a refund of any excess amounts withheld under the backup

withholding rules by filing the appropriate claim for refund with the Internal Revenue Service and

furnishing any required information.

Changes in income tax convention between Finland and the US

There have been recent proposals regarding the tax convention between the US and Finland, that

may affect our US shareholders. These proposals relate to the elimination of withholding taxes on

dividend payments for pension funds and for certain parent and subsidiary company relationships.

The proposals have been ratified in Finland but remain subject to approval in the US. If the

proposals are approved in the US by the end of 2007, the proposed elimination of withholding taxes

on dividends will become effective with regard to dividend income on or after January 1, 2007.

121