Nokia 2006 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

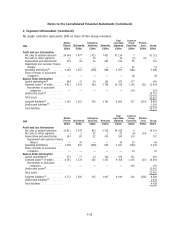

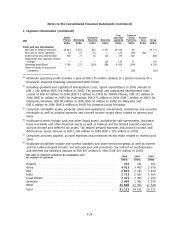

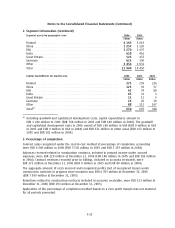

Notes to the Consolidated Financial Statements (Continued)

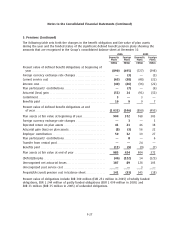

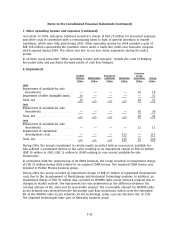

4. Personnel expenses

2006 2005 2004

EURm EURm EURm

Wages and salaries ************************************************ 3 457 3 127 2 805

Sharebased compensation expense, total***************************** 192 104 62

Pension expenses, net ********************************************** 310 252 253

Other social expenses ********************************************** 439 394 372

Personnel expenses as per profit and loss account ********************* 4 398 3 877 3 492

Sharebased compensation expense includes pension and other social costs of EUR 4 million

(EUR 9 million in 2005 and EUR 2 million in 2004) based upon the related employee charge

recognized during the year. In 2006, the benefit was due to a change in the treatment of pension

and other social costs.

The net of tax sharebased compensation expense amounted to EUR 141 million in 2006

(EUR 82 million in 2005 and EUR 60 million in 2004).

Pension expenses, comprised of multiemployer, insured and defined contribution plans were

EUR 198 million in 2006 (EUR 206 million in 2005 and EUR 192 million in 2004).

2006 2005 2004

Average personnel

Mobile Phones ************************************************** 3 639 2 647 2 853

Multimedia ***************************************************** 3 058 2 750 2 851

Enterprise Solutions ********************************************* 2 264 2 185 2 167

Networks******************************************************* 20 277 17 676 15 463

Common Group Functions **************************************** 36 086 31 638 30 177

Nokia Group **************************************************** 65 324 56 896 53 511

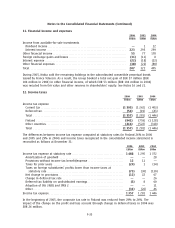

5. Pensions

The most significant pension plans are in Finland and are comprised of the Finnish state TEL system

with benefits directly linked to employee earnings. These benefits are financed in two distinct

portions. The majority of benefits are financed by contributions to a central pool with the majority of

the contributions being used to pay current benefits. The other part comprises reserved benefits which

are prefunded through the trusteeadministered Nokia Pension Foundation. The pooled portion of the

TEL system is accounted for as a defined contribution plan and the reserved portion as a defined

benefit plan. The foreign plans include both defined contribution and defined benefit plans.

Effective on January 1, 2005, the Finnish TEL system was reformed. The most significant change that

has an impact on the Group’s future financial statements is that pensions accumulated after 2005

are calculated on the earnings during the entire working career, not only on the basis of the last

few years of employment as provided by the old rules. An increase to the rate at which pensions

accrue led to a past service cost of EUR 5 million in 2004, which will be recognized over employees’

future average working life.

As a result of the changes in the TEL system, which increased the Group’s obligation in respect of ex

employees, and reduced the obligation in respect of recent recruits, a change in the liability has

been recognised to cover future disability pensions. In 2005, to compensate the Group for the

additional liability in respect of exemployees assets of EUR 24 million were transferred from the

pooled part of the pension system to cover future disability pensions inside Nokia Pension

Foundation. As this transfer of assets is effectively a reduction of the obligation to the pooled

premium, it has been accounted for as a credit to the profit and loss account during 2005.

F26