Nokia 2006 Annual Report Download - page 145

Download and view the complete annual report

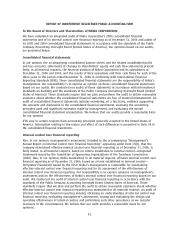

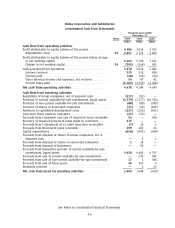

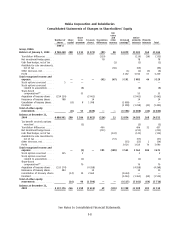

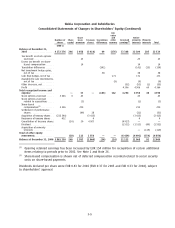

Please find page 145 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements

1. Accounting principles

Basis of presentation

The consolidated financial statements of Nokia Corporation (‘‘Nokia’’ or ‘‘the Group’’), a Finnish

public limited liability company with domicile in Helsinki, in the Republic of Finland, are prepared in

accordance with International Financial Reporting Standards (‘‘IFRS’’). The consolidated financial

statements are presented in millions of euros (‘‘EURm’’), except as noted, and are prepared under

the historical cost convention, except as disclosed in the accounting policies below. The notes to the

consolidated financial statements also conform with Finnish Accounting legislation. On January 25,

2007, Nokia’s Board of Directors authorized the financial statements for issuance.

Adoption of pronouncements under IFRS

In the current year, the Group has adopted all of the new and revised standards, amendments and

interpretations to existing standards issued by the International Accounting Standards Board (the

IASB) that are relevant to its operations and effective for accounting periods prospectively from

January 1, 2006.

)The Group adopted Amendment to IAS 19, Actuarial Gains and Losses, Group Plans and

Disclosures, which introduced the option of an alternative recognition approach for actuarial

gains and losses. The Group did not adopt this alternative option.

)The Group adopted Amendment to IAS 39, Cash Flow Hedge Accounting of Forecast Intragroup

Transactions, where an entity may designate intragroup transactions as hedged items if

certain criteria are fulfilled.

)The Group adopted Amendment to IAS 39, The Fair Value Option, which restricts use of the

fair value option for financial instruments to certain circumstances.

)The Group adopted Amendments to IAS 39 and IFRS 4, Financial Guarantee Contracts, in which

all financial guarantee contracts are initially recognized at fair value and subsequently

measured at the higher of either the amount determined in accordance with IAS 37 or the

amount initially recognized less any cumulative amortization.

)The Group adopted IFRIC 4, Determining whether an Arrangement contains a Lease, where if

fulfillment of an arrangement is dependent on the use of a specific asset and conveys a right

to use, the arrangement contains a lease.

The adoption of each standard did not have any impact to the Group’s balance sheet, profit and loss

or cash flows.

Change in method of quantifying misstatements

During the year, the Group changed its method of quantifying misstatements. The Group previously

quantified misstatements based on the amount of the error originating in the current year profit

and loss account statement. The Group has now decided to consider the effect of any misstatements

based on both (1) the amount of the misstatement originating in the current year profit and loss

account statement and (2) the effects of correcting the misstatement existing in the balance sheet at

the end of the current year irrespective of the year in which the misstatement originated.

As a result of this change, management has adjusted its financial statements and previously reported

deferred tax assets and retained earnings have been increased by EUR 154 million for each period

presented. Under the previous method of quantifying misstatements these adjustments were

considered to be immaterial. These deferred tax assets relate to certain of the Group’s warranty and

other provisions recorded in periods prior to 2002, for which no corresponding tax amounts were

deferred.

F10