Nokia 2006 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

38. Differences between International Financial Reporting Standards and US Generally

Accepted Accounting Principles (Continued)

business partners or customers, in connection with any patent, or any copyright or other intellectual

property infringement claim by any third party with respect to the Group’s products. The term of

these indemnification agreements is generally perpetual following execution of the agreement. The

maximum potential amount of future payments the Group could be required to make under these

indemnification agreements is unlimited; however, the Group has not incurred costs to defend

lawsuits or settle claims related to these indemnification agreements and accordingly, no amounts

have been accrued in respect of the indemnification provisions as of December 31, 2006. In addition,

the Group has entered into customary Directors’ and Officers’ liability insurance policy, and, to a

limited extent, indemnification agreements covering its directors and officers.

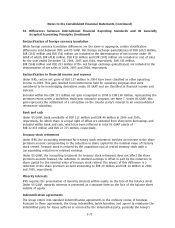

Adoption of pronouncements under US GAAP

In November 2005, the FASB issued Staff Position No. (FSP) 1151 The Meaning of OtherThan

Temporary Impairment and its Application to Certain Investments. FSP 1151 provides accounting

guidance for identifying and recognizing otherthantemporary impairments of debt and equity

securities, as well as cost method investments in addition to disclosure requirements. FSP 1151 is

effective for reporting periods beginning after December 15, 2005. The adoption of FSP 1151 did not

have a material impact on the Group’s financial condition or results or operations.

In September 2006, the SEC issued Staff Accounting Bulletin No. 108, Considering the Effects of Prior

Year Misstatements when Quantifying Misstatements in the Current Year Financial Statements.

SAB 108 puts forward a single quantification framework, the dual approach, to be used by all public

companies in the quantification of identified misstatements. The dual approach requires

consideration of the impact of misstatements on both the income statement (‘‘the rollover method’’)

and the balance sheet (‘‘the ironcurtain method’’). The impact resulting from the adoption of

SAB 108 is detailed in change in method of quantifying misstatements section.

In September 2006, the FASB issued FAS 158, Employers’ Accounting for Defined Benefit Pension and

Other Postretirement Plans an amendment of FASB Statements No. 87, 88, 106, and 132(R). FAS 158

requires balance sheet recognition of the funded status of singleemployer defined benefit pension

schemes. The funded status is measured as the difference between the plan assets at fair value and

the projected benefit obligation. Actuarial gains and losses, prior service costs and credits, and

transition obligations that have not been recognized as of the end of the fiscal year are recognized

along with amounts required to recognize the additional minimum liability, net of tax, as

components of accumulated other comprehensive income. Other comprehensive income is then

adjusted as these amounts are subsequently recognized as components of net periodic pension cost.

FAS 158 also requires the employer to align the measurement date for plan assets and benefit

obligations with the employer’s fiscal yearend. The impact resulting from the adoption of FAS 158 is

detailed in pensions section.

New accounting pronouncements under US GAAP

In June 2006, the FASB issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes

(FIN 48), an Interpretation of SFAS 109, Accounting for Income Taxes. FIN 48 was issued to clarify the

accounting for uncertainty in tax positions taken or expected to be taken in a tax return. Under

FIN 48, the tax benefit from an uncertain tax position may be recognized only if it is more likely

than not that the tax position will be sustained upon examination by tax authorities. The Group

plans to adopt FIN 48 for annual periods beginning January 1, 2007. The Group is currently

evaluating the potential impact that the adoption of FIN 48 will have on its consolidated financial

statements.

F78