Nokia 2006 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216

|

|

Notes to the Consolidated Financial Statements (Continued)

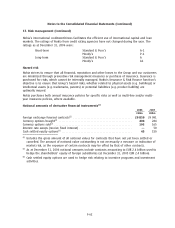

37. Risk management (Continued)

Nokia’s international creditworthiness facilitates the efficient use of international capital and loan

markets. The ratings of Nokia from credit rating agencies have not changed during the year. The

ratings as at December 31, 2006 were:

Shortterm Standard & Poor’s A1

Moody’s P1

Longterm Standard & Poor’s A

Moody’s A1

Hazard risk

Nokia strives to ensure that all financial, reputation and other losses to the Group and our customers

are minimized through preventive risk management measures or purchase of insurance. Insurance is

purchased for risks, which cannot be internally managed. Nokia’s Insurance & Risk Finance function’s

objective is to ensure that Group’s hazard risks, whether related to physical assets (e.g. buildings) or

intellectual assets (e.g. trademarks, patents) or potential liabilities (e.g. product liability) are

optimally insured.

Nokia purchases both annual insurance policies for specific risks as well as multiline and/or multi

year insurance policies, where available.

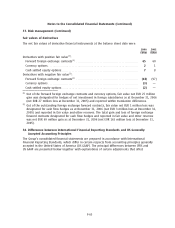

Notional amounts of derivative financial instruments(1)

2006 2005

EURm EURm

Foreign exchange forward contracts(2) **************************************** 29 859 29 991

Currency options bought(2) ************************************************** 404 284

Currency options sold(2) ***************************************************** 193 165

Interest rate swaps (receive fixed interest) ************************************ —50

Cash settled equity options(3) ************************************************ 45 150

(1) Includes the gross amount of all notional values for contracts that have not yet been settled or

cancelled. The amount of notional value outstanding is not necessarily a measure or indication of

market risk, as the exposure of certain contracts may be offset by that of other contracts.

(2) As at December 31, 2006 notional amounts include contracts amounting to EUR 2.4 billion used to

hedge the shareholders’ equity of foreign subsidiaries (at December 31, 2005 EUR 2.4 billion).

(3) Cash settled equity options are used to hedge risk relating to incentive programs and investment

activities.

F62