Nokia 2006 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

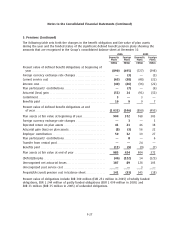

7. Other operating income and expenses (Continued)

real estate. In 2005, Enterprise Solutions recorded a charge of EUR 29 million for personnel expenses

and other costs in connection with a restructuring taken in light of general downturn in market

conditions, which were fully paid during 2005. Other operating income for 2004 includes a gain of

EUR 160 million representing the premium return under a multiline, multiyear insurance program,

which expired during 2004. The return was due to our low claims experience during the policy

period.

In all three years presented ‘‘Other operating income and expenses’’ include the costs of hedging

forecasted sales and purchases (forward points of cash flow hedges).

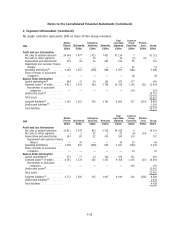

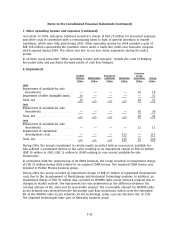

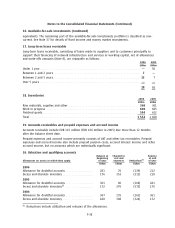

8. Impairment

Common

Mobile Enterprise Group

Phones Multimedia Solutions Networks Functions Group

EURm EURm EURm EURm EURm EURm

2006

Impairment of availableforsale

investments ********************* — — — — 18 18

Impairment of other intangible assets** 33 — — — — 33

Total, net ************************* 33 — — — 18 51

2005

Impairment of availableforsale

investments ********************* — — — — 30 30

Total, net ************************* — — — — 30 30

2004

Impairment of availableforsale

investments ********************* — — — — 11 11

Impairment of capitalized

development costs *************** — — — 115 — 115

Total, net ************************* — — — 115 11 126

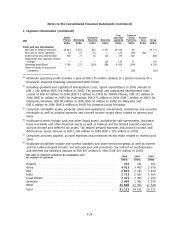

During 2006, the Group’s investment in certain equity securities held as noncurrent availablefor

sale suffered a permanent decline in fair value resulting in an impairment charge of EUR 18 million

(EUR 30 million in 2005, EUR 11 million in 2004) relating to noncurrent availableforsale

investments.

In connection with the restructuring of its CDMA business, the Group recorded an impairment charge

of EUR 33 million during 2006 related to an acquired CDMA license. The impaired CDMA license was

included in Mobile Phones business group.

During 2004, the Group recorded an impairment charge of EUR 65 million of capitalized development

costs due to the abandonment of FlexiGateway and Horizontal Technology modules. In addition, an

impairment charge of EUR 50 million was recorded on WCDMA radio access network program due to

changes in market outlook. The impairment loss was determined as the difference between the

carrying amount of the asset and its recoverable amount. The recoverable amount for WCDMA radio

access network was derived from the discounted cash flow projections, which cover the estimated

life of the WCDMA radio access network current technology, using a pretax discount rate of 15%.

The impaired technologies were part of Networks business group.

F30